| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

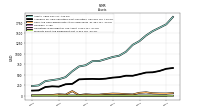

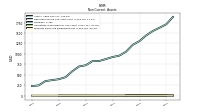

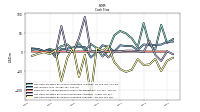

| Revenues | 105.39 | 90.94 | 90.40 | 89.20 | 88.62 | 80.69 | 79.66 | 78.11 | 73.17 | 67.66 | 57.72 | 49.24 | 42.30 | 45.00 | 43.15 | 38.02 | 34.62 | 30.46 | 25.91 | 22.31 | 15.64 | 18.92 | 19.89 | 18.52 | |

| Premiums Earned Net | 93.75 | 85.82 | 83.11 | 83.24 | 82.23 | 77.94 | 80.27 | 76.03 | 67.84 | 64.72 | 54.22 | 47.05 | 38.92 | 42.02 | 39.32 | 34.81 | 30.99 | 27.66 | 23.21 | 18.35 | 17.62 | 16.04 | 18.28 | 17.99 | |

| Net Investment Income | 7.01 | 6.03 | 5.54 | 5.12 | 4.42 | 3.74 | 3.14 | 2.58 | 2.43 | 2.24 | 2.19 | 2.22 | 2.33 | 2.14 | 2.11 | 2.04 | 1.80 | 1.73 | 1.48 | 0.96 | 1.03 | 0.86 | 0.73 | 0.62 | |

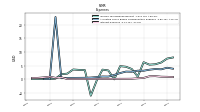

| Gain Loss On Investments | 3.04 | -1.38 | 1.13 | 0.15 | 0.84 | -2.36 | -4.74 | -1.28 | 2.03 | -0.31 | 0.30 | -0.74 | 0.24 | 0.02 | 0.78 | 0.44 | 1.18 | 0.36 | 0.49 | 2.41 | -3.54 | 1.34 | 0.26 | -0.62 | |

| Interest Expense | 0.82 | 0.87 | 1.06 | 1.02 | 0.40 | 0.27 | 0.11 | 0.09 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.64 | 0.43 | 0.86 | 0.60 | 0.43 | 0.40 | |

| Interest Paid Net | 1.25 | 0.39 | 1.02 | 1.02 | 0.35 | 0.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.72 | 0.44 | 0.54 | 0.31 | 0.46 | 0.42 | |

| Allocated Share Based Compensation Expense | 4.18 | 3.59 | 3.70 | 3.45 | 3.07 | 3.09 | 2.70 | 2.76 | 2.21 | 1.52 | 0.91 | 0.94 | 0.71 | 0.55 | 0.46 | 0.44 | 0.43 | 0.41 | 0.31 | 22.96 | 0.00 | 0.00 | NA | NA | |

| Income Tax Expense Benefit | 7.56 | 6.10 | 5.46 | 5.32 | 6.22 | 0.91 | 3.70 | 4.55 | 4.76 | -0.12 | 3.18 | 3.48 | -0.56 | -6.16 | 3.30 | 3.38 | 3.53 | 2.00 | 1.79 | 0.14 | -0.01 | 0.00 | 0.00 | -0.01 | |

| Income Taxes Paid Net | 0.03 | 5.44 | 15.65 | 0.00 | 0.02 | 5.79 | NA | NA | 0.00 | NA | NA | NA | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 25.90 | 18.43 | 17.56 | 17.31 | 18.76 | 4.29 | 14.59 | 14.54 | 16.63 | 0.25 | 12.34 | 16.63 | -1.85 | -15.69 | 12.01 | 11.78 | 10.88 | 7.45 | 6.70 | -14.41 | 4.13 | 1.57 | 6.93 | 5.59 | |

| Comprehensive Income Net Of Tax | 45.13 | 9.94 | 13.88 | 22.79 | 24.87 | -11.13 | 0.52 | -3.93 | 13.84 | -1.41 | 15.05 | 10.43 | 0.96 | -14.78 | 22.69 | 5.94 | 9.67 | 8.43 | 10.00 | -12.22 | 5.08 | 1.26 | 6.84 | 4.69 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

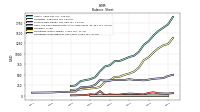

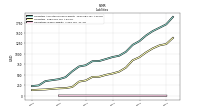

| Assets | 1708.02 | 1626.33 | 1546.31 | 1440.99 | 1306.45 | 1216.47 | 1051.14 | 957.43 | 925.73 | 876.81 | 829.66 | 825.87 | 729.09 | 699.76 | 584.05 | 443.64 | 395.46 | 372.83 | 349.43 | 246.24 | 231.13 | NA | NA | NA | |

| Liabilities | 1236.77 | 1205.00 | 1132.60 | 1036.34 | 921.70 | 848.62 | 673.08 | 577.03 | 531.57 | 499.03 | 452.91 | 449.48 | 365.38 | 337.86 | 208.81 | 182.82 | 176.91 | 164.37 | 149.79 | 144.33 | 134.84 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1708.02 | 1626.33 | 1546.31 | 1440.99 | 1306.45 | 1216.47 | 1051.14 | 957.43 | 925.73 | 876.81 | 829.66 | 825.87 | 729.09 | 699.76 | 584.05 | 443.64 | 395.46 | 372.83 | 349.43 | 246.24 | 231.13 | NA | NA | NA | |

| Stockholders Equity | 471.25 | 421.33 | 413.71 | 404.65 | 384.75 | 367.85 | 378.06 | 380.40 | 394.17 | 377.78 | 376.75 | 376.38 | 363.71 | 361.89 | 375.24 | 260.82 | 218.56 | 208.46 | 199.64 | 101.91 | 96.29 | 91.21 | 89.95 | 83.11 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

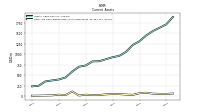

| Cash And Cash Equivalents At Carrying Value | 51.55 | 53.03 | 58.31 | 80.30 | 68.11 | 29.47 | 36.47 | 46.88 | 50.28 | 41.41 | 24.93 | 23.58 | 33.54 | 14.03 | 109.32 | 23.84 | 33.12 | 16.48 | 14.40 | 10.49 | 9.53 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 51.85 | 53.29 | 58.60 | 80.36 | 68.16 | 29.54 | 36.51 | 46.94 | 50.37 | 41.63 | 25.62 | 23.85 | 33.79 | 14.20 | 109.94 | 24.16 | 33.35 | 16.90 | 14.88 | 10.89 | 9.92 | 9.54 | 8.91 | 8.03 | |

| Available For Sale Securities Debt Securities | 643.80 | 591.91 | 560.12 | 554.49 | 515.06 | 476.79 | 478.48 | 444.32 | 432.68 | 408.05 | 396.64 | 402.28 | 397.99 | 390.81 | 282.86 | 273.36 | 217.15 | 223.99 | 208.06 | 126.95 | 122.22 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

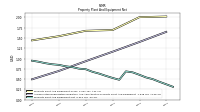

| Property Plant And Equipment Gross | 2.02 | NA | NA | NA | 2.00 | NA | NA | NA | 1.69 | NA | NA | NA | 1.67 | NA | NA | NA | 1.54 | NA | NA | NA | 1.44 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 1.65 | NA | NA | NA | 1.40 | NA | NA | NA | 1.17 | NA | NA | NA | 0.94 | NA | NA | NA | 0.70 | NA | NA | NA | 0.49 | NA | NA | NA | |

| Property Plant And Equipment Net | 0.37 | 0.43 | 0.50 | 0.54 | 0.60 | 0.66 | 0.69 | 0.48 | 0.53 | 0.58 | 0.63 | 0.68 | 0.74 | 0.75 | 0.79 | 0.81 | 0.84 | 0.86 | 0.89 | 0.92 | 0.95 | NA | NA | NA | |

| Goodwill | 3.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | 12.31 | 12.71 | 13.10 | NA | 8.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 675.13 | 647.58 | 605.04 | 594.74 | 561.58 | NA | NA | NA | NA | NA | 384.45 | 393.42 | 381.28 | 377.66 | 270.85 | 274.86 | 211.28 | 216.62 | 202.44 | 125.05 | 122.95 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

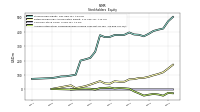

| Stockholders Equity | 471.25 | 421.33 | 413.71 | 404.65 | 384.75 | 367.85 | 378.06 | 380.40 | 394.17 | 377.78 | 376.75 | 376.38 | 363.71 | 361.89 | 375.24 | 260.82 | 218.56 | 208.46 | 199.64 | 101.91 | 96.29 | 91.21 | 89.95 | 83.11 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 471.25 | 421.33 | 413.71 | 404.65 | 384.75 | 367.85 | 378.06 | 380.40 | 394.17 | NA | NA | NA | 363.71 | NA | NA | NA | 218.56 | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 350.60 | 345.67 | 341.41 | 337.49 | 333.56 | 330.38 | 326.47 | 322.05 | 318.90 | 316.35 | 313.91 | 312.75 | 310.50 | 309.50 | 308.07 | 216.33 | 180.01 | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 144.64 | 118.88 | 107.02 | 98.19 | 87.71 | 80.09 | 78.81 | 71.50 | 69.95 | 53.32 | 53.08 | 56.59 | 39.96 | 41.96 | 57.64 | 45.63 | 33.86 | 22.98 | 15.52 | 8.82 | 28.36 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -23.99 | -43.22 | -34.73 | -31.04 | -36.52 | -42.63 | -27.22 | -13.15 | 5.31 | 8.10 | 9.76 | 7.05 | 13.25 | 10.44 | 9.53 | -1.15 | 4.69 | 5.90 | 4.92 | 1.62 | -0.56 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

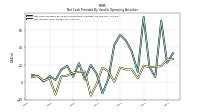

| Net Cash Provided By Used In Operating Activities | 22.27 | 70.63 | 5.77 | 17.44 | 75.04 | 11.74 | 35.00 | 47.80 | 54.40 | 42.77 | 3.70 | -13.05 | 9.38 | 19.67 | 2.69 | 21.80 | 6.04 | 18.77 | 14.44 | 2.46 | 7.00 | 0.63 | 6.77 | 8.41 | |

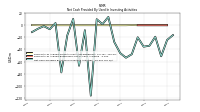

| Net Cash Provided By Used In Investing Activities | -24.32 | -51.25 | -19.01 | -33.90 | -35.38 | -19.93 | -47.87 | -53.63 | -45.99 | -27.67 | 13.66 | 1.82 | 9.91 | -116.29 | -8.18 | -66.87 | 10.41 | -16.73 | -77.87 | 3.63 | -6.61 | -1.55 | -5.90 | -11.31 | |

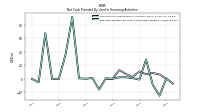

| Net Cash Provided By Used In Financing Activities | 0.62 | -24.70 | -8.52 | 28.66 | -1.03 | 1.22 | 2.44 | 2.40 | 0.34 | 0.92 | -15.59 | 1.30 | 0.30 | 0.88 | 91.27 | 35.88 | -0.00 | -0.01 | 67.42 | -5.12 | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 22.27 | 70.63 | 5.77 | 17.44 | 75.04 | 11.74 | 35.00 | 47.80 | 54.40 | 42.77 | 3.70 | -13.05 | 9.38 | 19.67 | 2.69 | 21.80 | 6.04 | 18.77 | 14.44 | 2.46 | 7.00 | 0.63 | 6.77 | 8.41 | |

| Net Income Loss | 25.90 | 18.43 | 17.56 | 17.31 | 18.76 | 4.29 | 14.59 | 14.54 | 16.63 | 0.25 | 12.34 | 16.63 | -1.85 | -15.69 | 12.01 | 11.78 | 10.88 | 7.45 | 6.70 | -14.41 | 4.13 | 1.57 | 6.93 | 5.59 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -24.32 | -51.25 | -19.01 | -33.90 | -35.38 | -19.93 | -47.87 | -53.63 | -45.99 | -27.67 | 13.66 | 1.82 | 9.91 | -116.29 | -8.18 | -66.87 | 10.41 | -16.73 | -77.87 | 3.63 | -6.61 | -1.55 | -5.90 | -11.31 | |

| Payments To Acquire Property Plant And Equipment | 0.00 | -0.00 | NA | NA | 0.01 | 0.04 | 0.26 | 0.01 | 0.00 | 0.00 | NA | NA | 0.05 | 0.02 | 0.04 | 0.02 | 0.04 | 0.03 | 0.02 | 0.03 | 0.02 | 0.04 | 0.02 | 0.25 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 0.62 | -24.70 | -8.52 | 28.66 | -1.03 | 1.22 | 2.44 | 2.40 | 0.34 | 0.92 | -15.59 | 1.30 | 0.30 | 0.88 | 91.27 | 35.88 | -0.00 | -0.01 | 67.42 | -5.12 | 0.00 | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.13 | 6.57 | 8.74 | 6.83 | 11.14 | 3.00 | 7.28 | 12.99 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 105.39 | 90.94 | 90.40 | 89.20 | 88.62 | 80.69 | 79.66 | 78.11 | 73.17 | 67.66 | 57.72 | 49.24 | 42.30 | 45.00 | 43.15 | 38.02 | 34.62 | 30.46 | 25.91 | 22.31 | 15.64 | 18.92 | 19.89 | 18.52 |