| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 13.57 | 13.50 | 13.47 | 13.13 | 13.08 | 12.99 | 12.94 | 12.82 | 12.62 | 12.44 | 12.37 | 12.07 | |

| Weighted Average Number Of Diluted Shares Outstanding | 12.92 | 13.02 | NA | 12.85 | 12.90 | 12.93 | NA | 12.82 | 12.61 | 12.29 | NA | 12.12 | |

| Weighted Average Number Of Shares Outstanding Basic | 12.69 | 12.62 | NA | 12.24 | 12.18 | 12.09 | NA | 11.88 | 11.64 | 11.53 | NA | 11.95 | |

| Earnings Per Share Basic | 0.64 | 0.90 | 0.52 | 0.22 | 0.24 | 0.24 | 0.83 | 1.00 | 0.79 | 0.70 | 1.00 | 0.53 | |

| Earnings Per Share Diluted | 0.63 | 0.87 | 0.50 | 0.21 | 0.23 | 0.22 | 0.77 | 0.92 | 0.73 | 0.66 | 0.97 | 0.53 | |

| Income Loss From Continuing Operations Per Basic Share | 0.00 | 0.00 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | 0.00 | 0.00 | |

| Income Loss From Continuing Operations Per Diluted Share | 0.00 | 0.00 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | 0.00 | 0.00 |

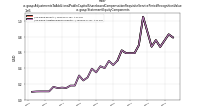

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 39.32 | 38.70 | 37.51 | 31.79 | 25.84 | 21.45 | 21.11 | 18.53 | 18.75 | 16.89 | 16.93 | 16.98 | |

| Insurance Commissions And Fees | 0.08 | 0.09 | 0.18 | 0.20 | 0.22 | 0.25 | 0.30 | 0.24 | 0.25 | 0.22 | 0.25 | 0.22 | |

| Marketing And Advertising Expense | NA | NA | NA | 0.23 | 0.20 | 0.33 | 0.11 | 0.21 | 0.15 | 0.07 | 0.20 | 0.23 | |

| Interest Expense | 17.45 | 12.03 | 7.25 | 4.06 | 1.43 | 1.41 | 1.55 | 1.39 | 1.78 | 1.56 | 1.17 | 2.62 | |

| Interest Income Expense Net | 29.58 | 32.73 | 33.45 | 29.85 | 26.66 | 21.85 | 21.50 | 19.10 | 19.05 | 17.50 | 17.69 | 16.01 | |

| Interest Paid Net | 18.08 | 12.15 | 5.99 | 2.85 | 2.58 | 0.86 | 1.66 | 1.10 | 2.13 | 1.26 | -1.00 | 3.01 | |

| Income Tax Expense Benefit | 1.96 | 0.47 | 1.97 | 0.40 | 0.86 | 0.91 | 2.88 | 3.16 | 1.67 | 2.17 | 1.32 | 2.02 | |

| Income Taxes Paid | 10.21 | 0.03 | NA | 0.10 | 0.20 | 0.12 | NA | 1.66 | NA | NA | NA | 6.16 | |

| Profit Loss | 8.00 | 11.22 | 6.37 | 2.56 | 2.79 | 2.67 | 9.80 | 11.67 | 9.16 | 8.06 | 11.84 | 6.49 | |

| Other Comprehensive Income Loss Net Of Tax | -3.53 | 6.77 | 2.27 | -10.56 | -12.26 | -13.56 | -2.79 | -0.81 | 1.89 | -4.12 | 3.48 | 0.94 | |

| Net Income Loss | NA | NA | 6.51 | 2.72 | 2.96 | 2.86 | 9.96 | 11.83 | 9.25 | 8.09 | 11.84 | 6.49 | |

| Comprehensive Income Net Of Tax | 4.59 | 18.11 | 8.78 | -7.84 | -9.30 | -10.69 | 7.17 | 11.01 | 11.14 | 3.97 | 15.32 | 7.43 | |

| Net Income Loss Available To Common Stockholders Basic | 8.11 | 11.34 | 6.51 | 2.72 | 2.96 | 2.86 | 9.96 | 11.83 | 9.25 | 8.05 | 11.72 | 6.38 | |

| Interest Income Expense After Provision For Loan Loss | 33.82 | 28.15 | 30.75 | 24.73 | 21.56 | 20.57 | 27.24 | 18.72 | 20.59 | 16.89 | 17.97 | 7.38 | |

| Noninterest Expense | 30.28 | 28.32 | 28.74 | 29.96 | 29.82 | 28.86 | 29.10 | 25.83 | 23.40 | 19.12 | 20.89 | 18.27 | |

| Noninterest Income | 6.42 | 3.07 | 6.32 | 8.19 | 11.91 | 11.87 | 14.54 | 21.95 | 13.64 | 12.46 | 16.08 | 19.40 |

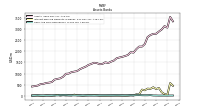

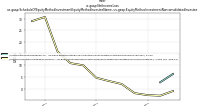

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 3351.85 | 3551.88 | 3068.85 | 3139.92 | 2984.43 | 2893.46 | 2792.45 | 2788.82 | 2734.54 | 2646.09 | 2331.48 | 2214.46 | |

| Liabilities | 3077.55 | 3280.56 | 2807.46 | 2895.56 | 2731.52 | 2629.60 | 2517.15 | 2522.12 | 2485.14 | 2409.41 | 2091.99 | 1980.34 | |

| Liabilities And Stockholders Equity | 3351.85 | 3551.88 | 3068.85 | 3139.92 | 2984.43 | 2893.46 | 2792.45 | 2788.82 | 2734.54 | 2646.09 | 2331.48 | 2214.46 | |

| Stockholders Equity | 274.35 | 271.13 | 261.08 | 243.91 | 252.30 | 263.08 | 274.33 | 265.56 | 248.61 | 236.21 | 239.48 | 234.12 |

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 455.83 | 575.26 | 40.28 | 79.95 | 161.76 | 353.97 | 307.44 | 390.08 | 332.77 | 339.62 | 263.89 | 295.82 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 455.83 | 575.26 | 40.28 | 79.95 | 161.76 | 353.97 | 307.44 | 390.08 | 334.09 | 339.62 | 263.89 | 295.82 | |

| Equity Securities Fv Ni | 41.08 | 38.58 | 38.74 | 34.10 | 34.25 | 34.45 | 32.40 | 29.81 | 32.22 | 28.20 | 27.59 | 24.16 |

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 2.84 | 2.84 | 3.99 | 3.99 | 3.99 | 3.99 | 3.99 | 3.99 | 4.12 | 2.35 | 2.35 | 2.35 | |

| Finite Lived Intangible Assets Net | NA | NA | 1.63 | NA | NA | NA | 2.32 | NA | NA | NA | 2.40 | NA | |

| Equity Securities Fv Ni | 41.08 | 38.58 | 38.74 | 34.10 | 34.25 | 34.45 | 32.40 | 29.81 | 32.22 | 28.20 | 27.59 | 24.16 | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | 376.19 | 427.13 | 416.22 | 411.77 | 413.28 | 421.27 | 435.22 | 446.68 | 420.69 | 400.72 | 291.61 |

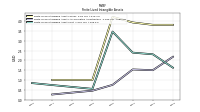

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 402.29 | 290.50 | 263.25 | 196.04 | 151.75 | 43.01 | 64.35 | 21.47 | 27.89 | 66.15 | 126.86 | 108.55 |

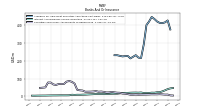

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | -0.05 | 0.18 | 0.31 | 0.45 | 0.61 | 0.78 | 0.97 | 1.14 | 0.79 | 0.47 | NA | NA |

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 274.35 | 271.13 | 261.08 | 243.91 | 252.30 | 263.08 | 274.33 | 265.56 | 248.61 | 236.21 | 239.48 | 234.12 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 274.30 | 271.32 | 261.39 | 244.36 | 252.91 | 263.86 | 275.30 | 266.70 | 249.40 | 236.68 | 239.48 | 234.12 | |

| Common Stock Value | 13.57 | 13.50 | 13.47 | 13.13 | 13.08 | 12.99 | 12.94 | 12.82 | 12.62 | 12.44 | 12.37 | 12.07 | |

| Additional Paid In Capital Common Stock | 158.57 | 157.84 | 157.15 | 146.95 | 145.48 | 144.97 | 143.52 | 140.24 | 132.82 | 130.34 | 129.12 | 124.47 | |

| Retained Earnings Accumulated Deficit | 153.41 | 147.47 | 144.91 | 140.55 | 139.90 | 139.02 | 138.22 | 130.07 | 119.91 | 112.07 | 105.17 | 94.50 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -34.46 | -30.94 | -37.70 | -39.98 | -29.42 | -17.16 | -3.61 | -0.81 | -0.00 | -1.89 | 2.23 | -1.25 | |

| Treasury Stock Value | NA | 16.74 | 16.74 | 16.74 | 16.74 | 16.74 | 16.74 | 16.74 | 16.74 | 16.74 | 16.74 | 3.00 | |

| Minority Interest | -0.05 | 0.18 | 0.31 | 0.45 | 0.61 | 0.78 | 0.97 | 1.14 | 0.79 | 0.47 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.79 | 0.83 | NA | 0.67 | 0.76 | 0.67 | NA | 1.05 | 0.69 | 0.59 | NA | 0.59 |

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 35.93 | -5.32 | 61.40 | 14.33 | 46.79 | -57.34 | 23.03 | 6.99 | -5.42 | 10.22 | 20.93 | 212.03 | |

| Net Cash Provided By Used In Investing Activities | 40.62 | 69.37 | -11.58 | -248.86 | -341.53 | -26.98 | -84.00 | -147.54 | -77.02 | -263.39 | -139.39 | -65.46 | |

| Net Cash Provided By Used In Financing Activities | -195.98 | 470.93 | -89.48 | 152.72 | 102.53 | 130.86 | -21.67 | 196.54 | 76.92 | 328.90 | 86.54 | 70.41 |

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 35.93 | -5.32 | 61.40 | 14.33 | 46.79 | -57.34 | 23.03 | 6.99 | -5.42 | 10.22 | 20.93 | 212.03 | |

| Net Income Loss | NA | NA | 6.51 | 2.72 | 2.96 | 2.86 | 9.96 | 11.83 | 9.25 | 8.09 | 11.84 | 6.49 | |

| Profit Loss | 8.00 | 11.22 | 6.37 | 2.56 | 2.79 | 2.67 | 9.80 | 11.67 | 9.16 | 8.06 | 11.84 | 6.49 | |

| Depreciation Depletion And Amortization | 1.26 | 1.42 | 2.08 | 1.46 | 0.93 | 0.85 | 1.40 | 0.78 | 1.01 | 1.00 | 2.53 | -0.95 | |

| Deferred Income Tax Expense Benefit | 0.04 | 0.02 | -3.65 | 0.00 | 0.00 | 0.01 | 7.32 | 0.53 | -0.68 | -1.04 | -7.34 | 2.68 | |

| Share Based Compensation | 0.79 | 0.83 | 0.70 | 0.67 | 0.76 | 0.67 | 0.29 | 1.05 | 0.69 | 0.59 | 0.64 | 0.59 |

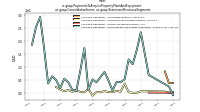

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 40.62 | 69.37 | -11.58 | -248.86 | -341.53 | -26.98 | -84.00 | -147.54 | -77.02 | -263.39 | -139.39 | -65.46 | |

| Payments To Acquire Property Plant And Equipment | 0.30 | 0.91 | 0.31 | 0.62 | 0.88 | 1.23 | 1.28 | 2.94 | 0.72 | 1.44 | 2.40 | 1.65 |

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -195.98 | 470.93 | -89.48 | 152.72 | 102.53 | 130.86 | -21.67 | 196.54 | 76.92 | 328.90 | 86.54 | 70.41 | |

| Payments Of Dividends Common Stock | 2.16 | 2.15 | 2.14 | 2.08 | 2.08 | 2.06 | 1.81 | 1.67 | 1.41 | 1.15 | 1.05 | 1.08 |

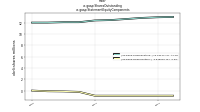

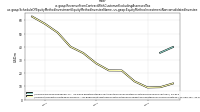

| 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Discontinued Operations Disposed Of By Sale, Chartwell | 0.00 | 14.17 | NA | NA | 4.21 | 4.09 | NA | NA | NA | NA | NA | NA | |

| Intercoastal Mortgage Company, Equity Method Investment Nonconsolidated Investee Or Group Of Investees | 12.24 | 9.41 | 9.21 | 13.82 | 22.06 | 22.12 | 27.44 | 35.23 | 40.08 | 50.80 | 57.41 | 62.91 | |

| Warp Speed Holdings L L C, Equity Method Investment Nonconsolidated Investee Or Group Of Investees | 39.82 | 35.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |