| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

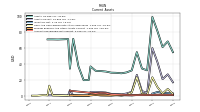

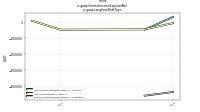

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | 98.82 | 97.74 | 96.84 | NA | 74.70 | 71.62 | 64.59 | NA | 44.30 | 41.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 98.82 | 97.74 | 96.84 | NA | 74.35 | 71.62 | 64.59 | NA | 44.30 | 41.87 | NA | NA | NA | 38.81 | NA | NA | NA | 25.40 | NA | |

| Earnings Per Share Basic | -0.10 | -0.08 | -0.17 | -0.15 | -0.40 | 0.01 | -0.12 | -0.22 | -0.12 | -0.19 | -0.08 | NA | NA | NA | -0.08 | NA | NA | NA | 0.18 | NA | |

| Earnings Per Share Diluted | -0.10 | -0.08 | -0.17 | -0.15 | -0.40 | -0.01 | -0.12 | -0.22 | -0.12 | -0.19 | -0.08 | NA | NA | NA | -0.08 | NA | NA | NA | 0.17 | NA |

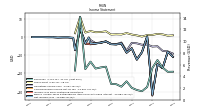

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

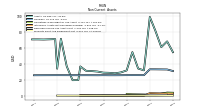

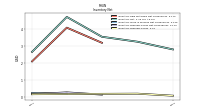

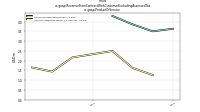

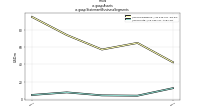

| Revenue From Contract With Customer Excluding Assessed Tax | 4.77 | 4.76 | 5.49 | 6.78 | 5.40 | 2.16 | 1.44 | 1.65 | 2.02 | 3.13 | 2.21 | 2.64 | 2.69 | 5.64 | 5.51 | 5.32 | 6.50 | 5.21 | 14.19 | 4.98 | |

| Revenues | 4.77 | 4.76 | 5.49 | 6.78 | 5.40 | 2.16 | 1.44 | 1.65 | 2.02 | 3.13 | 2.21 | 2.64 | 2.69 | 5.64 | 5.51 | 5.32 | 6.50 | 5.21 | 14.19 | 4.98 | |

| Cost Of Goods And Services Sold | 3.78 | 3.96 | 3.96 | 5.01 | 4.19 | 1.03 | 1.12 | 0.69 | 0.60 | 0.90 | 0.77 | 1.09 | 1.26 | 2.42 | 2.72 | 2.62 | 3.16 | 2.71 | 3.07 | 2.87 | |

| Gross Profit | 0.99 | 0.80 | 1.52 | 1.77 | 1.21 | 1.13 | 0.31 | 0.95 | 1.42 | 2.23 | 1.45 | 1.55 | 1.43 | 3.22 | 2.79 | 2.70 | 3.34 | 2.51 | 11.12 | 2.11 | |

| Operating Expenses | 10.06 | 8.67 | 9.05 | 6.79 | 6.41 | 5.17 | 4.51 | 4.37 | 4.58 | 9.73 | 4.42 | 5.41 | 5.21 | 5.51 | 5.71 | 6.01 | 4.94 | 5.85 | 6.45 | 8.71 | |

| Research And Development Expense | 1.60 | 1.67 | 1.88 | 1.00 | 1.12 | 1.16 | 0.85 | 1.05 | 0.82 | 0.57 | 0.38 | 0.86 | 0.90 | 1.05 | 1.08 | 1.31 | 1.28 | 1.67 | 1.72 | 2.30 | |

| General And Administrative Expense | 4.81 | 5.19 | 5.25 | 4.30 | 4.18 | 3.30 | 3.02 | 2.76 | 3.38 | 4.28 | 3.76 | 3.94 | 3.70 | 3.75 | 3.97 | 3.98 | 2.82 | 2.94 | 3.32 | 4.49 | |

| Selling And Marketing Expense | 1.58 | 1.82 | 1.93 | 1.49 | 1.11 | 0.71 | 0.64 | 0.56 | 0.39 | 0.38 | 0.28 | 0.60 | 0.61 | 0.70 | 0.67 | 0.72 | 0.84 | 1.24 | 1.41 | 1.92 | |

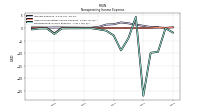

| Operating Income Loss | -9.07 | -7.88 | -7.54 | -5.02 | -5.20 | -4.04 | -4.19 | -3.41 | -3.17 | -7.50 | -2.97 | -3.86 | -3.79 | -2.29 | -2.92 | -3.31 | -1.59 | -3.34 | 4.67 | -6.59 | |

| Interest Expense | NA | NA | 0.27 | 0.38 | NA | NA | 1.84 | 2.22 | 1.49 | 1.36 | 0.46 | 0.10 | 0.10 | 0.14 | 0.15 | 0.19 | 0.19 | 0.15 | 0.18 | 0.20 | |

| Interest Income Expense Net | -0.76 | -0.99 | NA | NA | -0.42 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 0.34 | 0.20 | 0.20 | 0.20 | 0.05 | 0.03 | 0.72 | 0.57 | 0.57 | 0.35 | 0.23 | 0.10 | 0.09 | 0.15 | 0.15 | 0.21 | 0.18 | 0.16 | 0.18 | 0.18 | |

| Net Income Loss | -10.89 | -8.02 | -17.07 | -14.92 | -31.81 | 0.37 | -8.29 | -12.36 | -6.16 | -8.57 | -3.51 | -3.96 | -3.88 | -2.43 | -3.07 | -3.49 | -3.59 | -3.52 | 4.47 | -7.16 | |

| Comprehensive Income Net Of Tax | -10.81 | -8.10 | -17.16 | -14.95 | -31.81 | 0.34 | -8.29 | -12.35 | -6.09 | -8.52 | -3.51 | -4.04 | -3.81 | -2.46 | -3.10 | -3.47 | -3.62 | -3.54 | 4.39 | NA |

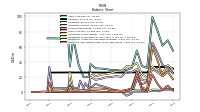

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

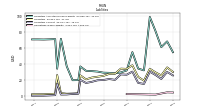

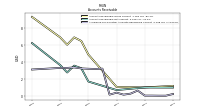

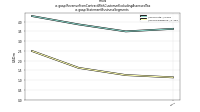

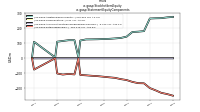

| Assets | 54.84 | 68.48 | 61.24 | 81.42 | 99.29 | 31.95 | 34.21 | 54.93 | 31.84 | 29.35 | 28.22 | 28.84 | 29.05 | 30.43 | 31.02 | 31.43 | 36.88 | NA | NA | NA | |

| Liabilities | 29.95 | 35.70 | 25.54 | 29.43 | 34.02 | 18.93 | 23.73 | 38.37 | 33.81 | 34.16 | 27.71 | 27.49 | 25.03 | 23.94 | 22.87 | 20.63 | 25.68 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 54.84 | 68.48 | 61.24 | 81.42 | 99.29 | 31.95 | 34.21 | 54.93 | 31.84 | 29.35 | 28.22 | 28.84 | 29.05 | 30.43 | 31.02 | 31.43 | 36.88 | NA | NA | NA | |

| Stockholders Equity | 24.88 | 32.78 | 35.69 | 51.99 | 65.28 | 13.03 | 10.48 | 16.56 | -1.98 | -4.81 | 0.51 | 1.35 | 4.03 | 6.48 | 8.14 | 10.81 | 5.83 | 11.64 | 15.10 | 5.77 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 16.86 | 26.91 | 20.82 | 42.27 | 60.01 | 3.64 | 5.73 | 26.30 | 4.91 | 2.76 | 1.64 | 2.22 | 2.31 | 3.95 | 4.53 | 4.84 | 4.72 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 1.96 | 8.54 | 2.71 | 10.81 | 23.14 | 0.88 | 2.71 | 23.47 | 3.94 | 1.14 | 0.15 | 0.83 | 0.28 | 0.07 | 0.25 | 1.06 | 0.84 | NA | NA | 0.24 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1.96 | 8.54 | 2.71 | 10.81 | 23.14 | 0.97 | 2.81 | 23.56 | 4.03 | 1.23 | 0.24 | 0.92 | 0.36 | 0.07 | 0.25 | 1.06 | 6.34 | 0.12 | 0.22 | NA | |

| Accounts Receivable Net Current | 0.96 | NA | NA | NA | 0.97 | NA | NA | NA | 0.66 | NA | NA | NA | 1.67 | 3.24 | 3.55 | 2.74 | 3.61 | NA | NA | NA | |

| Inventory Net | 2.78 | 3.24 | 3.53 | 4.70 | 2.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Inventory Finished Goods | 0.05 | 0.17 | NA | NA | 0.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 1.03 | 0.81 | 1.19 | 1.29 | 0.69 | 0.74 | 1.59 | 0.79 | 0.30 | 0.46 | 0.56 | 0.47 | 0.37 | 0.64 | 0.74 | 1.04 | 0.27 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

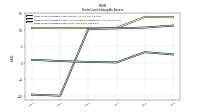

| Property Plant And Equipment Net | 0.22 | 0.21 | 0.14 | 0.08 | NA | NA | NA | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | 0.04 | 0.04 | 0.05 | 0.07 | NA | NA | NA | |

| Goodwill | 31.11 | 33.06 | 33.14 | 33.23 | 33.26 | 25.88 | 25.91 | 25.91 | 25.90 | 25.83 | 25.78 | 25.78 | 25.86 | 25.79 | 25.82 | 25.85 | 25.82 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 2.52 | 2.69 | 2.86 | 3.03 | 3.21 | 0.04 | 0.05 | 0.08 | 0.11 | 0.14 | 0.17 | 0.21 | 0.25 | NA | NA | NA | 0.52 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 2.52 | NA | NA | NA | 3.21 | NA | NA | NA | 0.11 | NA | NA | NA | 0.25 | NA | NA | NA | 0.52 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

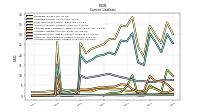

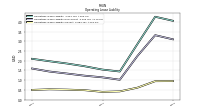

| Liabilities Current | 25.58 | 29.94 | 21.16 | 26.12 | 30.29 | 14.85 | 16.16 | 30.39 | 26.46 | 26.91 | 20.03 | 21.05 | 19.83 | 19.46 | 17.50 | 16.10 | 19.97 | NA | NA | NA | |

| Long Term Debt Current | 9.67 | 12.69 | 2.03 | 3.49 | 4.90 | 0.08 | 0.08 | 10.01 | 4.43 | 1.69 | 1.33 | 1.20 | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 7.70 | 7.51 | 7.51 | 6.81 | 6.59 | 7.08 | 7.04 | 7.78 | 8.46 | 9.07 | 9.74 | 10.67 | 10.16 | 9.56 | 9.08 | 8.60 | 9.89 | NA | NA | NA | |

| Other Accrued Liabilities Current | 0.69 | NA | NA | NA | 0.58 | NA | NA | NA | 0.45 | NA | NA | NA | 0.35 | NA | NA | NA | 0.21 | NA | NA | NA | |

| Accrued Income Taxes Current | 0.46 | NA | NA | NA | 0.26 | NA | NA | NA | 0.17 | NA | NA | NA | 0.32 | NA | NA | NA | 0.12 | NA | NA | NA | |

| Accrued Liabilities Current | 2.90 | 5.60 | 6.95 | 7.11 | 9.62 | 2.42 | 1.97 | 3.19 | 5.35 | 5.55 | 4.42 | 4.40 | 4.04 | 3.98 | 3.36 | 2.97 | 3.03 | NA | NA | NA | |

| Contract With Customer Liability Current | 2.90 | 1.65 | 1.72 | 3.26 | 3.97 | 1.81 | 2.01 | 2.18 | 2.40 | 3.21 | 2.98 | 3.13 | 3.36 | 3.17 | 2.10 | NA | 2.63 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | NA | 1.28 | 1.28 | 1.28 | 1.28 | 0.54 | 0.54 | 0.54 | 0.54 | 0.24 | 0.24 | 0.24 | 0.24 | NA | NA | NA | 0.06 | NA | NA | NA | |

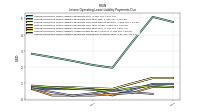

| Operating Lease Liability Noncurrent | 3.10 | 3.32 | 2.24 | 1.02 | 1.15 | 1.23 | 1.34 | 1.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 24.88 | 32.78 | 35.69 | 51.99 | 65.28 | 13.03 | 10.48 | 16.56 | -1.98 | -4.81 | 0.51 | 1.35 | 4.03 | 6.48 | 8.14 | 10.81 | 5.83 | 11.64 | 15.10 | 5.77 | |

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

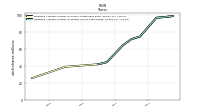

| Additional Paid In Capital | 275.56 | 272.66 | 267.46 | 266.61 | 264.94 | 180.89 | 177.25 | 175.05 | 144.16 | 135.24 | 132.04 | 129.37 | 128.01 | 126.65 | 125.85 | 125.42 | 118.06 | NA | NA | NA | |

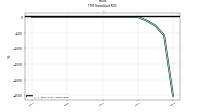

| Retained Earnings Accumulated Deficit | -250.22 | -239.33 | -231.31 | -214.24 | -199.32 | -167.51 | -166.46 | -158.17 | -145.80 | -139.65 | -131.08 | -127.57 | -123.60 | -119.72 | -117.29 | -114.23 | -111.82 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.47 | -0.55 | -0.47 | -0.38 | -0.35 | -0.36 | -0.32 | -0.33 | -0.34 | -0.41 | -0.46 | -0.45 | -0.38 | -0.45 | -0.42 | -0.39 | -0.42 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.64 | 3.65 | NA | NA | 62.03 | 2.17 | 0.83 | 29.70 | 7.84 | 1.34 | 0.52 | 0.49 | NA | NA | NA | NA | 0.00 | -0.01 | 4.77 | 4.80 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.90 | 0.85 | 0.74 | 0.52 | 1.04 | 1.46 | 1.37 | 1.05 | 1.03 | 1.71 | 1.11 | 0.64 | 0.67 | 0.68 | 0.42 | 0.01 | 0.17 | 0.07 | 0.06 | NA |

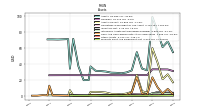

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

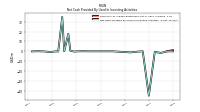

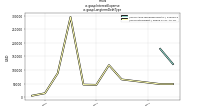

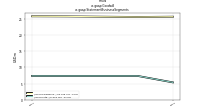

| Net Cash Provided By Used In Operating Activities | -3.96 | -7.88 | -4.82 | -10.17 | -3.42 | -4.72 | -7.07 | -7.30 | -4.46 | -1.76 | -2.85 | -1.91 | -0.29 | -0.03 | -1.75 | -4.12 | -1.09 | 0.52 | -2.72 | -3.30 | |

| Net Cash Provided By Used In Investing Activities | -0.00 | -0.08 | -1.64 | -0.57 | -44.89 | 0.00 | -0.40 | -1.10 | NA | NA | 0.00 | 0.00 | 0.00 | -0.02 | 0.00 | 0.09 | -0.07 | 0.60 | 0.05 | -0.20 | |

| Net Cash Provided By Used In Financing Activities | -2.71 | 13.88 | -1.57 | -1.55 | 70.47 | 2.92 | -13.29 | 27.92 | 7.18 | 2.71 | 2.17 | 2.54 | 0.51 | -0.10 | 0.96 | -1.28 | 1.91 | -1.21 | 2.72 | 3.39 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -3.96 | -7.88 | -4.82 | -10.17 | -3.42 | -4.72 | -7.07 | -7.30 | -4.46 | -1.76 | -2.85 | -1.91 | -0.29 | -0.03 | -1.75 | -4.12 | -1.09 | 0.52 | -2.72 | -3.30 | |

| Net Income Loss | -10.89 | -8.02 | -17.07 | -14.92 | -31.81 | 0.37 | -8.29 | -12.36 | -6.16 | -8.57 | -3.51 | -3.96 | -3.88 | -2.43 | -3.07 | -3.49 | -3.59 | -3.52 | 4.47 | -7.16 | |

| Increase Decrease In Accounts Receivable | -0.73 | 0.90 | -0.43 | 0.25 | -0.26 | 0.51 | -0.28 | 0.04 | -0.24 | 0.26 | -0.03 | -0.78 | -1.53 | -0.36 | 0.92 | -0.85 | -0.53 | -0.41 | 0.06 | -1.57 | |

| Increase Decrease In Inventories | -0.32 | -0.16 | -1.17 | 2.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 0.19 | 0.01 | 0.70 | 0.22 | -0.33 | 0.05 | -0.60 | -0.68 | -0.11 | 0.18 | -0.49 | 0.85 | 1.07 | 0.48 | 0.48 | -1.29 | 0.77 | 1.32 | 0.41 | 1.66 | |

| Share Based Compensation | 0.84 | 0.90 | 0.71 | 0.56 | 1.01 | 1.50 | 1.38 | 1.05 | 1.03 | 1.71 | 1.11 | 0.64 | 0.67 | 0.68 | 0.42 | 0.01 | 0.17 | 0.07 | 0.06 | 0.15 | |

| Amortization Of Financing Costs | 0.34 | 0.43 | 0.10 | 0.15 | 0.17 | 0.00 | 1.12 | 0.62 | 0.32 | 0.18 | 0.16 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -0.00 | -0.08 | -1.64 | -0.57 | -44.89 | 0.00 | -0.40 | -1.10 | NA | NA | 0.00 | 0.00 | 0.00 | -0.02 | 0.00 | 0.09 | -0.07 | 0.60 | 0.05 | -0.20 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -2.71 | 13.88 | -1.57 | -1.55 | 70.47 | 2.92 | -13.29 | 27.92 | 7.18 | 2.71 | 2.17 | 2.54 | 0.51 | -0.10 | 0.96 | -1.28 | 1.91 | -1.21 | 2.72 | 3.39 |

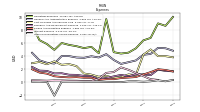

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 4.77 | 4.76 | 5.49 | 6.78 | 5.40 | 2.16 | 1.44 | 1.65 | 2.02 | 3.13 | 2.21 | 2.64 | 2.69 | 5.64 | 5.51 | 5.32 | 6.50 | 5.21 | 14.19 | 4.98 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 4.77 | 4.76 | 5.49 | 6.78 | 5.40 | 2.16 | 1.44 | 1.65 | 2.02 | 3.13 | 2.21 | 2.64 | 2.69 | 5.64 | 5.51 | 5.32 | 6.50 | 5.21 | 14.19 | 4.98 | |

| Hardware Revenues | 3.63 | 3.50 | 3.86 | 4.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Platform Revenue | NA | 1.26 | 1.63 | 2.49 | NA | 2.16 | 1.44 | 1.65 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Lyte | 3.63 | 3.50 | 3.86 | 4.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Phunware | 1.14 | 1.26 | 1.63 | 2.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |