| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.23 | 0.23 | 0.23 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.19 | 0.19 | 0.19 | 0.16 | 0.15 | 0.15 | 0.15 | NA | 0.12 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 21.98 | 22.21 | 22.50 | NA | 22.39 | 22.36 | 22.35 | NA | 22.58 | 22.68 | 22.58 | NA | 22.94 | 23.34 | 24.54 | NA | 24.68 | 24.30 | 24.20 | NA | 24.33 | 24.27 | 21.35 | NA | 19.70 | 17.32 | 16.35 | NA | 15.86 | 13.64 | 12.23 | NA | 12.13 | 12.10 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 21.97 | 22.20 | 22.48 | NA | 22.34 | 22.31 | 22.27 | NA | 22.52 | 22.59 | 22.52 | NA | 22.94 | 23.34 | 24.43 | NA | 24.49 | 24.08 | 24.00 | NA | 23.86 | 23.82 | 20.90 | NA | 19.27 | 16.80 | 15.74 | NA | 15.58 | 13.36 | 11.96 | NA | 11.91 | 11.90 | NA | |

| Earnings Per Share Basic | 0.71 | 0.86 | 0.86 | 1.31 | 1.04 | 0.97 | 0.92 | 1.02 | 0.86 | 0.88 | 0.81 | 0.36 | 0.00 | 0.53 | 0.06 | 0.52 | 0.51 | 0.67 | 0.58 | 0.68 | 0.35 | 0.53 | 0.08 | 0.10 | 0.10 | 0.21 | 0.54 | 0.74 | 0.51 | 0.51 | 0.43 | 0.64 | 0.29 | 0.56 | 0.55 | |

| Earnings Per Share Diluted | 0.71 | 0.86 | 0.86 | 1.31 | 1.04 | 0.97 | 0.92 | 1.02 | 0.86 | 0.88 | 0.81 | 0.36 | 0.00 | 0.53 | 0.06 | 0.51 | 0.51 | 0.67 | 0.57 | 0.67 | 0.35 | 0.52 | 0.08 | 0.10 | 0.10 | 0.20 | 0.52 | 0.72 | 0.51 | 0.50 | 0.42 | 0.63 | 0.28 | 0.55 | 0.54 | |

| Tier One Risk Based Capital To Risk Weighted Assets | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | NA | |

| Capital To Risk Weighted Assets | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | NA |

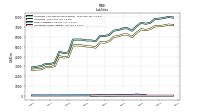

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

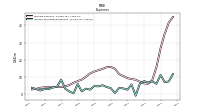

| Interest Income Operating | 103.58 | 100.49 | 95.54 | 90.22 | 79.56 | 69.24 | 62.75 | 60.43 | 58.49 | 58.40 | 60.50 | 62.71 | 60.31 | 60.55 | 61.31 | 64.44 | 65.01 | 60.64 | 59.43 | 61.59 | 56.99 | 58.28 | 46.51 | 43.50 | 43.25 | 34.53 | 31.84 | 29.98 | 31.19 | 32.12 | 27.97 | 30.30 | 28.95 | 31.24 | 27.30 | |

| Interest Expense | 44.99 | 41.65 | 35.03 | 26.66 | 15.53 | 7.90 | 5.92 | 6.13 | 7.09 | 8.29 | 8.63 | 9.20 | 10.33 | 11.56 | 14.66 | 15.76 | 15.56 | 14.56 | 13.83 | 13.06 | 11.91 | 10.00 | 8.32 | 7.46 | 6.48 | 5.13 | 4.38 | 4.02 | 3.92 | 4.13 | 3.93 | 3.85 | 3.51 | 2.92 | 2.60 | |

| Interest Income Expense Net | 58.60 | 58.84 | 60.50 | 63.55 | 64.02 | 61.33 | 56.83 | 54.30 | 51.40 | 50.11 | 51.87 | 53.52 | 49.98 | 48.99 | 46.65 | 48.69 | 49.45 | 46.08 | 45.60 | 48.53 | 45.08 | 48.29 | 38.19 | 36.04 | 36.77 | 29.40 | 27.46 | 25.96 | 27.27 | 27.99 | 24.04 | 26.45 | 25.44 | 28.32 | 24.70 | |

| Interest Paid Net | 44.18 | 34.94 | 34.89 | 25.62 | 15.70 | 7.16 | 6.59 | 6.17 | 8.19 | 7.93 | 9.44 | 8.81 | 10.67 | 14.25 | 13.98 | 16.17 | 14.19 | 15.36 | 12.43 | 13.77 | 10.08 | 11.03 | 6.08 | 7.29 | 5.68 | 5.56 | 3.44 | 4.85 | 3.10 | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | -4.96 | NA | NA | NA | -0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 11.53 | 7.25 | 6.89 | 11.03 | 5.86 | 7.28 | 6.64 | 7.49 | 5.88 | -1.08 | 5.50 | 2.41 | 3.18 | 3.42 | 0.46 | 3.28 | 4.01 | 5.04 | 4.35 | 4.53 | 2.44 | 3.04 | 1.38 | 5.78 | 0.28 | 1.38 | 2.98 | 8.33 | 4.10 | 3.68 | 2.78 | 2.81 | 1.93 | 2.76 | 3.59 | |

| Income Taxes Paid Net | 6.74 | 9.62 | 1.41 | 14.50 | 5.41 | 14.69 | 1.91 | 14.41 | -19.55 | 11.26 | 1.65 | 0.41 | 1.65 | 0.01 | 0.90 | -0.13 | 0.00 | 0.28 | 0.34 | 0.01 | 0.05 | 0.50 | 0.03 | 0.02 | 0.01 | 0.62 | 0.01 | 0.92 | 0.00 | 0.00 | 0.16 | -1.55 | 5.42 | NA | NA | |

| Profit Loss | 18.04 | 21.57 | 21.77 | 32.87 | 23.52 | 21.88 | 20.75 | 23.11 | 19.55 | 20.12 | 18.54 | 8.33 | 0.09 | 12.57 | 1.55 | 12.79 | 12.65 | 16.36 | 13.98 | 16.34 | 8.50 | 12.78 | 1.81 | 1.99 | 2.04 | 3.54 | 8.49 | 11.58 | 8.04 | 6.79 | 5.12 | 7.70 | 3.45 | 6.67 | 6.59 | |

| Net Income Loss | 18.04 | 21.57 | 21.77 | 32.87 | 23.52 | 21.88 | 20.75 | 23.11 | 19.55 | 20.12 | 18.54 | 8.33 | 0.09 | 12.57 | 1.55 | 12.79 | 12.65 | 16.36 | 13.98 | 16.34 | 8.50 | 12.78 | 1.81 | 1.99 | 2.04 | 3.54 | 8.49 | 11.58 | 8.05 | 6.79 | 5.12 | 7.70 | 3.44 | 6.65 | 6.53 | |

| Comprehensive Income Net Of Tax | 1.58 | 14.65 | 27.77 | 27.46 | -1.76 | -3.18 | -12.52 | 17.20 | 20.31 | 18.09 | 19.52 | 10.35 | -1.23 | 14.85 | 2.56 | 12.08 | 13.64 | 20.04 | 19.57 | 18.95 | 6.08 | 11.20 | -0.67 | 2.57 | 2.13 | 4.82 | 8.90 | 1.64 | 7.91 | 8.12 | 7.23 | 3.10 | 4.70 | 4.64 | NA | |

| Net Income Loss Available To Common Stockholders Basic | 15.63 | 19.12 | 19.31 | 29.34 | 23.27 | 21.64 | 20.51 | 22.86 | 19.36 | 19.93 | 18.35 | 8.27 | 0.02 | 12.44 | 1.48 | 12.66 | 12.58 | 16.19 | 13.84 | 16.18 | 8.41 | 12.67 | 1.74 | 1.86 | 2.01 | 3.52 | 8.49 | 11.69 | 8.01 | 6.75 | 5.12 | 7.80 | 3.42 | 6.61 | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 15.63 | 19.12 | 19.31 | 29.34 | 23.27 | 21.64 | 20.51 | 22.86 | 19.36 | 19.93 | 18.35 | 8.27 | 0.02 | 12.44 | 1.48 | 12.66 | 12.58 | 16.19 | 13.84 | 16.18 | 8.41 | 12.67 | 1.74 | 1.94 | 1.99 | 3.50 | 8.44 | 11.52 | 8.01 | 6.75 | 5.09 | 7.65 | 3.42 | 6.61 | NA | |

| Interest Income Expense After Provision For Loan Loss | 53.43 | 52.96 | 57.37 | 60.01 | 57.05 | 55.89 | 52.66 | 53.83 | 51.58 | 50.56 | 48.30 | 43.46 | 39.01 | 37.38 | 36.08 | 43.38 | 45.09 | 42.00 | 42.36 | 45.07 | 42.98 | 46.43 | 36.18 | 29.96 | 35.28 | 28.94 | 25.93 | 23.51 | 25.87 | 27.36 | 22.92 | 25.40 | 18.74 | 25.94 | 23.70 | |

| Noninterest Expense | 42.04 | 42.89 | 44.48 | 49.94 | 43.50 | 41.34 | 40.88 | 45.76 | 41.29 | 48.94 | 39.08 | 47.05 | 54.66 | 40.78 | 42.67 | 46.33 | 48.02 | 40.19 | 41.10 | 45.38 | 50.32 | 46.55 | 49.60 | 36.19 | 48.36 | 37.65 | 30.79 | 34.09 | 28.66 | 30.91 | 27.64 | 27.69 | 27.82 | 30.70 | 31.55 | |

| Noninterest Income | 18.18 | 18.75 | 15.78 | 33.84 | 15.83 | 14.61 | 15.61 | 22.52 | 15.14 | 17.42 | 14.82 | 14.34 | 18.92 | 19.40 | 8.60 | 19.01 | 19.61 | 19.59 | 17.07 | 21.17 | 18.27 | 15.95 | 16.61 | 14.00 | 15.40 | 13.62 | 16.33 | 30.49 | 14.94 | 14.02 | 12.62 | 12.80 | 14.46 | 14.20 | 18.02 |

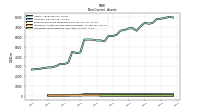

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

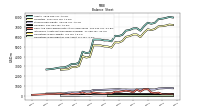

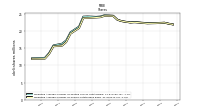

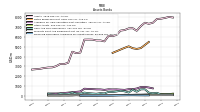

| Assets | 7975.93 | 8034.72 | 7930.17 | 7855.50 | 7821.88 | 7435.81 | 7338.72 | 7443.81 | 7093.96 | 6630.01 | 6884.79 | 6868.54 | 6700.05 | 6644.50 | 6208.23 | 6087.02 | 6113.90 | 5546.06 | 5641.78 | 5637.67 | 5724.61 | 5730.60 | 5723.37 | 4412.70 | 4347.76 | 4491.64 | 3373.58 | 3233.72 | 3247.73 | 3021.78 | 2898.08 | 2884.82 | 2832.31 | 2753.58 | NA | |

| Liabilities | 7211.68 | 7257.90 | 7154.53 | 7096.93 | 7082.60 | 6799.62 | 6693.73 | 6779.97 | 6436.11 | 5981.82 | 6249.32 | 6247.15 | 6078.16 | 6010.91 | 5577.07 | 5425.11 | 5458.38 | 4906.17 | 5017.61 | 5029.15 | 5130.47 | 5138.06 | 5137.99 | 3963.16 | 3897.07 | 4039.69 | 3039.24 | 2911.91 | 2925.94 | 2705.47 | NA | 2651.77 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 7975.93 | 8034.72 | 7930.17 | 7855.50 | 7821.88 | 7435.81 | 7338.72 | 7443.81 | 7093.96 | 6630.01 | 6884.79 | 6868.54 | 6700.05 | 6644.50 | 6208.23 | 6087.02 | 6113.90 | 5546.06 | 5641.78 | 5637.67 | 5724.61 | 5730.60 | 5723.37 | 4412.70 | 4347.76 | 4491.64 | 3373.58 | 3233.72 | 3247.73 | 3021.78 | NA | 2884.82 | NA | NA | NA | |

| Stockholders Equity | 764.25 | 776.82 | 775.64 | 758.57 | 739.28 | 636.19 | 644.99 | 663.84 | 657.84 | 648.19 | 635.47 | 621.39 | 621.88 | 633.59 | 631.16 | 661.91 | 655.52 | 639.89 | 624.17 | 608.52 | 594.15 | 592.53 | 585.38 | 449.55 | 450.69 | 451.95 | 334.33 | 321.77 | 321.75 | 316.27 | 238.39 | 232.88 | NA | NA | NA | |

| Tier One Risk Based Capital | NA | NA | NA | 734.75 | NA | NA | NA | 485.24 | NA | NA | NA | 429.09 | NA | NA | NA | 516.65 | NA | NA | NA | 468.21 | NA | NA | NA | 367.84 | NA | 386.86 | 308.04 | 305.28 | 296.15 | 291.77 | NA | 210.61 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

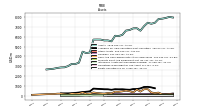

| Cash And Cash Equivalents At Carrying Value | 132.13 | 160.69 | 138.31 | 150.32 | 313.19 | 270.12 | 332.26 | 680.37 | 662.64 | 425.10 | 631.22 | 341.64 | 461.20 | 519.87 | 449.40 | 394.50 | 409.35 | 245.41 | 276.48 | 213.70 | 242.43 | 276.33 | 331.18 | 215.20 | 183.57 | 334.36 | 218.10 | 190.72 | 228.03 | 123.37 | 162.42 | 212.47 | 206.66 | 172.23 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 132.13 | 160.69 | 138.31 | 150.32 | 313.19 | 270.12 | 332.26 | 680.37 | 662.64 | 425.10 | 631.22 | 341.64 | 461.20 | 519.87 | 449.40 | 394.50 | 409.35 | 245.41 | 276.48 | 213.70 | 242.43 | 276.33 | 331.18 | 215.20 | 183.57 | 334.36 | 218.10 | 190.72 | NA | NA | NA | 212.47 | NA | NA | NA | |

| Equity Securities Fv Ni | 4.33 | 4.29 | 8.72 | 8.63 | 8.62 | 8.74 | 9.17 | 9.53 | 9.54 | 9.51 | 9.38 | 9.42 | 9.14 | 9.00 | 5.64 | 5.62 | 5.61 | 3.37 | 3.41 | 3.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | 760.54 | 849.07 | 906.60 | 890.78 | 747.33 | 681.01 | 676.71 | 609.83 | 630.69 | 656.25 | 649.43 | 663.02 | 609.66 | 652.74 | 657.45 | 682.40 | 704.59 | 726.96 | 447.69 | NA | NA | NA | NA | 252.21 | 238.78 | NA | 236.63 | NA | NA | NA |

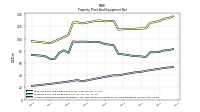

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 136.26 | 133.61 | 132.39 | 128.92 | 126.90 | 126.00 | 116.88 | 116.38 | 116.27 | 115.59 | 115.79 | 115.29 | 114.70 | 128.92 | 128.81 | 128.26 | 129.65 | 129.21 | 127.39 | 126.23 | 124.97 | 126.75 | 126.16 | 105.79 | NA | NA | NA | 92.50 | NA | NA | NA | 95.67 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 53.52 | 52.60 | 51.81 | 50.63 | 49.38 | 48.34 | 47.14 | 45.59 | 45.03 | 43.79 | 42.53 | 41.17 | 39.73 | 39.88 | 38.69 | 37.21 | 35.75 | 34.38 | 32.88 | 31.39 | 29.91 | 31.96 | 30.83 | 29.63 | NA | NA | NA | 25.81 | NA | NA | NA | 22.53 | NA | NA | NA | |

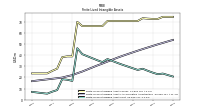

| Amortization Of Intangible Assets | 1.13 | 1.21 | 1.29 | 1.33 | 1.36 | 1.32 | 1.40 | 1.43 | 1.45 | 1.47 | 1.51 | 1.56 | 1.56 | 1.63 | 1.76 | 1.80 | 1.80 | 1.67 | 1.81 | 1.85 | 1.85 | 1.58 | 1.68 | 1.03 | 1.19 | 0.58 | 0.53 | 0.53 | 0.51 | 0.52 | 0.58 | 0.60 | 0.60 | 0.60 | NA | |

| Property Plant And Equipment Net | 82.74 | 81.01 | 80.58 | 78.29 | 77.52 | 77.67 | 69.75 | 70.79 | 71.24 | 71.80 | 73.25 | 74.12 | 74.97 | 89.05 | 90.12 | 91.06 | 93.90 | 94.82 | 94.51 | 94.84 | 95.06 | 94.78 | 95.33 | 76.16 | 80.94 | 76.60 | 66.91 | 66.69 | 70.73 | 72.15 | NA | 73.13 | NA | NA | NA | |

| Goodwill | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 161.90 | 172.80 | 172.80 | 171.76 | 171.07 | 164.67 | 164.67 | 164.67 | 164.04 | 164.04 | 155.67 | 98.62 | 97.35 | 96.94 | 50.81 | 48.84 | 46.52 | 46.52 | NA | 46.52 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 17.24 | 18.37 | 19.57 | 20.87 | 22.20 | 23.56 | 22.98 | 24.37 | 26.07 | 27.90 | 26.87 | 28.38 | 29.94 | 31.50 | 33.12 | 34.89 | 36.69 | 33.89 | 35.57 | 37.38 | 39.23 | 41.08 | 46.47 | 16.93 | 17.97 | 18.46 | 8.63 | 7.19 | 5.39 | 5.91 | NA | 7.00 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 20.87 | 22.20 | 23.56 | 22.98 | 24.37 | 26.07 | 27.90 | 26.87 | 28.38 | 29.94 | 31.50 | 33.12 | 34.89 | 36.69 | 33.89 | 35.57 | 37.38 | 39.23 | 41.08 | 46.47 | 16.93 | 17.97 | 18.46 | 8.63 | 7.19 | 5.39 | 5.91 | NA | 7.00 | NA | NA | NA | |

| Equity Securities Fv Ni | 4.33 | 4.29 | 8.72 | 8.63 | 8.62 | 8.74 | 9.17 | 9.53 | 9.54 | 9.51 | 9.38 | 9.42 | 9.14 | 9.00 | 5.64 | 5.62 | 5.61 | 3.37 | 3.41 | 3.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | 841.97 | 897.94 | 904.70 | 881.83 | 738.88 | 672.75 | 661.71 | 596.03 | 615.03 | 644.67 | 639.17 | 651.79 | 599.77 | 647.94 | 660.36 | 688.91 | 707.77 | 727.96 | 445.41 | NA | NA | NA | NA | 236.78 | 223.07 | NA | 226.66 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 323.97 | NA | NA | NA | 377.82 | NA | NA | NA | 540.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 6405.00 | 6426.55 | 6425.20 | 6364.65 | 6395.25 | 6184.44 | 6057.54 | 6110.65 | 5601.38 | 5196.35 | 5340.51 | 5101.02 | 5028.74 | 4943.11 | 4650.64 | 4544.25 | 4445.17 | 4011.21 | 4036.29 | 4074.17 | 4143.21 | 4159.86 | 4233.81 | 3131.09 | 3114.47 | 3333.03 | 2527.48 | 2404.37 | 2420.03 | 2354.55 | NA | 2367.65 | NA | NA | NA |

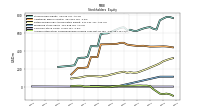

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

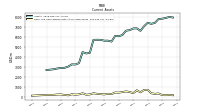

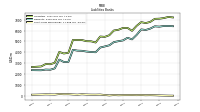

| Stockholders Equity | 764.25 | 776.82 | 775.64 | 758.57 | 739.28 | 636.19 | 644.99 | 663.84 | 657.84 | 648.19 | 635.47 | 621.39 | 621.88 | 633.59 | 631.16 | 661.91 | 655.52 | 639.89 | 624.17 | 608.52 | 594.15 | 592.53 | 585.38 | 449.55 | 450.69 | 451.95 | 334.33 | 321.77 | 321.75 | 316.27 | 238.39 | 232.88 | NA | NA | NA | |

| Common Stock Value | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.23 | 0.23 | 0.23 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.19 | 0.19 | 0.19 | 0.16 | 0.15 | 0.15 | 0.15 | NA | 0.12 | NA | NA | NA | |

| Additional Paid In Capital | 437.57 | 442.89 | 447.47 | 449.20 | 447.67 | 446.89 | 446.04 | 445.91 | 450.87 | 455.21 | 454.26 | 453.41 | 458.21 | 462.58 | 468.75 | 488.31 | 488.02 | 477.41 | 475.81 | 473.83 | 473.06 | 472.21 | 470.94 | 330.15 | 329.93 | 329.35 | 216.50 | 209.71 | 208.45 | 208.09 | NA | 135.82 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 317.10 | 307.89 | 295.20 | 282.40 | 259.22 | 242.17 | 226.76 | 212.47 | 195.61 | 182.36 | 168.56 | 156.33 | 154.03 | 160.05 | 153.72 | 165.92 | 159.10 | 152.39 | 141.91 | 133.78 | 122.75 | 119.52 | 112.01 | 114.48 | 116.37 | 118.20 | 117.87 | 112.51 | 103.81 | 98.55 | NA | 90.91 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -101.18 | -84.72 | -77.80 | -83.80 | -78.38 | -53.10 | -28.04 | 5.24 | 11.14 | 10.39 | 12.41 | 11.43 | 9.42 | 10.73 | 8.45 | 7.44 | 8.15 | 7.17 | 3.48 | -2.11 | -4.72 | -2.31 | -0.72 | 1.76 | 1.18 | 1.08 | -0.20 | -0.61 | 9.33 | 9.47 | NA | 6.03 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | NA | NA | NA | 0.00 | 110.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | -0.22 | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.60 | 0.57 | 0.62 | 0.66 | 0.50 | 0.52 | 0.53 | 0.51 | 0.44 | 0.48 | 0.50 | 0.55 | 0.41 | 0.62 | 0.60 | 0.57 | 0.45 | 0.49 | 0.85 | 0.07 | 0.27 | 0.40 | 0.12 | 0.14 | 0.14 | 0.14 | 0.13 | 0.18 | 0.10 | 0.11 | 0.11 | 0.13 | 0.22 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

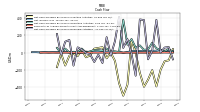

| Net Cash Provided By Used In Operating Activities | 6.53 | 44.74 | 16.01 | 30.68 | 51.59 | 115.40 | 39.08 | 33.34 | 84.44 | 58.28 | 158.38 | 93.29 | 381.87 | 8.44 | 15.55 | 17.51 | 48.34 | 23.55 | 30.00 | 31.13 | 15.82 | 2.24 | 47.88 | 7.82 | 11.09 | 3.94 | 47.61 | -4.76 | 55.63 | NA | NA | NA | NA | NA | NA | |

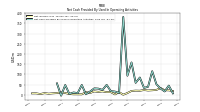

| Net Cash Provided By Used In Investing Activities | 41.99 | -87.43 | -98.41 | -197.92 | -389.52 | -200.68 | -310.77 | -393.31 | -231.52 | 1.44 | 144.88 | -369.70 | -496.57 | -351.76 | -94.40 | -0.37 | -64.53 | 63.89 | 55.47 | 47.02 | -32.61 | -52.81 | 31.74 | -38.33 | -12.99 | -35.34 | -147.95 | -8.19 | -167.06 | NA | NA | NA | NA | NA | NA | |

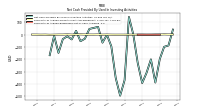

| Net Cash Provided By Used In Financing Activities | -77.09 | 65.07 | 60.08 | 4.37 | 381.00 | 23.13 | -76.42 | 377.69 | 384.62 | -265.84 | -13.68 | 156.86 | 56.03 | 413.79 | 133.74 | -31.98 | 180.11 | -118.51 | -22.68 | -106.88 | -17.10 | -4.29 | 36.36 | 62.14 | -148.88 | 147.67 | 127.71 | -24.36 | 216.09 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 6.53 | 44.74 | 16.01 | 30.68 | 51.59 | 115.40 | 39.08 | 33.34 | 84.44 | 58.28 | 158.38 | 93.29 | 381.87 | 8.44 | 15.55 | 17.51 | 48.34 | 23.55 | 30.00 | 31.13 | 15.82 | 2.24 | 47.88 | 7.82 | 11.09 | 3.94 | 47.61 | -4.76 | 55.63 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 18.04 | 21.57 | 21.77 | 32.87 | 23.52 | 21.88 | 20.75 | 23.11 | 19.55 | 20.12 | 18.54 | 8.33 | 0.09 | 12.57 | 1.55 | 12.79 | 12.65 | 16.36 | 13.98 | 16.34 | 8.50 | 12.78 | 1.81 | 1.99 | 2.04 | 3.54 | 8.49 | 11.58 | 8.05 | 6.79 | 5.12 | 7.70 | 3.44 | 6.65 | 6.53 | |

| Profit Loss | 18.04 | 21.57 | 21.77 | 32.87 | 23.52 | 21.88 | 20.75 | 23.11 | 19.55 | 20.12 | 18.54 | 8.33 | 0.09 | 12.57 | 1.55 | 12.79 | 12.65 | 16.36 | 13.98 | 16.34 | 8.50 | 12.78 | 1.81 | 1.99 | 2.04 | 3.54 | 8.49 | 11.58 | 8.04 | 6.79 | 5.12 | 7.70 | 3.45 | 6.67 | 6.59 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 41.99 | -87.43 | -98.41 | -197.92 | -389.52 | -200.68 | -310.77 | -393.31 | -231.52 | 1.44 | 144.88 | -369.70 | -496.57 | -351.76 | -94.40 | -0.37 | -64.53 | 63.89 | 55.47 | 47.02 | -32.61 | -52.81 | 31.74 | -38.33 | -12.99 | -35.34 | -147.95 | -8.19 | -167.06 | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 2.38 | 1.90 | 2.79 | 1.38 | 1.16 | 0.51 | 0.41 | 0.86 | 0.85 | 0.43 | 0.57 | 0.60 | 0.64 | 0.58 | 0.77 | 1.45 | 0.87 | 1.93 | 1.28 | 1.39 | 1.72 | 2.71 | 1.37 | 0.92 | 2.59 | 1.35 | 1.32 | 0.66 | -0.15 | 1.00 | 0.56 | 1.13 | 1.38 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -77.09 | 65.07 | 60.08 | 4.37 | 381.00 | 23.13 | -76.42 | 377.69 | 384.62 | -265.84 | -13.68 | 156.86 | 56.03 | 413.79 | 133.74 | -31.98 | 180.11 | -118.51 | -22.68 | -106.88 | -17.10 | -4.29 | 36.36 | 62.14 | -148.88 | 147.67 | 127.71 | -24.36 | 216.09 | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 6.60 | 6.66 | 6.75 | 6.52 | 6.47 | 6.47 | 6.46 | 6.25 | 6.30 | 6.33 | 6.30 | 6.03 | 6.11 | 6.24 | 6.58 | 5.97 | 5.96 | 5.84 | 5.82 | 5.27 | 5.24 | 5.23 | 4.24 | 3.85 | 3.84 | 3.19 | 3.13 | 2.80 | 2.79 | 2.13 | 2.14 | 2.01 | 1.89 | NA | NA | |

| Payments For Repurchase Of Common Stock | 6.06 | 6.17 | 2.80 | 0.00 | 0.00 | 0.00 | 1.11 | 5.24 | 5.24 | 0.00 | 1.21 | 6.88 | 5.01 | 7.16 | 20.56 | 2.19 | 1.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Asset Management | 5.47 | 5.36 | 5.64 | 5.34 | 5.24 | 5.14 | 5.98 | 5.90 | 5.62 | 4.97 | NA | NA | NA | NA | 4.21 | 4.02 | 4.40 | 4.08 | 3.62 | 4.33 | 4.33 | 4.32 | 3.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interchange Revenues | 3.61 | 3.70 | 3.41 | 3.48 | 3.53 | 3.59 | 3.28 | 3.68 | 3.65 | 3.80 | NA | NA | NA | NA | 2.83 | 3.05 | 3.25 | 3.01 | 2.68 | 2.94 | 2.76 | 2.93 | 2.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Nonsufficient Fund Fees | 1.95 | 1.74 | 1.70 | 1.77 | 1.77 | 1.52 | 1.33 | 1.52 | 1.47 | 1.20 | NA | NA | NA | NA | 1.87 | 2.07 | 2.10 | 1.80 | 1.75 | 2.13 | 2.10 | 1.99 | 1.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Deposit Account | 1.20 | 0.94 | 0.87 | 0.74 | 0.82 | 0.78 | 0.74 | 0.81 | 0.80 | 0.71 | NA | NA | NA | NA | 0.79 | 0.79 | 0.91 | 0.84 | 0.77 | 0.84 | 0.71 | 0.70 | 0.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Wealth Management Revenue | 0.40 | 0.48 | 0.34 | 0.44 | 0.48 | 0.46 | 0.56 | 0.61 | 0.65 | 0.65 | NA | NA | NA | NA | 0.54 | 0.45 | 0.70 | 0.65 | 0.59 | 0.53 | 0.34 | 0.21 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Card Merchant Discount | 0.41 | 0.40 | 0.36 | 0.39 | 0.45 | 0.40 | 0.36 | 0.37 | 0.41 | 0.40 | NA | NA | NA | NA | 0.35 | 0.38 | 0.37 | 0.39 | 0.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Performance | 0.42 | 0.43 | 0.43 | 0.45 | 0.48 | 0.54 | 0.60 | 0.84 | 0.33 | 0.48 | NA | NA | NA | NA | 0.40 | 0.36 | 0.36 | 0.23 | 0.22 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Service Other | -0.07 | 1.40 | 0.63 | 0.75 | 0.85 | 0.67 | 0.77 | 0.71 | 0.93 | 1.42 | NA | NA | NA | NA | 0.94 | 0.96 | 0.91 | 0.79 | 0.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Asset Management, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 5.98 | NA | 5.62 | 4.97 | 4.46 | NA | 4.05 | 4.27 | 4.21 | 4.02 | 4.40 | 4.08 | 3.62 | 4.33 | 4.33 | 4.32 | 3.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interchange Revenues, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 3.28 | NA | 3.65 | 3.80 | 3.38 | NA | 3.28 | 3.01 | 2.83 | 3.05 | 3.25 | 3.01 | 2.68 | 2.94 | 2.76 | 2.93 | 2.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Nonsufficient Fund Fees, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 1.33 | NA | 1.47 | 1.20 | 1.14 | NA | 1.33 | 0.96 | 1.87 | 2.07 | 2.10 | 1.80 | 1.75 | 2.13 | 2.10 | 1.99 | 1.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Deposit Account, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 0.74 | NA | 0.80 | 0.71 | 0.68 | NA | 0.76 | 0.74 | 0.79 | 0.79 | 0.91 | 0.84 | 0.77 | 0.84 | 0.71 | 0.70 | 0.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Wealth Management Revenue, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 0.56 | NA | 0.65 | 0.65 | 0.62 | NA | 0.63 | 0.61 | 0.54 | 0.45 | 0.70 | 0.65 | 0.59 | 0.53 | 0.34 | 0.21 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Card Merchant Discount, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 0.36 | NA | 0.41 | 0.40 | 0.34 | NA | 0.40 | 0.30 | 0.35 | 0.38 | 0.37 | 0.39 | 0.38 | 0.40 | 0.45 | 0.46 | 0.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Performance, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 0.60 | NA | NA | 0.48 | 0.40 | NA | 0.36 | 0.32 | 0.40 | 0.36 | 0.36 | 0.23 | 0.22 | 0.24 | 0.27 | 0.29 | 0.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Service Other, Calculated Under Revenue Guidance In Effect Before Topic606 | NA | NA | NA | NA | NA | NA | 0.77 | NA | 0.93 | 1.42 | 0.79 | NA | 0.33 | 0.93 | 0.94 | 0.96 | 0.91 | 0.79 | 0.82 | 0.90 | 0.28 | 0.69 | 1.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Operating | 103.58 | 100.49 | 95.54 | 90.22 | 79.56 | 69.24 | 62.75 | 60.43 | 58.49 | 58.40 | 60.50 | 62.71 | 60.31 | 60.55 | 61.31 | 64.44 | 65.01 | 60.64 | 59.43 | 61.59 | 56.99 | 58.28 | 46.51 | 43.50 | 43.25 | 34.53 | 31.84 | 29.98 | 31.19 | 32.12 | 27.97 | 30.30 | 28.95 | 31.24 | 27.30 |