| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 109.23 | 106.88 | 94.83 | NA | 84.69 | 74.28 | 74.16 | NA | 73.54 | 73.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 109.23 | 106.88 | 94.83 | NA | 84.69 | 74.28 | 74.16 | NA | 73.54 | 73.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Share Outstanding Basic And Diluted | NA | NA | NA | NA | NA | NA | 74.16 | NA | 73.54 | 73.40 | 70.42 | NA | 64.89 | 58.75 | 29.30 | NA | 2.81 | 2.72 | 2.64 | |

| Earnings Per Share Basic | -0.99 | -0.92 | -0.72 | -0.61 | -0.87 | -0.82 | -0.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.99 | -0.92 | -0.72 | -0.61 | -0.87 | -0.82 | -0.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic And Diluted | NA | NA | NA | NA | NA | NA | -0.78 | -0.72 | -0.72 | -0.60 | -0.53 | -0.52 | -0.42 | -0.46 | -0.74 | -6.48 | -6.08 | -4.85 | -4.84 |

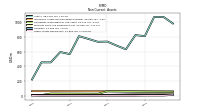

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 0.00 | 3.82 | 7.01 | 15.33 | 3.36 | 9.12 | 7.58 | 9.46 | 1.10 | 8.70 | 10.13 | 8.75 | 12.66 | 10.03 | 11.55 | 12.09 | 12.51 | 12.28 | 13.17 | |

| Revenues | 0.00 | 3.82 | 7.01 | 15.33 | 3.36 | 9.12 | 7.58 | 9.46 | 1.10 | 8.70 | 10.13 | 8.75 | 12.66 | 10.03 | 11.55 | 12.09 | 12.51 | 12.28 | 13.17 | |

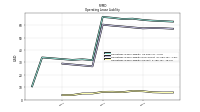

| Operating Expenses | 123.25 | 112.62 | 82.17 | 77.04 | 79.89 | 71.20 | 65.53 | 62.37 | 54.26 | 53.23 | 47.53 | 42.83 | 40.21 | 38.01 | 32.63 | 31.65 | 26.07 | 22.84 | 23.60 | |

| Research And Development Expense | 107.73 | 97.98 | 68.95 | 66.13 | 69.45 | 61.00 | 56.49 | 53.68 | 46.47 | 45.94 | 40.86 | 37.01 | 34.87 | 32.92 | 27.46 | 27.49 | 22.96 | 20.12 | 21.19 | |

| General And Administrative Expense | 15.51 | 14.64 | 13.22 | 10.91 | 10.43 | 10.20 | 9.04 | 8.69 | 7.79 | 7.30 | 6.67 | 5.83 | 5.34 | 5.09 | 5.17 | 4.16 | 3.10 | 2.73 | 2.42 | |

| Operating Income Loss | -123.25 | -108.80 | -75.16 | -61.71 | -76.53 | -62.09 | -57.95 | -52.91 | -53.16 | -44.53 | -37.40 | -34.08 | -27.55 | -27.98 | -21.08 | -19.56 | -13.56 | -10.56 | -10.44 | |

| Allocated Share Based Compensation Expense | 13.67 | 12.98 | 9.70 | 8.32 | 8.14 | 8.10 | 6.64 | 6.20 | 5.83 | 5.31 | 3.39 | 2.63 | 2.67 | 2.02 | 1.57 | 1.40 | 0.85 | 0.51 | 0.40 | |

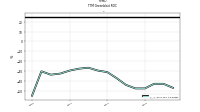

| Income Tax Expense Benefit | -3.87 | NA | NA | -0.12 | -0.30 | NA | NA | NA | NA | NA | NA | 0.36 | 0.00 | -0.06 | NA | NA | NA | NA | NA | |

| Profit Loss | -108.43 | -98.30 | -68.10 | -56.51 | -73.33 | -61.22 | -57.65 | -52.68 | -52.94 | -44.30 | -37.18 | -34.20 | -27.22 | -27.21 | -19.52 | -14.60 | -12.82 | -10.12 | -10.13 | |

| Net Income Loss | -108.43 | -98.30 | -68.10 | -56.51 | -73.33 | -61.22 | -57.65 | -52.68 | -52.94 | -44.30 | -37.18 | -34.20 | -27.22 | -27.21 | -19.52 | -14.60 | -12.82 | -10.12 | -10.13 | |

| Comprehensive Income Net Of Tax | -108.05 | -98.99 | -66.87 | -55.87 | -73.98 | -61.70 | -58.55 | -53.01 | -52.99 | -44.35 | -37.23 | -34.30 | -27.30 | -26.96 | -19.56 | -14.58 | -12.75 | -10.13 | -10.13 |

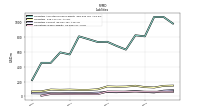

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 984.23 | 1073.71 | 1073.25 | 811.93 | 825.91 | 632.80 | 682.77 | 737.99 | 734.98 | 774.05 | 811.65 | 567.40 | 595.07 | 453.96 | 454.34 | 220.53 | NA | NA | NA | |

| Liabilities | 146.77 | 142.87 | 121.03 | 126.74 | 144.49 | 133.96 | 131.78 | 135.42 | 96.77 | 89.04 | 89.07 | 92.72 | 90.00 | 93.46 | 69.03 | 67.99 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 984.23 | 1073.71 | 1073.25 | 811.93 | 825.91 | 632.80 | 682.77 | 737.99 | 734.98 | 774.05 | 811.65 | 567.40 | 595.07 | 453.96 | 454.34 | 220.53 | NA | NA | NA | |

| Stockholders Equity | 837.46 | 930.84 | 952.22 | 685.19 | 681.42 | 498.84 | 550.99 | 602.57 | 638.20 | 685.01 | 722.58 | 474.68 | 505.07 | 360.50 | 385.32 | -152.57 | -139.45 | -127.70 | -118.11 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 824.47 | 922.09 | 922.75 | 660.18 | 675.11 | 483.05 | 534.34 | 589.77 | 623.54 | 661.01 | 697.40 | 454.12 | 482.90 | 340.38 | 362.09 | 133.98 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 358.40 | 380.33 | 427.22 | 161.41 | 178.94 | 105.78 | 97.67 | 108.50 | 129.15 | 195.60 | 351.60 | 104.27 | 64.87 | 23.98 | 182.67 | 16.66 | 21.82 | 85.47 | 62.76 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 360.79 | 382.92 | 428.96 | 163.15 | 180.68 | 107.52 | 99.40 | 110.23 | 130.24 | 196.68 | 352.68 | 105.35 | 65.95 | 25.06 | 182.88 | 16.87 | 22.04 | 85.69 | 62.97 | |

| Marketable Securities Current | 454.80 | 529.16 | 482.58 | 483.53 | 476.07 | 355.65 | 421.09 | 468.56 | 479.50 | 450.72 | 330.00 | 336.47 | 401.27 | 301.47 | 165.28 | 106.10 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 10.96 | 10.09 | 8.96 | 10.57 | 15.15 | 15.99 | 10.21 | 6.79 | 7.47 | 8.16 | 8.25 | 6.99 | 7.46 | 7.61 | 5.69 | 2.49 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 809.87 | 911.57 | 912.65 | 645.68 | 655.16 | 461.92 | 519.45 | 577.95 | 611.15 | 649.11 | 682.26 | 442.08 | 467.69 | 325.35 | 349.24 | 123.62 | NA | NA | NA |

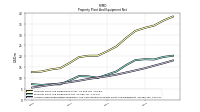

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

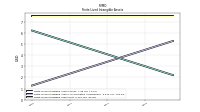

| Property Plant And Equipment Gross | 38.37 | 36.55 | 34.21 | 33.15 | 31.75 | 28.40 | 24.61 | 22.36 | 20.29 | 20.27 | 19.62 | 16.97 | 14.53 | 13.93 | 12.96 | 12.71 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 18.08 | 16.83 | 15.67 | 14.49 | 13.48 | 12.49 | 11.56 | 10.81 | 10.18 | 9.53 | 8.74 | 8.07 | 7.50 | 6.83 | 6.19 | 5.56 | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.30 | 0.30 | 0.27 | 0.27 | 0.30 | 0.30 | 0.27 | 0.27 | 0.30 | 0.30 | 0.27 | 0.27 | 0.30 | 0.30 | 0.27 | 0.27 | 0.30 | 0.30 | 0.27 | |

| Property Plant And Equipment Net | 20.29 | 19.72 | 18.54 | 18.66 | 18.27 | 15.91 | 13.06 | 11.54 | 10.11 | 10.74 | 10.88 | 8.90 | 7.04 | 7.10 | 6.78 | 7.15 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 58.01 | 58.27 | 58.54 | 58.81 | 59.08 | 59.34 | 59.61 | 59.88 | 60.14 | 60.41 | 60.68 | 60.95 | 61.21 | 61.48 | 61.75 | 62.01 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 2.21 | 2.47 | 2.74 | 3.01 | 3.27 | 3.54 | 3.81 | 4.08 | 4.34 | 4.61 | 4.88 | 5.14 | 5.41 | 5.68 | 5.95 | 6.21 | NA | NA | NA | |

| Other Assets Noncurrent | 11.35 | 2.69 | 2.77 | 2.86 | 0.86 | 0.72 | 0.85 | 0.76 | 0.26 | 0.26 | 0.30 | 0.30 | 0.04 | 0.41 | 0.44 | 2.57 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 810.74 | 912.82 | 913.21 | 647.47 | 657.58 | 463.68 | 520.73 | 578.32 | 611.19 | 649.10 | 682.20 | 441.96 | 467.48 | 325.06 | 349.20 | 123.54 | NA | NA | NA |

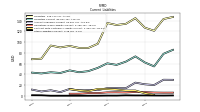

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 85.54 | 78.06 | 54.63 | 61.98 | 73.27 | 63.54 | 57.46 | 60.35 | 51.89 | 45.80 | 43.76 | 47.18 | 42.38 | 43.74 | 41.51 | 43.05 | NA | NA | NA | |

| Accounts Payable Current | 29.63 | 29.78 | 19.91 | 21.31 | 24.38 | 14.07 | 14.17 | 14.06 | 10.49 | 10.44 | 9.65 | 12.61 | 6.66 | 10.17 | 7.88 | 11.40 | NA | NA | NA | |

| Other Liabilities Current | 0.48 | 0.35 | 0.40 | 0.51 | 0.49 | 0.65 | 0.28 | 0.31 | 0.12 | 0.10 | 0.10 | 0.10 | 0.09 | 0.08 | 0.72 | 0.88 | NA | NA | NA | |

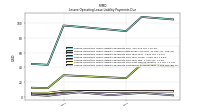

| Contract With Customer Liability Current | NA | NA | 1.43 | 4.46 | 9.69 | 9.69 | 11.43 | 12.36 | 12.66 | 8.34 | 9.96 | 12.11 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | 3.16 | 7.03 | 7.03 | 7.03 | 7.15 | 7.44 | 7.44 | 7.44 | 7.44 | 7.44 | 7.44 | 7.44 | 7.08 | 7.08 | 7.10 | 7.82 | NA | NA | NA | |

| Other Liabilities Noncurrent | 0.98 | 0.25 | 1.69 | 0.30 | 0.47 | 0.22 | 1.63 | 0.63 | 0.93 | 0.61 | 1.44 | 0.63 | 1.09 | 0.69 | 0.59 | 0.66 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 57.09 | 57.54 | 57.68 | 57.43 | 58.18 | 58.92 | 59.58 | 60.42 | 26.83 | 27.57 | 28.29 | 28.99 | NA | NA | NA | NA | NA | NA | NA |

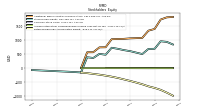

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 837.46 | 930.84 | 952.22 | 685.19 | 681.42 | 498.84 | 550.99 | 602.57 | 638.20 | 685.01 | 722.58 | 474.68 | 505.07 | 360.50 | 385.32 | -152.57 | -139.45 | -127.70 | -118.11 | |

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | NA | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1814.49 | 1799.81 | 1722.20 | 1388.30 | 1328.66 | 1072.10 | 1062.55 | 1055.57 | 1038.20 | 1032.01 | 1025.23 | 740.10 | 736.19 | 564.32 | 562.18 | 4.74 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -976.17 | -867.74 | -769.44 | -701.34 | -644.83 | -571.50 | -510.28 | -452.64 | -399.96 | -347.02 | -302.72 | -265.55 | -231.34 | -204.12 | -176.91 | -157.39 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.87 | -1.25 | -0.56 | -1.78 | -2.42 | -1.76 | -1.28 | -0.38 | -0.04 | 0.01 | 0.06 | 0.12 | 0.21 | 0.29 | 0.04 | 0.07 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 13.67 | 12.98 | 9.70 | NA | 8.14 | 8.10 | 6.64 | NA | 5.83 | 5.31 | 3.39 | NA | 2.67 | 2.02 | 1.57 | NA | 0.85 | 0.51 | 0.40 |

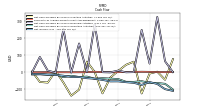

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -100.50 | -67.12 | -62.39 | -61.79 | -51.74 | -55.72 | -55.16 | -39.27 | -36.59 | -34.08 | -37.25 | -25.03 | -27.02 | -19.99 | -28.02 | -11.65 | -13.86 | -11.50 | -12.61 | |

| Net Cash Provided By Used In Investing Activities | 77.35 | -43.54 | 4.00 | -7.10 | -123.44 | 62.40 | 44.02 | 8.53 | -30.18 | -122.78 | 2.31 | 62.95 | -100.97 | -136.50 | -59.72 | 8.02 | -59.80 | -55.95 | 5.76 | |

| Net Cash Provided By Used In Financing Activities | 1.01 | 64.63 | 324.20 | 51.36 | 248.34 | 1.43 | 0.30 | 10.73 | 0.32 | 0.87 | 282.26 | 1.49 | 168.88 | -1.34 | 253.74 | -1.53 | 10.01 | 90.17 | 0.01 |

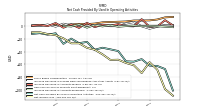

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -100.50 | -67.12 | -62.39 | -61.79 | -51.74 | -55.72 | -55.16 | -39.27 | -36.59 | -34.08 | -37.25 | -25.03 | -27.02 | -19.99 | -28.02 | -11.65 | -13.86 | -11.50 | -12.61 | |

| Net Income Loss | -108.43 | -98.30 | -68.10 | -56.51 | -73.33 | -61.22 | -57.65 | -52.68 | -52.94 | -44.30 | -37.18 | -34.20 | -27.22 | -27.21 | -19.52 | -14.60 | -12.82 | -10.12 | -10.13 | |

| Profit Loss | -108.43 | -98.30 | -68.10 | -56.51 | -73.33 | -61.22 | -57.65 | -52.68 | -52.94 | -44.30 | -37.18 | -34.20 | -27.22 | -27.21 | -19.52 | -14.60 | -12.82 | -10.12 | -10.13 | |

| Depreciation Depletion And Amortization | NA | 1.22 | 1.21 | 1.15 | 0.99 | 0.93 | 0.90 | 0.82 | 0.79 | 0.80 | 0.67 | 0.67 | 0.67 | 0.64 | 0.63 | 0.60 | 0.60 | 0.54 | 0.53 | |

| Increase Decrease In Accounts Receivable | -2.20 | -1.49 | -0.68 | -0.27 | -0.68 | 0.24 | -0.55 | -1.48 | 0.89 | -1.04 | 1.17 | -2.91 | 1.97 | -1.12 | -0.29 | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 0.58 | 8.63 | -1.05 | -1.51 | 10.24 | -0.95 | -0.49 | 2.57 | 0.19 | 1.61 | -2.13 | 4.62 | -3.37 | 2.14 | -3.08 | 4.23 | -0.47 | 1.31 | 0.20 | |

| Share Based Compensation | 13.67 | 12.98 | 9.70 | 8.32 | 8.14 | 8.10 | 6.64 | 6.20 | 5.83 | 5.31 | 3.39 | 2.63 | 2.67 | 2.02 | 1.57 | 1.40 | 0.85 | 0.51 | 0.40 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 77.35 | -43.54 | 4.00 | -7.10 | -123.44 | 62.40 | 44.02 | 8.53 | -30.18 | -122.78 | 2.31 | 62.95 | -100.97 | -136.50 | -59.72 | 8.02 | -59.80 | -55.95 | 5.76 | |

| Payments To Acquire Property Plant And Equipment | 2.54 | 1.12 | 1.76 | 2.88 | 3.52 | 2.53 | 1.89 | 1.18 | 0.45 | 1.31 | 3.58 | 1.17 | 0.69 | 0.47 | 0.60 | 0.51 | 1.11 | 0.63 | 0.34 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 1.01 | 64.63 | 324.20 | 51.36 | 248.34 | 1.43 | 0.30 | 10.73 | 0.32 | 0.87 | 282.26 | 1.49 | 168.88 | -1.34 | 253.74 | -1.53 | 10.01 | 90.17 | 0.01 |

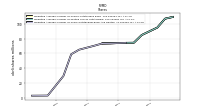

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 0.00 | 3.82 | 7.01 | 15.33 | 3.36 | 9.12 | 7.58 | 9.46 | 1.10 | 8.70 | 10.13 | 8.75 | 12.66 | 10.03 | 11.55 | 12.09 | 12.51 | 12.28 | 13.17 | |

| Collaboration Revenue | NA | NA | 7.01 | 15.33 | 3.36 | 9.12 | 7.58 | 9.46 | 1.10 | 8.70 | 10.13 | 8.75 | 12.66 | 10.03 | 11.55 | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 0.00 | 3.82 | 7.01 | 15.33 | 3.36 | 9.12 | 7.58 | 9.46 | 1.10 | 8.70 | 10.13 | 8.75 | 12.66 | 10.03 | 11.55 | 12.09 | 12.51 | 12.28 | 13.17 | |

| Collaboration Revenue | NA | NA | 7.01 | 15.33 | 3.36 | 9.12 | 7.58 | 9.46 | 1.10 | 8.70 | 10.13 | 8.75 | 12.66 | 10.03 | 11.55 | NA | NA | NA | NA |