| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.00 | 0.08 | |

| Earnings Per Share Basic | -0.30 | 0.52 | 0.06 | 0.41 | 6.82 | 43.79 | 1.91 | 1.68 | -1.01 | 3.04 | -3.56 | 2.62 | -0.17 | 0.88 | -0.48 | 0.53 | -0.83 | -0.89 | -0.73 | -0.64 | 17.44 | 2.52 | 0.81 | -0.05 | -0.88 | 0.79 | -0.74 | -0.07 | |

| Earnings Per Share Diluted | -0.30 | 0.52 | 0.06 | 0.41 | 6.82 | 43.79 | 1.91 | 1.68 | -1.01 | 3.04 | -3.56 | 2.62 | -0.17 | 0.88 | -0.48 | 0.53 | -0.83 | -0.89 | -0.73 | -0.64 | 17.44 | 2.52 | 0.81 | -0.05 | -0.88 | 0.79 | -0.74 | -0.07 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Including Assessed Tax | 13.45 | 12.53 | 12.24 | 11.69 | 12.78 | 8.32 | 7.77 | 7.79 | 8.12 | 10.03 | 10.79 | 11.83 | 18.68 | 11.45 | 11.95 | 11.92 | 6.31 | 11.41 | 11.84 | 11.93 | 24.76 | 33.51 | 31.61 | 31.08 | 30.91 | 31.49 | 0.00 | 0.00 | |

| Revenues | 13.45 | 12.53 | 12.24 | 11.69 | 12.78 | 8.32 | 7.77 | 7.79 | 8.12 | 10.03 | 10.79 | 11.83 | 18.68 | 12.16 | 11.95 | 11.92 | 6.31 | 11.88 | 11.84 | 11.93 | 24.76 | 33.51 | 31.61 | 31.08 | 30.91 | 31.49 | 0.00 | 0.00 | |

| Other Income | 0.67 | 0.69 | 0.85 | 0.68 | 1.01 | 0.75 | 0.51 | 0.31 | 0.49 | 0.41 | 0.60 | 1.47 | 1.23 | 0.71 | 1.87 | 1.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.07 | NA | |

| Costs And Expenses | 15.58 | 14.30 | 15.75 | 14.26 | 12.33 | 11.08 | 10.62 | 11.91 | 12.27 | 14.59 | 16.02 | 14.05 | 14.66 | 13.70 | 12.80 | 15.90 | 14.36 | 12.95 | 15.22 | 13.18 | NA | NA | NA | NA | NA | NA | NA | NA | |

| General And Administrative Expense | 1.36 | 1.43 | 3.52 | 2.88 | 2.60 | 2.76 | 2.06 | 2.53 | 3.88 | 2.81 | 3.09 | 2.65 | 2.22 | 1.64 | 1.41 | 2.52 | 2.80 | 2.49 | 3.33 | 2.33 | 5.14 | 1.86 | 2.17 | 2.19 | 1.60 | 1.59 | 0.00 | 1.18 | |

| Operating Income Loss | -2.13 | -1.77 | -3.51 | -2.57 | 0.46 | -2.77 | -2.85 | -4.13 | -4.15 | -4.56 | -5.22 | -2.23 | 4.02 | -1.54 | -0.85 | -3.98 | -2.04 | -1.06 | -3.38 | -1.25 | 0.52 | 5.77 | 4.64 | 5.19 | 3.30 | 5.77 | 0.00 | 3.81 | |

| Interest Expense Debt | 1.88 | 1.90 | 2.43 | 4.03 | 5.03 | 4.70 | 5.06 | 5.03 | 5.50 | 5.91 | 6.58 | 6.60 | 7.38 | 6.29 | 7.74 | 7.97 | 8.17 | 8.04 | 7.65 | 7.96 | 15.05 | 15.55 | 14.18 | 14.09 | 14.73 | 14.24 | -0.01 | -9.03 | |

| Interest Paid Net | 1.53 | 1.44 | 1.43 | 6.40 | 0.00 | 7.96 | 0.63 | 9.21 | 1.45 | 8.18 | 2.73 | 12.11 | 6.02 | 6.40 | 3.31 | 11.40 | 1.96 | 14.54 | 3.99 | 8.94 | 22.07 | 12.85 | 13.36 | 13.30 | 13.48 | 9.85 | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | -1.71 | NA | 0.00 | -1.17 | 0.00 | -1.64 | 0.00 | -1.45 | NA | NA | NA | NA | NA | NA | 0.00 | -5.22 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -0.70 | 1.32 | 0.20 | 1.11 | 15.09 | 88.04 | 0.04 | 0.03 | 0.03 | 0.16 | -1.23 | 0.04 | -0.34 | 0.05 | 0.05 | 0.25 | 2.00 | NA | NA | NA | -2.42 | 0.79 | NA | NA | -0.18 | NA | -0.00 | -0.16 | |

| Profit Loss | -2.10 | 4.76 | 0.88 | 3.71 | 59.19 | 378.58 | 16.62 | 14.62 | -8.61 | 26.38 | -30.58 | 22.89 | -1.08 | 7.69 | -3.92 | 4.77 | -6.98 | -7.77 | -5.97 | -5.43 | 152.65 | 23.12 | 7.37 | -0.10 | -7.22 | 7.17 | -0.01 | -0.54 | |

| Net Income Loss | -2.56 | 4.45 | 0.53 | 3.52 | 58.95 | 378.35 | 16.46 | 14.50 | -8.75 | 26.25 | -30.73 | 22.63 | -1.48 | 7.69 | -4.16 | 4.61 | -7.18 | -7.79 | -6.34 | -5.61 | 152.23 | 22.20 | 7.25 | -0.23 | -7.35 | 7.07 | -5.85 | -0.22 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

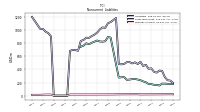

| Assets | 1043.04 | 1080.41 | 1081.53 | 1128.81 | 1218.16 | 1164.54 | 754.47 | 750.96 | 788.41 | 791.24 | 825.24 | 837.50 | 879.08 | 845.35 | 864.17 | 850.79 | 865.92 | 872.87 | 853.89 | 852.61 | 862.38 | 1422.93 | 1368.74 | 1330.59 | 1313.42 | 1250.73 | 0.97 | 1044.27 | |

| Liabilities | 196.09 | 230.45 | 236.32 | 284.48 | 377.55 | 383.11 | 351.62 | 364.73 | 416.80 | 411.02 | 471.40 | 453.08 | 517.55 | 482.73 | 509.25 | 491.95 | 511.85 | 511.82 | 484.99 | 477.71 | 481.98 | 1184.95 | 1153.66 | 1122.65 | 1105.16 | 1035.01 | 0.84 | 904.64 | |

| Liabilities And Stockholders Equity | 1043.04 | 1080.41 | 1081.53 | 1128.81 | 1218.16 | 1164.54 | 754.47 | 750.96 | 788.41 | 791.24 | 825.24 | 837.50 | 879.08 | 845.35 | 864.17 | 850.79 | 865.92 | 872.87 | 853.89 | 852.61 | 862.38 | 1422.93 | 1368.74 | 1330.59 | 1313.42 | 1250.73 | 0.97 | 1044.27 | |

| Stockholders Equity | 826.01 | 827.97 | 823.51 | 822.98 | 819.47 | 760.52 | 382.17 | 365.71 | 351.20 | 359.95 | 333.71 | 364.44 | 341.81 | 340.75 | 333.06 | 337.22 | 332.60 | 339.78 | 347.65 | 354.04 | 359.72 | 217.71 | 195.74 | 188.72 | 189.17 | 196.75 | 0.12 | 122.72 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 36.70 | 47.18 | 58.87 | 55.31 | 113.42 | 131.20 | 38.20 | 13.79 | 50.73 | 63.85 | 46.00 | 53.86 | 36.76 | 32.97 | 42.25 | 39.92 | 51.18 | 63.07 | 37.58 | 28.16 | 36.36 | 23.76 | 28.11 | 40.89 | 42.70 | 57.98 | NA | 6.32 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 79.03 | 83.33 | 69.81 | 110.50 | 222.31 | 149.15 | 57.66 | 35.42 | 72.72 | 83.94 | 68.00 | 75.06 | 86.97 | 61.00 | 72.36 | 68.08 | 83.26 | 99.95 | 82.18 | 80.14 | 106.56 | 96.45 | 92.77 | 96.29 | 88.34 | 100.73 | NA | NA | |

| Short Term Investments | 90.45 | 134.19 | 136.97 | 158.09 | 119.79 | 75.33 | 7.88 | 32.59 | 16.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 104.16 | 108.99 | 108.99 | 119.20 | 108.93 | 64.88 | 65.42 | 65.62 | 67.35 | 42.62 | 48.37 | 48.36 | 50.76 | 50.76 | NA | NA | 49.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 0.56 | 0.79 | 0.70 | 3.62 | 20.90 | 306.30 | 52.21 | 50.57 | 52.88 | 49.88 | 51.70 | 47.12 | 51.79 | 71.17 | 22.64 | 22.63 | 22.63 | 22.18 | 22.17 | 22.16 | 22.17 | 2.77 | 2.47 | 2.48 | 2.47 | 2.44 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 179.14 | 178.89 | 180.83 | 183.64 | 184.46 | 154.96 | 164.62 | 165.66 | 176.75 | 178.36 | 204.69 | 218.18 | 236.07 | NA | 255.88 | 252.70 | 246.55 | 241.44 | 283.78 | NA | 277.24 | NA | NA | 886.55 | 894.48 | 830.37 | NA | NA | |

| Minority Interest | 20.95 | 22.00 | 21.69 | 21.34 | 21.14 | 20.91 | 20.68 | 20.52 | 20.40 | 20.27 | 20.13 | 19.98 | 19.72 | 21.86 | 21.86 | 21.62 | 21.46 | 21.26 | 21.24 | 20.86 | 20.68 | 20.26 | 19.35 | 19.22 | 19.09 | 18.97 | 0.02 | 16.91 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

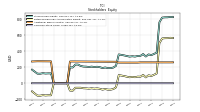

| Stockholders Equity | 826.01 | 827.97 | 823.51 | 822.98 | 819.47 | 760.52 | 382.17 | 365.71 | 351.20 | 359.95 | 333.71 | 364.44 | 341.81 | 340.75 | 333.06 | 337.22 | 332.60 | 339.78 | 347.65 | 354.04 | 359.72 | 217.71 | 195.74 | 188.72 | 189.17 | 196.75 | 0.12 | 122.72 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 846.95 | 849.97 | 845.20 | 844.33 | 840.61 | 781.42 | 402.85 | 386.23 | 371.61 | 380.22 | 353.84 | 384.42 | 361.53 | 362.62 | 354.92 | 358.84 | 354.07 | 361.05 | 368.90 | 374.91 | 380.40 | 237.98 | 215.09 | 207.94 | 208.26 | 215.72 | 0.14 | 139.62 | |

| Common Stock Value | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.00 | 0.08 | |

| Additional Paid In Capital | 260.99 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 260.39 | 257.85 | 257.85 | 257.85 | 257.85 | 257.85 | 257.94 | 257.98 | 258.05 | 268.28 | 268.50 | 268.73 | 268.95 | 269.18 | 0.27 | 273.06 | |

| Retained Earnings Accumulated Deficit | 564.93 | 567.49 | 563.04 | 562.51 | 558.99 | 500.05 | 121.69 | 105.23 | 90.73 | 99.48 | 73.23 | 103.97 | 81.33 | 82.81 | 75.12 | 79.28 | 74.67 | 81.84 | 89.63 | 95.98 | 101.58 | -50.65 | -72.85 | -80.10 | -79.86 | -72.52 | -0.15 | -150.42 | |

| Minority Interest | 20.95 | 22.00 | 21.69 | 21.34 | 21.14 | 20.91 | 20.68 | 20.52 | 20.40 | 20.27 | 20.13 | 19.98 | 19.72 | 21.86 | 21.86 | 21.62 | 21.46 | 21.26 | 21.24 | 20.86 | 20.68 | 20.26 | 19.35 | 19.22 | 19.09 | 18.97 | 0.02 | 16.91 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

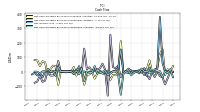

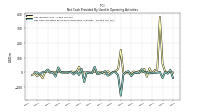

| Net Cash Provided By Used In Operating Activities | -38.92 | 16.28 | -9.97 | 1.53 | -40.00 | 2.12 | -3.34 | -4.18 | -3.79 | -7.65 | 1.35 | -0.90 | 20.79 | -5.71 | -1.69 | -7.76 | -26.46 | 6.47 | 1.87 | -17.64 | -160.88 | -21.43 | -0.57 | 1.69 | -14.23 | -23.52 | -0.00 | -30.38 | |

| Net Cash Provided By Used In Investing Activities | 36.38 | -0.79 | 15.44 | -24.21 | 154.01 | 121.06 | 26.65 | 5.65 | -5.71 | 77.01 | 14.88 | 14.15 | -11.97 | 7.44 | 3.29 | 1.62 | 7.18 | -8.88 | -2.47 | -5.43 | 210.24 | -12.80 | -25.75 | -24.07 | -57.88 | -8.22 | -0.00 | 36.88 | |

| Net Cash Provided By Used In Financing Activities | -1.76 | -1.97 | -46.16 | -89.13 | -40.85 | -31.68 | -1.07 | -38.77 | -1.72 | -53.42 | -23.30 | -25.16 | 17.15 | -13.10 | 2.68 | -9.04 | 2.58 | 20.18 | 2.64 | -3.36 | -39.25 | 37.91 | 22.79 | 30.33 | 255.15 | -167.62 | 0.00 | -17.71 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -38.92 | 16.28 | -9.97 | 1.53 | -40.00 | 2.12 | -3.34 | -4.18 | -3.79 | -7.65 | 1.35 | -0.90 | 20.79 | -5.71 | -1.69 | -7.76 | -26.46 | 6.47 | 1.87 | -17.64 | -160.88 | -21.43 | -0.57 | 1.69 | -14.23 | -23.52 | -0.00 | -30.38 | |

| Net Income Loss | -2.56 | 4.45 | 0.53 | 3.52 | 58.95 | 378.35 | 16.46 | 14.50 | -8.75 | 26.25 | -30.73 | 22.63 | -1.48 | 7.69 | -4.16 | 4.61 | -7.18 | -7.79 | -6.34 | -5.61 | 152.23 | 22.20 | 7.25 | -0.23 | -7.35 | 7.07 | -5.85 | -0.22 | |

| Profit Loss | -2.10 | 4.76 | 0.88 | 3.71 | 59.19 | 378.58 | 16.62 | 14.62 | -8.61 | 26.38 | -30.58 | 22.89 | -1.08 | 7.69 | -3.92 | 4.77 | -6.98 | -7.77 | -5.97 | -5.43 | 152.65 | 23.12 | 7.37 | -0.10 | -7.22 | 7.17 | -0.01 | -0.54 | |

| Depreciation Depletion And Amortization | 4.05 | 3.34 | 3.42 | 3.75 | 3.70 | 3.05 | 3.15 | 3.21 | 3.33 | 3.94 | 3.80 | 3.95 | 5.56 | 6.21 | 3.42 | 3.39 | 3.42 | 3.42 | 3.44 | 3.11 | 2.90 | 6.89 | 6.52 | 6.45 | 6.55 | 6.33 | 0.01 | 5.43 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 36.38 | -0.79 | 15.44 | -24.21 | 154.01 | 121.06 | 26.65 | 5.65 | -5.71 | 77.01 | 14.88 | 14.15 | -11.97 | 7.44 | 3.29 | 1.62 | 7.18 | -8.88 | -2.47 | -5.43 | 210.24 | -12.80 | -25.75 | -24.07 | -57.88 | -8.22 | -0.00 | 36.88 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -1.76 | -1.97 | -46.16 | -89.13 | -40.85 | -31.68 | -1.07 | -38.77 | -1.72 | -53.42 | -23.30 | -25.16 | 17.15 | -13.10 | 2.68 | -9.04 | 2.58 | 20.18 | 2.64 | -3.36 | -39.25 | 37.91 | 22.79 | 30.33 | 255.15 | -167.62 | 0.00 | -17.71 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2013-09-30 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 13.45 | 12.53 | 12.24 | 11.69 | 12.78 | 8.32 | 7.77 | 7.79 | 8.12 | 10.03 | 10.79 | 11.83 | 18.68 | 12.16 | 11.95 | 11.92 | 6.31 | 11.88 | 11.84 | 11.93 | 24.76 | 33.51 | 31.61 | 31.08 | 30.91 | 31.49 | 0.00 | 0.00 | |

| Operating, Commercial | 3.11 | 3.94 | 3.73 | 3.64 | 2.97 | 4.72 | 4.31 | 4.25 | 4.20 | 5.92 | 6.67 | 6.53 | 13.71 | 7.77 | 7.86 | 7.88 | 8.44 | 8.02 | 8.02 | 8.23 | 9.93 | 8.23 | 7.40 | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 13.45 | 12.53 | 12.24 | 11.69 | 12.78 | 8.32 | 7.77 | 7.79 | 8.12 | 10.03 | 10.79 | 11.83 | 18.68 | 11.45 | 11.95 | 11.92 | 6.31 | 11.41 | 11.84 | 11.93 | 24.76 | 33.51 | 31.61 | 31.08 | 30.91 | 31.49 | 0.00 | 0.00 |