| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

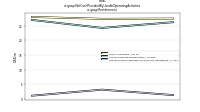

| Weighted Average Number Of Diluted Shares Outstanding | 43.80 | 43.74 | 43.74 | NA | 43.70 | 43.68 | 43.73 | 43.73 | 43.96 | 44.11 | 44.07 | 43.90 | 43.90 | 43.80 | 44.76 | 45.10 | 45.11 | 45.13 | 38.91 | 38.49 | 38.53 | 38.52 | 0.38 | 0.38 | 0.34 | 0.33 | 0.33 | 0.33 | 0.49 | 0.28 | 0.27 | 0.27 | 0.27 | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.12 | 0.17 | 0.17 | 0.17 | 0.11 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 43.65 | 43.64 | 43.58 | NA | 43.57 | 43.57 | 43.55 | 43.53 | 43.81 | 43.95 | 43.92 | 43.86 | 43.86 | 43.78 | 44.66 | 44.97 | 45.04 | 45.06 | 38.82 | 38.37 | 38.37 | 38.35 | 0.38 | 0.38 | 0.34 | 0.33 | 0.33 | 0.33 | 0.48 | 0.27 | 0.27 | 0.27 | 0.26 | 0.21 | 0.21 | 0.21 | 0.21 | 0.21 | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 | 0.11 | 0.17 | 0.17 | 0.17 | 0.11 | NA | |

| Earnings Per Share Basic | 0.37 | 0.43 | 0.42 | 0.48 | 0.55 | 0.57 | 0.54 | 0.49 | 0.53 | 0.50 | 0.46 | 0.50 | 0.46 | 0.33 | 0.26 | 0.41 | 0.46 | 0.37 | 0.28 | 0.35 | 0.34 | 0.37 | 33.33 | 20.00 | 24.00 | 27.33 | 24.67 | 16.67 | 13.78 | 23.11 | 20.00 | 22.67 | 16.44 | 22.67 | 25.78 | 23.56 | 23.56 | 23.11 | 17.33 | 20.89 | 24.44 | 28.89 | 26.67 | 25.78 | 24.89 | 43.11 | 40.00 | 20.89 | 36.44 | 38.22 | -6.67 | |

| Earnings Per Share Diluted | 0.37 | 0.43 | 0.42 | 0.49 | 0.55 | 0.57 | 0.54 | 0.49 | 0.52 | 0.50 | 0.46 | 0.50 | 0.46 | 0.33 | 0.26 | 0.41 | 0.46 | 0.37 | 0.28 | 0.34 | 0.34 | 0.37 | 33.33 | 20.00 | 24.00 | 27.33 | 24.67 | 16.67 | 13.33 | 23.11 | 19.56 | 22.67 | 16.00 | 21.78 | 24.44 | 22.67 | 22.67 | 22.22 | 16.89 | 20.00 | 23.11 | 27.56 | 25.78 | 24.89 | 24.00 | 41.33 | 39.11 | 20.44 | 35.56 | 36.89 | -6.67 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA |

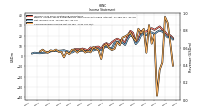

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

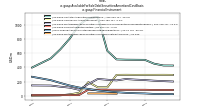

| Interest And Fee Income Loans And Leases | 63.00 | 60.59 | 55.36 | 47.02 | 47.05 | 41.55 | 37.88 | 41.17 | 40.39 | 39.24 | 40.82 | 46.74 | 44.05 | 43.92 | 44.96 | 46.77 | 49.45 | 47.78 | 39.62 | 38.52 | 37.52 | 36.31 | 35.13 | 32.63 | 28.11 | 26.80 | 24.79 | 25.71 | 25.31 | 20.79 | 19.75 | 20.23 | 20.30 | 17.98 | 16.86 | 16.45 | 16.40 | 16.63 | 12.95 | 14.04 | 14.84 | 16.91 | 16.44 | 17.34 | 15.53 | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 38.03 | 30.71 | 26.56 | 18.41 | 9.63 | 4.56 | 3.91 | 4.14 | 4.32 | 4.79 | 5.05 | 9.61 | 6.75 | 7.35 | 10.73 | 11.88 | 12.25 | 12.32 | 11.09 | 9.89 | 8.50 | 7.19 | 6.01 | 5.32 | 4.19 | 3.61 | 3.27 | 8.45 | 4.55 | 3.78 | 3.75 | 3.57 | 3.80 | 3.28 | 3.21 | 3.24 | 3.45 | 3.33 | 3.19 | 3.31 | 3.37 | 3.40 | 3.42 | 3.46 | 3.72 | 3.52 | 3.63 | 3.87 | 4.02 | 4.25 | 4.60 | |

| Interest Income Expense Net | 42.09 | 46.16 | 45.24 | 44.94 | 53.40 | 53.01 | 48.17 | 49.98 | 46.54 | 42.63 | 42.54 | 43.62 | 43.40 | 43.00 | 40.92 | 41.52 | 43.46 | 41.53 | 34.28 | 33.84 | 33.77 | 33.55 | 33.41 | 31.45 | 27.88 | 27.20 | 25.57 | 20.94 | 24.41 | 20.87 | 19.77 | 20.22 | 19.78 | 17.85 | 16.89 | 16.52 | 16.40 | 16.79 | 13.27 | 14.13 | 14.67 | 16.57 | 16.01 | 17.00 | 15.00 | 13.01 | 13.20 | 13.59 | 11.99 | 11.46 | 13.07 | |

| Interest Paid Net | 34.49 | 23.89 | 26.02 | 14.99 | 10.08 | 3.58 | 4.73 | 3.33 | 5.33 | 4.13 | 5.99 | 9.38 | 6.62 | 7.77 | 11.02 | 11.54 | 12.53 | 11.79 | 10.65 | 9.55 | 8.25 | 6.97 | 5.68 | 5.13 | 4.05 | 3.57 | 3.21 | 8.99 | 4.50 | 3.40 | 3.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Disposal Group Not Discontinued Operation Gain Loss On Disposal | -0.19 | -0.13 | -0.22 | -0.12 | -0.40 | -0.36 | -0.17 | -1.93 | -0.07 | -0.01 | -0.28 | -0.73 | -0.11 | -0.19 | -0.12 | -0.38 | -0.09 | -0.17 | -0.10 | -0.09 | -0.16 | -0.27 | -0.15 | -0.18 | -0.06 | -0.08 | -0.05 | -0.17 | -0.11 | -0.14 | -0.27 | -0.08 | -0.25 | -0.15 | 0.04 | 0.17 | 0.04 | -0.10 | -0.04 | -0.66 | -0.06 | -0.16 | 0.07 | -0.12 | -0.31 | -0.16 | -0.03 | -1.02 | -1.09 | -0.25 | -0.32 | |

| Income Tax Expense Benefit | 1.28 | 1.45 | 1.86 | 2.65 | 2.01 | 3.98 | 3.54 | 4.08 | 4.06 | 3.77 | 3.45 | 1.97 | 4.33 | 1.99 | 1.58 | 3.92 | 4.00 | 3.31 | 2.07 | 2.54 | 2.60 | 2.79 | 2.52 | 5.76 | 2.51 | 3.52 | 3.05 | 1.61 | 2.59 | 2.62 | 1.98 | 2.21 | 1.35 | 1.75 | 1.91 | 1.66 | 1.74 | 1.89 | 0.86 | 1.09 | 1.63 | 2.23 | 2.10 | 2.20 | 1.98 | 2.26 | 2.01 | 1.14 | 1.24 | 1.00 | 0.93 | |

| Income Taxes Paid Net | 0.00 | NA | NA | -0.13 | 0.29 | NA | NA | 0.42 | 0.50 | NA | NA | 0.76 | 9.82 | 0.00 | 0.00 | 11.90 | 0.02 | 1.30 | 0.00 | 0.16 | 2.69 | NA | NA | 0.00 | 4.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 16.20 | 18.76 | 18.23 | 21.16 | 23.82 | 24.86 | 23.56 | 21.43 | 23.07 | 22.17 | 20.42 | 21.89 | 20.31 | 14.64 | 11.65 | 18.54 | 20.54 | 16.64 | 10.82 | 13.13 | 13.06 | 14.12 | 12.80 | 7.65 | 8.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 0.00 | -1.12 | NA | NA | 1.54 | 0.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 16.20 | 18.76 | 18.23 | 21.16 | 23.82 | 24.86 | 23.56 | 21.43 | 23.07 | 22.17 | 20.42 | 21.89 | 20.31 | 14.64 | 11.65 | 18.54 | 20.54 | 16.64 | 10.82 | 13.13 | 13.06 | 14.12 | 12.80 | 7.65 | 8.17 | 9.07 | 8.22 | 5.60 | 6.60 | 6.33 | 5.38 | 6.17 | 4.29 | 4.73 | 5.36 | 4.95 | 4.96 | 4.78 | 3.42 | 4.12 | 4.79 | 5.67 | 5.31 | 5.17 | 4.85 | 4.91 | 4.61 | 3.52 | 3.42 | 3.09 | 2.87 | |

| Comprehensive Income Net Of Tax | -9.31 | 12.88 | 32.39 | 38.09 | -6.24 | -13.43 | -38.55 | 21.12 | 12.08 | 30.12 | 3.26 | 26.47 | 22.32 | 26.59 | 14.54 | 18.33 | 22.98 | 20.67 | 19.14 | 17.95 | 10.69 | 13.71 | 6.94 | 5.88 | 7.81 | 11.43 | 10.09 | -2.85 | 5.82 | 7.22 | 8.80 | 3.64 | 4.98 | 3.42 | 6.26 | 5.78 | 3.40 | 6.02 | 6.15 | 1.82 | 4.19 | -1.22 | 4.25 | 4.07 | 6.28 | 4.91 | 5.54 | 3.41 | 4.19 | 6.21 | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 16.20 | 18.76 | 18.23 | 21.16 | 23.82 | 24.86 | 23.56 | 21.43 | 23.07 | 22.17 | 20.42 | 21.89 | 20.31 | 14.64 | 11.65 | -114.53 | 20.54 | 16.64 | 10.82 | 13.13 | 13.06 | 14.12 | 12.80 | 7.65 | 8.17 | 9.07 | 8.22 | 5.60 | 6.60 | 6.33 | 5.34 | 6.14 | 4.26 | 4.70 | 5.33 | 4.92 | 4.92 | 4.75 | 3.39 | 4.05 | 4.72 | 5.57 | 5.17 | 5.01 | 4.79 | 4.80 | 4.46 | 3.46 | 2.71 | 2.82 | NA | |

| Interest Income Expense After Provision For Loan Loss | 41.83 | 45.48 | 44.99 | 45.01 | 54.00 | 52.77 | 49.56 | 52.05 | 45.43 | 44.12 | 42.17 | 40.58 | 41.34 | 35.94 | 32.33 | 41.18 | 43.09 | 40.63 | 33.92 | 33.31 | 32.60 | 32.91 | 32.84 | 30.36 | 27.17 | 26.87 | 25.24 | 20.32 | 23.95 | 20.64 | 19.24 | 19.88 | 19.48 | 15.94 | 16.27 | 15.54 | 14.66 | 16.45 | 13.27 | 15.13 | 14.56 | 15.85 | 13.93 | 15.29 | 13.96 | 12.80 | 12.64 | 12.75 | 10.43 | 10.13 | 10.41 | |

| Noninterest Expense | 36.17 | 36.26 | 34.52 | 31.87 | 38.35 | 36.37 | 36.61 | 39.37 | 34.35 | 33.39 | 32.17 | 36.45 | 33.41 | 30.43 | 31.15 | 30.65 | 30.06 | 31.58 | 29.74 | 26.12 | 25.62 | 24.94 | 25.84 | 26.29 | 24.51 | 22.49 | 21.52 | 23.29 | 24.82 | 21.55 | 19.75 | 19.24 | 22.23 | 16.65 | 16.07 | 15.67 | 15.35 | 16.41 | 14.51 | 15.61 | 14.06 | 14.79 | 13.98 | 15.84 | 14.84 | 12.18 | 11.16 | 13.09 | 12.31 | 10.49 | 11.58 | |

| Noninterest Income | 11.83 | 11.00 | 9.62 | 10.67 | 10.19 | 12.43 | 14.15 | 12.83 | 16.04 | 15.21 | 13.87 | 19.73 | 16.70 | 11.12 | 12.06 | 11.93 | 11.51 | 10.90 | 8.71 | 8.48 | 8.69 | 8.93 | 8.32 | 9.34 | 8.02 | 8.21 | 7.56 | 10.19 | 10.06 | 9.87 | 7.86 | 7.75 | 8.40 | 7.19 | 7.07 | 6.74 | 7.39 | 6.63 | 5.52 | 5.69 | 5.91 | 6.85 | 7.46 | 7.92 | 7.71 | 6.55 | 5.14 | 5.00 | 6.54 | 4.45 | 4.96 |

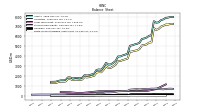

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

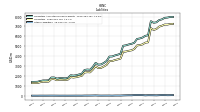

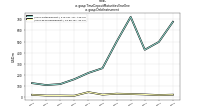

| Assets | 7959.43 | 7963.35 | 7897.99 | 7872.52 | 7718.69 | 7640.94 | 7420.33 | 7374.90 | 7534.24 | 6109.23 | 6055.53 | 5886.61 | 5790.14 | 5739.26 | 5351.32 | 5246.83 | 5186.71 | 5098.68 | 5051.64 | 4246.69 | 4150.56 | 4076.61 | 3969.75 | 3964.30 | 3519.50 | 3321.18 | 3169.64 | 3141.16 | 3325.65 | 2918.08 | 2627.92 | 2652.40 | 2607.91 | 2219.31 | 2153.97 | 2076.92 | 2037.05 | 2073.25 | 1806.58 | 1758.28 | 1781.02 | 1785.91 | 1734.25 | 1848.23 | 1846.78 | 1563.27 | 1546.83 | 1547.16 | 1490.81 | 1413.74 | 1400.92 | |

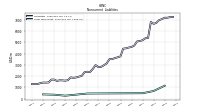

| Liabilities | 7266.06 | 7254.11 | 7195.44 | 7195.14 | 7073.70 | 6983.07 | 6742.88 | 6651.69 | 6825.70 | 5398.85 | 5366.15 | 5194.40 | 5119.85 | 5087.06 | 4720.48 | 4590.81 | 4544.00 | 4472.22 | 4442.17 | 3754.70 | 3672.97 | 3606.08 | 3509.33 | 3507.22 | 3127.45 | 2963.92 | 2821.07 | 2800.30 | 2979.91 | 2637.08 | 2366.50 | 2385.57 | 2343.18 | 2017.18 | 1954.47 | 1882.51 | 1847.27 | 1885.91 | 1636.80 | 1593.76 | 1617.57 | 1625.74 | 1571.97 | 1689.26 | 1690.91 | 1432.65 | 1420.59 | 1425.70 | 1372.13 | 1292.23 | 1288.64 | |

| Liabilities And Stockholders Equity | 7959.43 | 7963.35 | 7897.99 | 7872.52 | 7718.69 | 7640.94 | 7420.33 | 7374.90 | 7534.24 | 6109.23 | 6055.53 | 5886.61 | 5790.14 | 5739.26 | 5351.32 | 5246.83 | 5186.71 | 5098.68 | 5051.64 | 4246.69 | 4150.56 | 4076.61 | 3969.75 | 3964.30 | 3519.50 | 3321.18 | 3169.64 | 3141.16 | 3325.65 | 2918.08 | 2627.92 | 2652.40 | 2607.91 | 2219.31 | 2153.97 | 2076.92 | 2037.05 | 2073.25 | 1806.58 | 1758.28 | 1781.02 | 1785.91 | 1734.25 | 1848.23 | 1846.78 | 1563.27 | 1546.83 | 1547.16 | 1490.81 | 1413.74 | 1400.92 | |

| Stockholders Equity | 693.37 | 709.24 | 702.56 | 677.38 | 644.99 | 657.87 | 677.45 | 723.21 | 708.54 | 710.37 | 689.38 | 692.22 | 670.29 | 652.21 | 630.84 | 656.02 | 642.71 | 626.46 | 609.47 | 491.99 | 477.59 | 470.54 | 460.42 | 457.08 | 392.06 | 357.26 | 348.57 | 340.86 | 345.74 | 281.00 | 261.42 | 266.83 | 264.74 | 202.13 | 199.49 | 194.41 | 189.78 | 187.34 | 169.78 | 164.52 | 163.46 | 160.16 | 162.28 | 158.97 | 155.86 | 130.61 | 126.24 | 121.47 | 118.68 | 121.51 | 112.28 | |

| Tier One Risk Based Capital | 769.42 | 755.41 | 742.17 | 729.84 | 712.64 | 699.75 | 679.23 | 661.73 | 634.11 | 634.36 | 622.09 | 607.34 | 601.33 | 585.39 | 514.49 | 530.64 | 516.69 | 501.27 | 491.30 | 409.76 | 399.88 | 386.41 | NA | 368.36 | 331.96 | 312.30 | 305.66 | 301.74 | 302.49 | 253.19 | 203.80 | 249.92 | 229.99 | 176.47 | 178.78 | 176.10 | NA | NA | NA | 158.83 | NA | NA | NA | 145.27 | NA | NA | NA | 126.47 | NA | NA | NA |

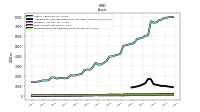

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 175.14 | 228.99 | 134.72 | 123.50 | 109.66 | 108.85 | 120.95 | 593.51 | 971.82 | 304.17 | 529.34 | 249.71 | NA | NA | NA | 98.83 | NA | NA | NA | NA | 69.70 | 69.02 | NA | 76.44 | 72.66 | 65.99 | NA | 70.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

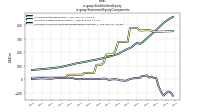

| Available For Sale Securities Debt Securities | 865.17 | 905.81 | 943.44 | 997.56 | 985.65 | 1041.02 | 1112.51 | 1160.81 | 1669.63 | 1691.19 | 1262.17 | 1134.03 | 1015.34 | 935.14 | NA | 834.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

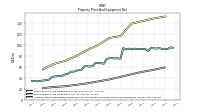

| Property Plant And Equipment Gross | NA | NA | NA | 151.28 | NA | NA | NA | 147.72 | NA | NA | NA | 143.17 | NA | NA | NA | 138.44 | NA | NA | NA | 115.79 | NA | NA | NA | 112.37 | NA | NA | NA | 99.60 | NA | NA | NA | 90.52 | NA | NA | NA | 79.41 | NA | NA | NA | 70.62 | NA | NA | NA | 65.21 | NA | NA | NA | 55.65 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 58.60 | NA | NA | NA | 54.28 | NA | NA | NA | 50.75 | NA | NA | NA | 46.23 | NA | NA | NA | 41.46 | NA | NA | NA | 36.84 | NA | NA | NA | 33.25 | NA | NA | NA | 29.72 | NA | NA | NA | 26.95 | NA | NA | NA | 24.43 | NA | NA | NA | 23.03 | NA | NA | NA | 20.98 | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.90 | 0.90 | 0.90 | 0.93 | 0.93 | 0.93 | 0.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 94.72 | 95.05 | 91.81 | 92.68 | 92.36 | 93.78 | 93.08 | 93.44 | 93.87 | 88.60 | 92.11 | 92.42 | 92.19 | 92.23 | 92.78 | 92.21 | 92.80 | 91.47 | 93.82 | 74.33 | 75.35 | 75.06 | 75.41 | 75.53 | 73.74 | 65.36 | 66.31 | 66.36 | 67.27 | 61.19 | 60.19 | 60.80 | 60.70 | 54.78 | 53.99 | 52.46 | 50.95 | 50.85 | 47.01 | 46.19 | 43.47 | 43.36 | 42.43 | 42.18 | 40.30 | 35.98 | 35.77 | 34.66 | 34.29 | 33.26 | 34.19 | |

| Goodwill | 155.21 | 155.21 | 155.21 | 155.21 | 155.21 | 154.57 | 154.57 | 154.57 | 162.79 | 151.24 | 151.24 | 151.24 | 151.24 | 151.24 | 151.24 | 151.24 | 151.24 | 151.11 | 145.69 | 119.88 | 119.88 | 119.88 | 119.88 | 119.88 | 93.75 | 77.64 | 77.64 | 76.94 | 74.31 | 56.46 | 49.60 | 49.60 | 49.60 | 28.18 | 28.18 | 28.18 | 28.03 | 28.03 | 20.48 | 19.75 | 19.75 | 19.75 | 19.75 | 19.75 | 19.75 | 5.91 | 5.91 | 5.91 | 5.91 | 5.91 | 5.91 | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 17.24 | 18.16 | 19.09 | 20.02 | 20.94 | 21.15 | 21.16 | 22.06 | 22.95 | 23.87 | 24.78 | 25.72 | 26.68 | 27.66 | 28.66 | 31.17 | 10.39 | 10.88 | 11.36 | 11.84 | 12.40 | 9.49 | 9.08 | 9.45 | 9.37 | 9.58 | 8.69 | 7.09 | 7.37 | 7.65 | 3.53 | 3.74 | 3.96 | 4.19 | 4.42 | 3.10 | 3.29 | 3.48 | 3.67 | 3.86 | 4.05 | 4.29 | 2.07 | 2.18 | 2.29 | 2.40 | 2.52 | 2.74 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 409.65 | 315.78 | 307.26 | 341.81 | 390.96 | 299.01 | 180.89 | 13.41 | 9.49 | NA | 0.00 | NA | NA | 0.00 | 0.12 | 0.09 | 0.13 | 0.25 | 0.43 | 3.69 | 5.78 | 4.71 | 4.69 | 3.09 | 0.96 | 1.02 | 2.18 | 2.74 | 0.76 | 2.61 | 0.24 | 0.56 | 0.28 | 0.69 | 0.22 | 0.11 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1556.85 | 1668.23 | 1709.39 | 1681.31 | 1640.59 | 1754.21 | 1827.85 | 1559.99 | 768.10 | 162.65 | 170.95 | 179.99 | 191.61 | 201.82 | 207.32 | 215.15 | 217.72 | 219.89 | 210.11 | 208.27 | 219.16 | 206.73 | 203.90 | 201.09 | 202.22 | 203.54 | 200.48 | NA | 194.29 | 180.06 | 188.09 | 193.70 | 188.57 | 167.58 | 171.41 | 169.90 | 175.84 | 175.49 | 9.91 | 9.91 | 9.91 | 9.91 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | 1966.48 | 1983.50 | 2015.54 | 2022.75 | 2031.54 | 2052.77 | 2006.13 | 1552.44 | 769.24 | 153.28 | 161.65 | 168.68 | 180.27 | 190.94 | 199.47 | 207.90 | 210.31 | 213.77 | 206.33 | 210.11 | 223.85 | 209.77 | 206.69 | 200.45 | 198.60 | 199.47 | 198.87 | 193.19 | 187.03 | 173.70 | 180.29 | 187.63 | 182.19 | 162.66 | 164.28 | 165.77 | 172.45 | 173.20 | 9.91 | 9.91 | 9.91 | 9.91 | 2.11 | NA | 6.10 | 6.10 | 7.10 | 7.10 | 10.63 | 10.63 | 9.60 | |

| Available For Sale Debt Securities Amortized Cost Basis | 1024.62 | 1033.13 | 1064.94 | 1137.70 | 1147.47 | 1162.98 | 1186.13 | 1153.61 | 1655.19 | 1662.25 | 1243.31 | 1090.36 | 976.81 | 899.54 | 470.87 | 409.19 | 364.87 | 280.72 | 277.26 | 237.87 | 187.26 | 167.11 | 159.95 | 167.59 | 160.02 | 157.79 | 141.89 | 126.62 | 90.24 | 79.38 | 84.65 | 79.80 | 83.22 | 78.08 | 78.47 | 73.56 | 74.13 | 84.17 | NA | 221.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.01 | 0.51 | 1.11 | 0.37 | 0.01 | 0.46 | 2.61 | 20.95 | 8.35 | 9.37 | 9.30 | 11.31 | 11.34 | 10.88 | 7.97 | 7.34 | 7.55 | 6.38 | 4.21 | 1.85 | 1.09 | 1.67 | 1.90 | 3.73 | 4.58 | 5.09 | 3.80 | 3.63 | 8.03 | 8.97 | 8.04 | 6.64 | 6.67 | 5.62 | 7.34 | 4.24 | 3.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 409.65 | 315.78 | 307.26 | 341.81 | 390.96 | 299.01 | 180.89 | 13.41 | 9.49 | NA | 0.00 | NA | NA | 0.00 | 0.12 | 0.09 | 0.13 | 0.25 | 0.43 | 3.69 | 5.78 | 4.71 | 4.69 | 3.09 | 0.96 | 1.02 | 2.18 | 2.74 | 0.76 | 2.61 | 0.24 | 0.56 | 0.28 | 0.69 | 0.22 | 0.11 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Next Rolling Twelve Months Fair Value | 35.15 | 33.70 | 46.95 | 32.38 | 32.49 | 35.82 | 28.41 | 5.26 | 4.67 | 4.35 | 6.33 | 7.33 | 8.24 | 11.31 | 10.13 | 7.87 | 6.48 | 2.50 | 0.15 | 0.07 | 5.63 | 5.55 | 8.70 | 1.93 | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 6.14 | 5.95 | 9.91 | 9.91 | 9.91 | 9.91 | 2.11 | NA | 6.10 | 6.10 | NA | 7.13 | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling After Ten Years Fair Value | 696.89 | 778.92 | 807.30 | 793.54 | 749.32 | 809.44 | 868.01 | 880.83 | 181.09 | 25.36 | 26.69 | 28.47 | 29.20 | 30.22 | 33.34 | 34.44 | 36.17 | 37.90 | 37.21 | 38.75 | 44.81 | 34.20 | 35.99 | 45.68 | 44.47 | 52.36 | 48.28 | 51.75 | 47.03 | 35.09 | 33.10 | 28.98 | 33.40 | 27.91 | 33.94 | 40.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Six Through Ten Fair Value | 278.55 | 283.22 | 276.72 | 280.62 | 290.17 | 313.47 | 314.13 | 275.31 | 188.96 | 78.96 | 82.25 | 88.30 | 91.58 | 95.23 | 95.03 | 98.48 | 101.78 | 104.17 | 101.18 | 101.53 | 101.20 | 103.25 | 96.33 | 91.25 | 90.37 | 88.39 | 87.89 | 88.81 | 93.50 | 92.55 | 102.86 | 110.03 | 105.15 | 105.07 | 109.39 | 101.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Two Through Five Fair Value | 212.23 | 217.64 | 214.35 | 209.85 | 195.64 | 195.38 | 194.89 | 66.98 | 46.57 | 44.94 | 45.32 | 44.36 | 47.75 | 49.60 | 52.36 | 57.05 | 55.55 | 57.12 | 51.15 | 49.32 | 48.79 | 44.38 | 42.97 | 41.53 | 38.65 | 33.41 | 31.89 | 25.27 | 23.96 | 20.44 | 16.13 | 18.40 | 15.29 | 8.32 | 1.24 | 0.59 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 697.60 | NA | NA | NA | 511.72 | NA | NA | NA | 445.91 | NA | NA | NA | 747.02 | NA | NA | NA | 525.95 | NA | NA | NA | 277.50 | NA | NA | NA | 257.07 | NA | NA | NA | 167.79 | NA | NA | NA | 125.38 | NA | NA | NA | 116.48 | NA | NA | NA | 140.88 | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 5700.10 | 5709.33 | 5701.94 | 5857.77 | 5830.84 | 5845.59 | 5851.50 | 5802.99 | 5979.90 | 4781.63 | 4721.82 | 4531.13 | 4336.29 | 4307.60 | 3882.27 | 3931.00 | 3915.96 | 3930.78 | 3888.02 | 3139.38 | 3128.55 | 3016.16 | 2933.68 | 2881.00 | 2608.28 | 2418.78 | 2443.70 | 2471.21 | 2336.16 | 2082.26 | 1878.48 | 1880.15 | 1913.08 | 1584.72 | 1465.10 | 1482.32 | 1449.66 | 1499.10 | 1355.57 | 1291.52 | 1328.32 | 1297.26 | 1315.06 | 1294.15 | 1306.97 | 1045.79 | 1064.62 | 1009.87 | 989.75 | 1020.28 | 985.50 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | 1142.95 | NA | NA | NA | 675.75 | NA | NA | NA | 475.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 449.35 | NA | NA | NA | 351.20 | NA | NA | NA | 256.30 | NA | NA | NA | 345.76 | NA | NA | NA | 370.11 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

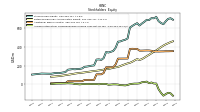

| Stockholders Equity | 693.37 | 709.24 | 702.56 | 677.38 | 644.99 | 657.87 | 677.45 | 723.21 | 708.54 | 710.37 | 689.38 | 692.22 | 670.29 | 652.21 | 630.84 | 656.02 | 642.71 | 626.46 | 609.47 | 491.99 | 477.59 | 470.54 | 460.42 | 457.08 | 392.06 | 357.26 | 348.57 | 340.86 | 345.74 | 281.00 | 261.42 | 266.83 | 264.74 | 202.13 | 199.49 | 194.41 | 189.78 | 187.34 | 169.78 | 164.52 | 163.46 | 160.16 | 162.28 | 158.97 | 155.86 | 130.61 | 126.24 | 121.47 | 118.68 | 121.51 | 112.28 | |

| Additional Paid In Capital | 355.48 | 354.95 | 354.04 | 354.19 | 352.84 | 352.41 | 351.52 | 352.12 | 351.95 | 359.23 | 362.61 | 362.94 | 362.18 | 361.09 | 361.02 | 379.85 | 379.45 | 380.74 | 378.96 | 276.10 | 275.80 | 275.59 | 275.30 | 275.06 | 212.44 | 182.55 | 182.40 | 182.33 | 181.90 | 120.76 | 106.50 | 106.37 | 106.08 | 46.62 | 46.06 | 45.92 | 45.73 | 45.44 | 32.60 | 32.50 | 32.24 | 32.11 | 32.04 | 31.96 | 31.89 | 10.85 | 10.64 | 10.61 | 10.58 | 10.47 | 10.36 | |

| Retained Earnings Accumulated Deficit | 461.32 | 452.21 | 440.56 | 429.38 | 415.28 | 398.52 | 380.70 | 363.74 | 348.94 | 332.51 | 316.08 | 301.42 | 284.83 | 269.85 | 260.50 | 269.74 | 256.62 | 241.52 | 230.33 | 224.03 | 214.75 | 205.53 | 195.29 | 185.57 | 181.40 | 176.12 | 169.95 | 164.17 | 161.03 | 156.65 | 152.22 | 148.69 | 144.34 | 141.89 | 138.50 | 134.48 | 130.86 | 127.15 | 123.68 | 121.25 | 118.16 | 114.40 | 109.70 | 105.40 | 101.27 | 97.35 | 93.20 | 89.39 | 86.52 | 84.42 | 80.24 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -123.43 | -97.92 | -92.03 | -106.20 | -123.12 | -93.06 | -54.77 | 7.34 | 7.64 | 18.64 | 10.69 | 27.85 | 23.28 | 21.27 | 9.32 | 6.43 | 6.65 | 4.21 | 0.18 | -8.14 | -12.96 | -10.59 | -10.18 | -3.55 | -1.78 | -1.42 | -3.78 | -5.64 | 2.81 | 3.59 | 2.70 | -0.72 | 1.81 | 1.12 | 2.43 | 1.52 | 0.69 | 2.24 | 1.00 | -1.73 | 0.56 | 1.16 | 8.04 | 9.10 | 10.20 | 8.78 | 8.77 | 7.84 | 7.95 | 7.18 | 2.35 |

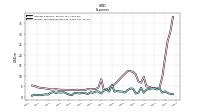

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

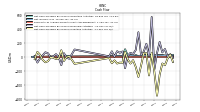

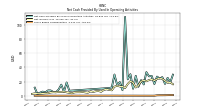

| Net Cash Provided By Used In Operating Activities | 29.84 | 18.80 | 25.31 | 16.72 | 26.28 | 24.33 | 27.05 | 16.53 | 28.04 | 27.41 | 33.37 | 15.93 | 22.00 | 12.65 | 28.18 | 9.83 | 30.43 | 23.13 | 111.57 | 7.80 | 19.26 | 15.39 | 29.99 | 11.79 | 10.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 7.01 | 18.72 | 5.59 | 15.64 | 8.89 | 4.84 | 5.22 | 7.40 | 7.49 | 4.72 | 5.77 | 2.35 | |

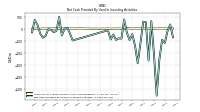

| Net Cash Provided By Used In Investing Activities | -71.36 | 35.10 | -19.49 | -117.61 | -92.46 | -253.91 | -555.96 | -216.69 | 62.62 | -264.45 | 55.45 | 57.51 | -121.30 | -286.48 | -142.05 | -45.26 | -93.94 | -32.01 | 76.49 | -82.36 | -80.09 | -93.23 | -48.24 | -89.15 | -13.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -97.50 | -40.57 | 8.04 | 0.26 | -56.12 | 97.61 | -18.41 | -28.31 | -10.11 | -3.55 | -59.00 | -75.49 | -40.22 | 73.95 | |

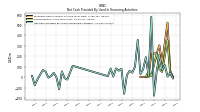

| Net Cash Provided By Used In Financing Activities | -12.33 | 40.36 | 5.40 | 114.73 | 66.99 | 217.48 | 56.35 | -178.15 | 576.98 | 11.88 | 190.81 | 77.14 | 28.29 | 357.50 | 101.50 | 42.99 | 60.10 | 17.44 | -160.41 | 79.81 | 61.51 | 83.55 | 5.11 | 82.09 | 8.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 108.42 | 42.84 | -23.83 | -10.22 | 55.20 | -116.93 | -1.31 | 41.29 | 9.59 | -5.25 | 53.50 | 68.40 | 23.87 | -78.82 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 29.84 | 18.80 | 25.31 | 16.72 | 26.28 | 24.33 | 27.05 | 16.53 | 28.04 | 27.41 | 33.37 | 15.93 | 22.00 | 12.65 | 28.18 | 9.83 | 30.43 | 23.13 | 111.57 | 7.80 | 19.26 | 15.39 | 29.99 | 11.79 | 10.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 7.01 | 18.72 | 5.59 | 15.64 | 8.89 | 4.84 | 5.22 | 7.40 | 7.49 | 4.72 | 5.77 | 2.35 | |

| Net Income Loss | 16.20 | 18.76 | 18.23 | 21.16 | 23.82 | 24.86 | 23.56 | 21.43 | 23.07 | 22.17 | 20.42 | 21.89 | 20.31 | 14.64 | 11.65 | 18.54 | 20.54 | 16.64 | 10.82 | 13.13 | 13.06 | 14.12 | 12.80 | 7.65 | 8.17 | 9.07 | 8.22 | 5.60 | 6.60 | 6.33 | 5.38 | 6.17 | 4.29 | 4.73 | 5.36 | 4.95 | 4.96 | 4.78 | 3.42 | 4.12 | 4.79 | 5.67 | 5.31 | 5.17 | 4.85 | 4.91 | 4.61 | 3.52 | 3.42 | 3.09 | 2.87 | |

| Profit Loss | 16.20 | 18.76 | 18.23 | 21.16 | 23.82 | 24.86 | 23.56 | 21.43 | 23.07 | 22.17 | 20.42 | 21.89 | 20.31 | 14.64 | 11.65 | 18.54 | 20.54 | 16.64 | 10.82 | 13.13 | 13.06 | 14.12 | 12.80 | 7.65 | 8.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Depreciation Depletion And Amortization | 2.65 | 2.67 | 2.60 | 2.73 | 2.82 | 2.56 | 2.64 | 3.08 | 2.69 | 2.74 | 2.66 | 3.05 | 2.63 | 2.30 | 2.61 | 2.62 | 2.68 | 2.83 | 1.55 | 1.77 | 1.75 | 1.49 | 1.81 | 1.63 | 1.48 | 1.42 | 1.40 | 1.49 | 1.33 | 1.28 | 1.18 | 1.13 | 1.14 | 0.93 | 0.96 | 0.97 | 1.00 | 0.96 | 0.84 | 0.83 | 0.84 | 0.84 | 0.85 | 0.89 | 0.69 | 0.65 | 0.65 | 0.65 | 0.64 | 0.62 | 0.60 | |

| Share Based Compensation | 0.94 | 0.94 | 0.76 | 0.69 | 0.63 | 0.63 | 0.53 | 0.01 | 0.01 | 0.01 | 0.03 | 0.03 | 0.03 | 0.03 | 0.05 | 0.05 | 0.05 | 0.06 | 0.06 | 0.04 | 0.04 | 0.08 | 0.08 | 0.09 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.10 | 0.07 | 0.07 | 0.08 | 0.08 | 0.06 | 0.06 | 0.06 | 0.06 | 0.03 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -71.36 | 35.10 | -19.49 | -117.61 | -92.46 | -253.91 | -555.96 | -216.69 | 62.62 | -264.45 | 55.45 | 57.51 | -121.30 | -286.48 | -142.05 | -45.26 | -93.94 | -32.01 | 76.49 | -82.36 | -80.09 | -93.23 | -48.24 | -89.15 | -13.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -97.50 | -40.57 | 8.04 | 0.26 | -56.12 | 97.61 | -18.41 | -28.31 | -10.11 | -3.55 | -59.00 | -75.49 | -40.22 | 73.95 | |

| Payments To Acquire Property Plant And Equipment | 1.16 | 4.71 | 0.57 | 1.73 | 1.48 | 2.15 | 1.08 | NA | NA | NA | 1.12 | NA | NA | NA | 2.03 | 0.85 | 2.22 | 4.80 | -3.26 | 0.14 | 1.42 | 0.80 | 1.07 | 0.02 | 1.61 | 0.03 | 1.02 | -0.34 | 1.04 | 0.45 | 0.24 | 0.86 | 1.17 | 1.42 | 2.17 | 2.17 | 0.76 | 1.93 | 1.39 | 3.29 | 0.68 | 1.51 | 0.84 | 2.46 | 2.20 | 0.70 | 1.62 | 0.89 | 1.53 | -0.98 | 0.39 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -12.33 | 40.36 | 5.40 | 114.73 | 66.99 | 217.48 | 56.35 | -178.15 | 576.98 | 11.88 | 190.81 | 77.14 | 28.29 | 357.50 | 101.50 | 42.99 | 60.10 | 17.44 | -160.41 | 79.81 | 61.51 | 83.55 | 5.11 | 82.09 | 8.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 108.42 | 42.84 | -23.83 | -10.22 | 55.20 | -116.93 | -1.31 | 41.29 | 9.59 | -5.25 | 53.50 | 68.40 | 23.87 | -78.82 | |

| Payments Of Dividends Common Stock | 7.09 | 7.11 | 7.06 | 7.06 | 7.06 | 7.04 | 6.61 | 6.63 | 6.64 | 5.74 | 5.76 | 5.31 | 5.33 | 5.29 | 5.26 | 5.42 | 5.44 | 5.45 | 4.52 | 3.85 | 3.85 | 3.87 | 3.85 | 3.48 | 2.90 | 2.90 | 2.45 | 2.46 | 2.23 | 1.89 | 1.80 | 1.80 | 1.80 | 1.31 | 1.30 | 1.30 | 1.21 | 1.27 | 0.96 | 0.96 | 0.96 | 0.87 | 0.87 | 0.88 | 0.87 | 0.65 | 0.65 | 0.60 | 0.60 | 0.57 | 0.56 |