| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

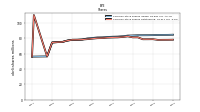

| Common Stock Value | 0.85 | 0.85 | 0.85 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.83 | 0.82 | 0.82 | 0.81 | 0.81 | 0.81 | 0.80 | 0.79 | 0.78 | 0.78 | 0.77 | 0.75 | 0.75 | 0.75 | 0.56 | NA | NA | 0.56 | NA | NA | NA | |

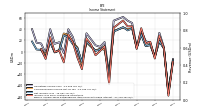

| Earnings Per Share Basic | -0.20 | -0.94 | 0.07 | 0.23 | -0.11 | 0.15 | 0.12 | 0.37 | 0.08 | 0.50 | 0.46 | 0.53 | 0.44 | -0.55 | 0.12 | 0.05 | 0.02 | 0.13 | 0.22 | -0.24 | 0.08 | 0.17 | 0.34 | 0.41 | 0.03 | -0.03 | 0.30 | -0.17 | 0.05 | 0.06 | 0.32 | |

| Earnings Per Share Diluted | -0.20 | -0.94 | 0.07 | 0.22 | -0.11 | 0.15 | 0.12 | 0.34 | 0.09 | 0.45 | 0.42 | 0.48 | 0.42 | -0.55 | 0.12 | 0.05 | 0.01 | 0.13 | 0.21 | -0.24 | 0.07 | 0.17 | 0.32 | 0.39 | 0.03 | -0.03 | 0.29 | -0.17 | 0.05 | 0.06 | 0.32 |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

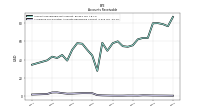

| Revenue From Contract With Customer Excluding Assessed Tax | 506.40 | 532.36 | 525.34 | 562.37 | 468.93 | 499.21 | 509.56 | 527.71 | 477.85 | 518.00 | 549.49 | 534.18 | 485.35 | 260.01 | 469.70 | 401.76 | 431.90 | 429.45 | 461.21 | 355.92 | 387.43 | 385.53 | 407.98 | 321.82 | 346.09 | 337.54 | 369.86 | 277.11 | 301.22 | 291.06 | 326.81 | |

| Cost Of Goods And Service Excluding Depreciation Depletion And Amortization | 246.99 | 252.03 | 247.84 | 254.05 | 222.18 | 232.80 | 234.57 | 236.04 | 217.69 | 226.46 | 235.95 | 224.69 | 210.81 | 140.78 | 218.55 | 187.54 | 204.50 | 202.51 | 211.97 | 173.47 | 182.59 | 177.06 | 180.45 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Expenses | 272.68 | 354.93 | 269.78 | 275.00 | 256.54 | 251.05 | 256.62 | 254.34 | 252.22 | 240.84 | 258.71 | 248.04 | 219.75 | 160.82 | 234.24 | 205.86 | 216.29 | 205.24 | 216.85 | 204.32 | 206.05 | 182.68 | 187.88 | 172.24 | 167.17 | 167.36 | 164.33 | 150.14 | 148.24 | NA | NA | |

| Selling General And Administrative Expense | 248.28 | 249.71 | 243.97 | 249.92 | 233.94 | 225.03 | 227.83 | 228.55 | 224.76 | 218.21 | 234.24 | 223.59 | 190.52 | 136.58 | 193.74 | 178.04 | 190.29 | 182.28 | 193.88 | 167.91 | 184.42 | 165.04 | 170.10 | 152.21 | 151.25 | 144.66 | 149.80 | 128.85 | 134.46 | NA | NA | |

| Operating Income Loss | -13.27 | -74.60 | 7.72 | 33.31 | -9.79 | 15.36 | 18.37 | 37.33 | 7.95 | 50.71 | 54.83 | 61.45 | 54.79 | -41.60 | 16.91 | 8.36 | 11.11 | 21.70 | 32.40 | -19.39 | -1.22 | 25.79 | 39.64 | -2.82 | 16.56 | 13.77 | 39.72 | -3.35 | 14.31 | 15.74 | 39.69 | |

| Interest Paid Net | 5.36 | 0.98 | 4.94 | 0.46 | 5.94 | 1.67 | 7.01 | 2.32 | 7.58 | 2.68 | 8.93 | 5.71 | 5.70 | 6.75 | 7.07 | 8.75 | 7.74 | 7.58 | 9.86 | 4.48 | 9.86 | 8.55 | 10.57 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -1.79 | -4.52 | 0.28 | 10.18 | -3.15 | 5.83 | 4.67 | 11.33 | -1.62 | 3.98 | 7.04 | 11.69 | 7.03 | -13.40 | -0.28 | -2.96 | -7.74 | 2.48 | 5.91 | -10.92 | -16.44 | 3.29 | 5.28 | -47.91 | 0.16 | 0.65 | 8.46 | -3.36 | 1.56 | NA | NA | |

| Income Taxes Paid Net | 1.23 | 1.99 | 4.24 | 0.11 | 0.86 | 0.98 | 5.76 | -0.13 | 1.14 | 2.30 | 6.63 | 0.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -15.99 | -73.80 | 5.61 | 18.27 | -9.26 | 11.50 | 9.73 | 30.15 | 6.22 | 40.99 | 37.60 | 43.43 | 35.29 | -43.83 | 9.74 | 3.92 | 1.19 | 10.26 | 17.43 | -18.44 | 5.82 | 13.08 | 25.05 | 28.70 | 1.55 | -1.50 | 17.07 | -9.71 | 3.03 | 3.59 | 17.85 | |

| Comprehensive Income Net Of Tax | -15.79 | -73.61 | 5.80 | 18.46 | -9.07 | 11.69 | 9.92 | 30.34 | 7.12 | 41.24 | 39.80 | 42.54 | 36.70 | -40.77 | 3.14 | 5.03 | 1.70 | 8.59 | 16.48 | -22.04 | 7.50 | 15.57 | 29.67 | 32.05 | 2.93 | -1.34 | 16.87 | -4.96 | 2.62 | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | -15.99 | -73.80 | 5.61 | 20.63 | -16.39 | 11.50 | 9.73 | 32.49 | 8.62 | 43.38 | 39.96 | 45.76 | 35.29 | -43.83 | 9.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

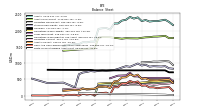

| Assets | 2172.51 | 2266.43 | 2333.93 | 2312.37 | 2291.25 | 2291.74 | 2278.34 | 2325.49 | 2293.09 | 2405.47 | 2369.22 | 2419.84 | 2307.51 | 2219.04 | 2218.75 | 2032.72 | 2078.42 | 2071.84 | 2053.09 | 1661.39 | 1660.69 | 1639.44 | 1644.55 | 1583.79 | 1588.86 | NA | NA | 1531.12 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 2172.51 | 2266.43 | 2333.93 | 2312.37 | 2291.25 | 2291.74 | 2278.34 | 2325.49 | 2293.09 | 2405.47 | 2369.22 | 2419.84 | 2307.51 | 2219.04 | 2218.75 | 2032.72 | 2078.42 | 2071.84 | 2053.09 | 1661.39 | 1660.69 | 1639.44 | 1644.55 | 1583.79 | 1588.86 | NA | NA | 1531.12 | NA | NA | NA | |

| Stockholders Equity | 829.42 | 840.35 | 908.41 | 896.73 | 901.11 | 906.92 | 891.67 | 950.73 | 925.98 | 988.56 | 938.34 | 887.53 | 864.96 | 820.94 | 786.16 | 776.44 | 765.47 | 774.43 | 762.58 | 743.15 | 758.17 | 729.59 | 711.27 | 659.59 | 254.59 | NA | NA | 401.89 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 396.67 | 500.06 | 494.29 | 486.48 | 473.84 | 477.06 | 480.47 | 532.59 | 514.58 | 646.39 | 608.36 | 656.95 | 555.43 | 453.12 | 441.22 | 234.64 | 278.65 | 270.89 | 270.09 | 214.70 | 211.10 | 199.43 | 218.63 | 162.48 | 178.79 | NA | NA | 147.26 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 149.90 | 265.81 | 254.65 | 246.91 | 229.43 | 256.21 | 254.38 | 314.64 | 305.80 | 439.12 | 408.30 | 453.79 | 377.01 | 256.29 | 263.15 | 39.34 | 94.09 | 82.78 | 72.51 | 17.13 | 48.88 | 34.64 | 58.43 | 4.21 | 27.62 | 24.86 | 29.91 | 4.95 | 23.74 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 151.03 | 267.15 | 255.98 | 248.41 | 230.62 | 257.52 | 255.60 | 315.98 | 306.88 | 440.46 | 409.65 | 455.35 | 378.42 | 257.63 | 264.11 | 40.31 | 95.29 | 83.86 | 73.85 | 18.00 | 50.07 | 35.82 | 60.00 | 5.19 | 28.60 | 26.02 | 31.11 | 5.69 | NA | NA | NA | |

| Accounts Receivable Net Current | 86.85 | 76.64 | 78.90 | 80.05 | 79.89 | 63.82 | 63.77 | 62.24 | 55.70 | 54.08 | 54.73 | 60.04 | 49.68 | 58.45 | 27.60 | 44.48 | 50.66 | 57.44 | 58.02 | 50.73 | 38.88 | 45.08 | 41.74 | 43.19 | 39.11 | NA | NA | 34.37 | NA | NA | NA | |

| Inventory Net | 119.91 | 120.58 | 120.87 | 123.52 | 123.16 | 122.03 | 129.49 | 127.40 | 123.67 | 124.64 | 120.86 | 119.53 | 111.70 | 117.86 | 130.37 | 127.56 | 111.89 | 105.66 | 111.94 | 116.02 | 99.28 | 94.91 | 93.68 | 91.15 | 89.37 | NA | NA | 87.06 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 40.01 | 37.02 | 39.87 | 36.00 | 41.36 | 35.00 | 32.82 | 28.31 | 29.41 | 28.55 | 24.47 | 23.60 | 17.05 | 20.52 | 20.09 | 23.27 | 22.01 | 25.02 | 27.63 | 30.82 | 24.07 | 24.80 | 24.78 | 23.93 | 22.69 | NA | NA | 20.88 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

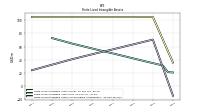

| Assets Noncurrent | 1775.84 | 1766.37 | 1839.64 | 1825.89 | 1817.41 | 1814.67 | 1797.87 | 1792.89 | 1778.52 | 1759.08 | 1760.85 | 1762.89 | 1752.08 | 1765.91 | 1777.53 | 1798.09 | 1799.78 | 1800.94 | 1783.00 | 1446.68 | 1449.59 | 1440.01 | 1425.93 | 1421.31 | 1410.07 | NA | NA | 1383.86 | NA | NA | NA | |

| Goodwill | 717.54 | 717.54 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 777.61 | 792.74 | 792.74 | 792.74 | 792.74 | 792.74 | NA | NA | 793.23 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 20.27 | 20.81 | 30.90 | 32.78 | 34.67 | 36.40 | 38.27 | 40.15 | 42.02 | 43.89 | 45.77 | 47.64 | 51.38 | 53.24 | 55.09 | 56.94 | NA | NA | NA | 64.53 | NA | NA | NA | 72.90 | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 28.34 | 26.67 | 24.78 | 23.38 | 21.98 | 21.84 | 18.48 | 22.27 | 17.00 | 18.87 | 17.71 | 17.30 | 16.32 | 12.87 | 10.78 | 8.13 | 6.58 | 6.26 | 7.09 | 8.88 | 9.05 | 9.97 | 10.86 | 10.99 | 11.11 | NA | NA | 12.33 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 397.70 | 373.53 | 363.23 | 361.76 | 344.26 | 336.62 | 353.79 | 345.41 | 343.80 | 348.84 | 370.48 | 359.83 | 356.05 | 311.94 | 287.46 | 273.18 | 303.90 | 288.28 | 297.67 | 211.65 | 197.20 | 189.26 | 221.66 | 211.31 | 219.18 | NA | NA | 199.68 | NA | NA | NA | |

| Long Term Debt Current | 7.50 | 7.50 | 7.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | 10.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 67.56 | 62.88 | 64.11 | 74.62 | 65.28 | 68.98 | 70.00 | 69.41 | 64.33 | 76.12 | 77.68 | 79.81 | 68.63 | 52.43 | 59.95 | 40.78 | 45.34 | 47.10 | 45.09 | 43.64 | 30.89 | 32.78 | 46.13 | 35.71 | 33.56 | NA | NA | 39.40 | NA | NA | NA | |

| Other Accrued Liabilities Current | 17.22 | 21.28 | 18.44 | 20.58 | 15.75 | 18.50 | 15.60 | 16.51 | 13.20 | 15.66 | 14.92 | 15.96 | 18.56 | 20.26 | 16.30 | 11.61 | 11.21 | 13.86 | 14.58 | 14.18 | 9.15 | 7.31 | 9.69 | 8.09 | 8.89 | NA | NA | 8.12 | NA | NA | NA | |

| Accrued Income Taxes Current | 1.86 | 0.02 | 1.11 | 12.62 | 0.10 | 7.43 | 3.86 | NA | 0.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 123.29 | 113.38 | 112.95 | 103.19 | 94.22 | 100.88 | 107.58 | 91.86 | 119.32 | 98.75 | 116.51 | 98.80 | 125.28 | 106.86 | 98.97 | 82.83 | 101.56 | 92.47 | 97.67 | 81.00 | 81.47 | 72.41 | 85.76 | 77.61 | 90.75 | NA | NA | 69.40 | NA | NA | NA | |

| Contract With Customer Liability Current | 62.87 | 64.06 | 64.10 | 64.36 | 62.20 | 63.88 | 64.30 | 65.22 | 65.33 | 68.76 | 68.61 | 65.62 | 56.85 | 51.62 | 56.51 | 55.87 | 57.23 | 56.37 | 55.66 | 52.14 | 53.95 | 53.22 | NA | 62.99 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

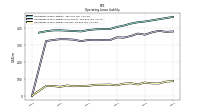

| Liabilities Noncurrent | 945.39 | 1052.55 | 1062.28 | 1053.88 | 1045.87 | 1048.19 | 1032.88 | 1029.35 | 1023.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt | 445.18 | 545.53 | 546.73 | 546.86 | 546.23 | 545.52 | 544.82 | 544.18 | 543.57 | 592.53 | 591.83 | 708.20 | 620.07 | 615.64 | NA | 536.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 437.68 | 538.03 | 539.23 | 546.86 | 546.23 | 545.52 | 544.82 | 544.18 | 543.57 | 592.53 | 591.83 | 708.20 | 620.07 | 615.64 | NA | 525.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

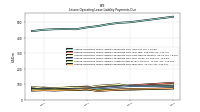

| Long Term Debt And Capital Lease Obligations | 450.77 | 552.19 | 555.18 | 563.70 | 563.39 | 564.18 | 564.15 | 564.65 | 566.08 | 615.62 | 616.16 | 733.73 | 648.14 | 644.94 | 713.25 | 555.93 | 584.25 | 579.09 | 578.40 | 570.54 | 566.93 | 566.57 | 562.00 | 561.98 | 912.73 | NA | NA | 738.34 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 87.88 | 93.65 | 95.22 | 87.56 | 93.87 | 87.69 | 86.49 | 91.32 | 82.85 | 89.09 | 80.00 | 76.35 | 73.75 | 67.40 | 58.71 | 60.15 | 62.79 | 69.09 | 67.33 | 61.94 | 75.38 | 91.23 | 87.28 | 73.65 | 120.56 | NA | NA | 111.28 | NA | NA | NA | |

| Other Liabilities Noncurrent | 8.46 | 9.79 | 9.26 | 9.08 | 8.90 | 8.95 | 9.04 | 9.13 | 8.97 | 13.59 | 14.27 | 14.54 | 23.69 | 25.93 | 20.53 | 13.73 | 13.41 | 18.48 | 11.52 | 53.96 | 42.29 | 42.29 | 42.13 | 46.04 | 49.71 | NA | NA | 50.50 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 376.81 | 374.81 | 380.68 | 371.69 | 358.11 | 364.80 | 350.19 | 340.90 | 342.24 | 325.79 | 326.48 | 325.62 | 320.15 | 328.45 | 331.23 | 331.77 | 326.49 | 320.75 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 829.42 | 840.35 | 908.41 | 896.73 | 901.11 | 906.92 | 891.67 | 950.73 | 925.98 | 988.56 | 938.34 | 887.53 | 864.96 | 820.94 | 786.16 | 776.44 | 765.47 | 774.43 | 762.58 | 743.15 | 758.17 | 729.59 | 711.27 | 659.59 | 254.59 | NA | NA | 401.89 | NA | NA | NA | |

| Common Stock Value | 0.85 | 0.85 | 0.85 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.83 | 0.82 | 0.82 | 0.81 | 0.81 | 0.81 | 0.80 | 0.79 | 0.78 | 0.78 | 0.77 | 0.75 | 0.75 | 0.75 | 0.56 | NA | NA | 0.56 | NA | NA | NA | |

| Additional Paid In Capital | 788.97 | 783.36 | 777.76 | 771.87 | 767.11 | 763.17 | 759.56 | 755.53 | 750.48 | 748.42 | 739.38 | 728.34 | 790.19 | 782.85 | 707.30 | 700.12 | 693.54 | 679.22 | 675.95 | 672.50 | 659.48 | 638.38 | 635.64 | 631.80 | 259.03 | NA | NA | 424.79 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 254.62 | 270.60 | 344.40 | 338.79 | 320.52 | 329.78 | 318.28 | 308.54 | 278.39 | 272.18 | 231.18 | 193.58 | 107.80 | 72.51 | 116.34 | 107.13 | 103.21 | 102.02 | 91.76 | 74.84 | 100.11 | 94.30 | 81.22 | 37.15 | 8.45 | NA | NA | -8.68 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.42 | -0.61 | -0.80 | -0.99 | -1.18 | -1.37 | -1.56 | -1.75 | -1.94 | -2.84 | -3.09 | -5.30 | -5.94 | -7.36 | -10.42 | -3.81 | -4.92 | -5.43 | -3.76 | -2.81 | -1.06 | -2.75 | -5.24 | -9.87 | -13.22 | NA | NA | -14.56 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

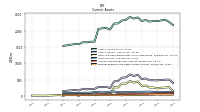

| Net Cash Provided By Used In Operating Activities | 19.76 | 41.06 | 38.15 | 74.06 | -2.14 | 33.31 | 40.91 | 47.12 | 25.13 | 44.00 | 92.16 | 97.65 | 132.30 | -14.64 | 86.06 | -5.86 | 51.66 | 36.27 | 83.01 | -9.32 | 35.82 | 2.35 | 77.79 | -6.00 | 28.32 | 21.43 | 46.51 | 6.51 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -33.24 | -27.79 | -27.17 | -27.61 | -24.83 | -30.37 | -27.62 | -28.08 | -36.45 | -17.66 | -22.42 | -16.37 | -14.98 | -12.68 | -12.85 | -24.72 | -24.12 | -25.98 | -25.81 | -25.54 | -30.11 | -25.89 | -22.68 | -26.08 | -24.61 | -23.43 | -20.70 | -23.16 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -102.64 | -2.09 | -3.41 | -28.66 | 0.07 | -1.02 | -73.67 | -9.94 | -122.26 | 4.46 | -115.44 | -1.09 | 3.47 | 20.84 | 150.60 | -24.40 | -16.12 | -0.27 | -1.35 | 2.80 | 8.54 | -0.64 | -0.30 | 8.66 | -1.36 | -3.09 | -0.38 | -2.15 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 19.76 | 41.06 | 38.15 | 74.06 | -2.14 | 33.31 | 40.91 | 47.12 | 25.13 | 44.00 | 92.16 | 97.65 | 132.30 | -14.64 | 86.06 | -5.86 | 51.66 | 36.27 | 83.01 | -9.32 | 35.82 | 2.35 | 77.79 | -6.00 | 28.32 | 21.43 | 46.51 | 6.51 | NA | NA | NA | |

| Net Income Loss | -15.99 | -73.80 | 5.61 | 18.27 | -9.26 | 11.50 | 9.73 | 30.15 | 6.22 | 40.99 | 37.60 | 43.43 | 35.29 | -43.83 | 9.74 | 3.92 | 1.19 | 10.26 | 17.43 | -18.44 | 5.82 | 13.08 | 25.05 | 28.70 | 1.55 | -1.50 | 17.07 | -9.71 | 3.03 | 3.59 | 17.85 | |

| Increase Decrease In Accounts Receivable | 10.56 | -2.18 | -0.98 | 0.42 | 15.92 | 0.23 | 2.04 | 6.62 | 1.56 | -0.35 | -5.09 | 2.70 | -8.72 | 30.84 | -16.43 | 0.90 | -4.54 | 1.26 | 9.31 | 13.99 | -4.57 | 5.07 | 0.17 | 12.12 | -1.62 | -1.29 | 7.64 | 9.64 | NA | NA | NA | |

| Increase Decrease In Inventories | 0.15 | 0.60 | -1.60 | 1.31 | 1.28 | -6.67 | 2.68 | 4.57 | -0.03 | 4.70 | 1.78 | 8.43 | -5.54 | -11.32 | 4.51 | 16.95 | 7.26 | -5.55 | -2.77 | 18.12 | 5.54 | 2.03 | 3.05 | 2.58 | 0.81 | 4.46 | 1.73 | 5.82 | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 4.67 | -1.23 | -10.52 | 9.35 | -3.70 | -1.02 | 0.59 | 5.08 | -11.79 | -1.55 | -2.13 | 14.95 | 16.22 | -7.54 | 19.17 | -4.55 | -1.76 | 2.01 | 1.45 | 12.76 | -1.90 | -13.34 | 10.42 | 2.15 | -0.87 | 4.46 | -9.43 | 14.35 | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | -5.58 | -1.63 | 7.60 | -6.38 | 6.37 | 1.14 | -4.90 | 8.41 | -6.88 | 9.00 | 2.90 | 11.69 | 6.95 | -13.40 | -0.28 | -3.03 | -7.59 | 2.33 | 5.91 | -11.28 | -16.44 | 3.09 | 5.28 | -48.66 | 0.16 | 0.65 | 8.12 | -4.72 | NA | NA | NA | |

| Share Based Compensation | 5.13 | 5.25 | 5.47 | 4.32 | 2.97 | 3.17 | 3.64 | 3.73 | 1.02 | 3.67 | 7.21 | 2.99 | 2.89 | 3.35 | 2.09 | 1.83 | 6.12 | 1.74 | 2.98 | 7.19 | 9.50 | 1.52 | 1.60 | 2.01 | 1.15 | 0.89 | 1.10 | 0.98 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -33.24 | -27.79 | -27.17 | -27.61 | -24.83 | -30.37 | -27.62 | -28.08 | -36.45 | -17.66 | -22.42 | -16.37 | -14.98 | -12.68 | -12.85 | -24.72 | -24.12 | -25.98 | -25.81 | -25.54 | -30.11 | -25.89 | -22.68 | -26.08 | -24.61 | -23.43 | -20.70 | -23.16 | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 32.81 | 27.84 | 26.40 | 27.72 | 27.43 | 30.41 | 27.62 | 28.10 | 36.59 | 20.11 | 22.43 | 16.38 | 15.04 | 12.74 | 13.05 | 24.85 | 24.37 | 26.11 | 25.99 | 25.68 | 30.13 | 25.89 | 22.79 | 26.08 | 22.92 | 23.52 | 20.70 | 23.25 | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -102.64 | -2.09 | -3.41 | -28.66 | 0.07 | -1.02 | -73.67 | -9.94 | -122.26 | 4.46 | -115.44 | -1.09 | 3.47 | 20.84 | 150.60 | -24.40 | -16.12 | -0.27 | -1.35 | 2.80 | 8.54 | -0.64 | -0.30 | 8.66 | -1.36 | -3.09 | -0.38 | -2.15 | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.75 | 0.05 | 0.00 | 27.61 | 0.71 | 0.04 | 72.98 | 10.65 | 71.88 | -0.05 | 0.04 | 1.42 | 0.02 | 0.00 | 0.07 | 0.65 | 25.00 | 0.00 | 0.00 | 1.03 | 0.04 | 0.01 | 0.85 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA |

| 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-10-01 | 2022-07-02 | 2022-04-02 | 2022-01-01 | 2021-10-02 | 2021-07-03 | 2021-04-03 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-10-01 | 2016-07-02 | 2016-04-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

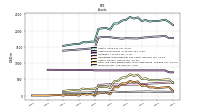

| Revenue From Contract With Customer Excluding Assessed Tax | 506.40 | 532.36 | 525.34 | 562.37 | 468.93 | 499.21 | 509.56 | 527.71 | 477.85 | 518.00 | 549.49 | 534.18 | 485.35 | 260.01 | 469.70 | 401.76 | 431.90 | 429.45 | 461.21 | 355.92 | 387.43 | 385.53 | 407.98 | 321.82 | 346.09 | 337.54 | 369.86 | 277.11 | 301.22 | 291.06 | 326.81 | |

| Material Reconciling Items | -5.78 | -0.25 | 4.81 | -5.68 | -5.70 | 2.42 | 10.68 | -14.06 | 9.89 | 3.00 | 4.21 | -23.07 | -9.19 | -27.58 | 19.45 | 3.17 | -4.07 | 7.42 | -12.46 | -1.87 | -0.56 | 6.05 | -7.01 | -4.23 | 0.04 | 2.11 | -6.91 | -5.90 | -3.15 | NA | NA | |

| Material Reconciling Items, Product Sales | -7.61 | -0.12 | 4.64 | -3.27 | -8.34 | 1.56 | 9.41 | -13.98 | 5.63 | 3.67 | 8.45 | -14.94 | -2.63 | -34.45 | 19.94 | 1.21 | -2.81 | 8.54 | -7.78 | -4.26 | 0.41 | 7.08 | -2.73 | -6.62 | 1.69 | 3.84 | -1.06 | NA | NA | NA | NA | |

| Material Reconciling Items, Services And Plans | 1.83 | -0.13 | 0.16 | -2.41 | 2.64 | 0.86 | 1.26 | -0.09 | 4.26 | -0.67 | -4.24 | -8.13 | -6.56 | 6.87 | -0.49 | 1.96 | -1.26 | -1.11 | -4.69 | 2.39 | -0.96 | -1.03 | -4.28 | 2.40 | -1.65 | -1.73 | -5.85 | NA | NA | NA | NA | |

| Operating, Product Sales, Legacy | 23.55 | 24.20 | 25.68 | 28.35 | 23.50 | 23.73 | 24.30 | 27.63 | 24.04 | 24.93 | 26.86 | 27.42 | 24.90 | 16.25 | 24.42 | 24.27 | 25.25 | 25.79 | 30.14 | 23.89 | 24.74 | 26.16 | 29.11 | 25.06 | 24.50 | 25.34 | 28.98 | NA | NA | NA | NA | |

| Operating, Product Sales, Owned And Host Store Brands | 335.67 | 346.54 | 339.31 | 374.84 | 310.30 | 323.47 | 326.00 | 357.90 | 306.31 | 338.93 | 361.38 | 369.37 | 323.16 | 177.43 | 281.91 | 248.36 | 270.17 | 260.87 | 296.92 | 217.47 | 240.88 | 236.38 | 261.62 | 198.34 | 211.03 | 203.39 | 235.10 | NA | NA | NA | NA | |

| Operating, Product Sales, Corporate And Other | 59.28 | 64.94 | 63.29 | 64.84 | 57.30 | 61.94 | 61.88 | 61.70 | 55.50 | 58.06 | 61.52 | 61.22 | 57.91 | 50.47 | 66.57 | 55.82 | 63.17 | 62.34 | 63.88 | 55.02 | 53.29 | 49.79 | 50.78 | 45.35 | 46.42 | 44.39 | 43.56 | NA | NA | NA | NA | |

| Operating, Services And Plans, Legacy | 10.89 | 12.52 | 12.78 | 12.93 | 11.72 | 12.94 | 13.54 | 14.53 | 13.41 | 15.91 | 16.75 | 16.16 | 15.33 | 9.16 | 12.04 | 12.58 | 14.10 | 13.48 | 14.44 | 11.43 | 12.49 | 12.95 | 13.65 | 12.12 | 12.86 | 12.22 | 12.76 | NA | NA | NA | NA | |

| Operating, Services And Plans, Owned And Host Store Brands | 82.79 | 84.39 | 79.44 | 87.07 | 71.81 | 74.71 | 73.16 | 80.02 | 68.70 | 77.17 | 78.78 | 83.08 | 73.24 | 34.27 | 65.31 | 57.57 | 63.27 | 59.55 | 68.30 | 49.37 | 55.67 | 53.23 | 58.78 | 44.29 | 48.12 | 46.10 | 52.19 | NA | NA | NA | NA | |

| Operating, Services And Plans, Corporate And Other | 0.00 | 0.02 | 0.03 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.61 | 0.91 | 0.97 | 1.05 | 0.90 | 3.11 | 3.99 | 4.17 | NA | NA | NA | NA | |

| Operating, Legacy | 34.43 | 36.72 | 38.47 | 41.28 | 35.22 | 36.66 | 37.84 | 42.16 | 37.45 | 40.84 | 43.60 | 43.58 | 40.23 | 25.41 | 36.46 | 36.85 | 39.35 | 39.26 | 44.58 | 35.32 | 37.23 | 39.11 | 42.76 | 37.17 | 37.37 | 37.56 | 41.74 | 35.36 | 37.35 | NA | NA | |

| Operating, Owned And Host Store Brands | 418.46 | 430.93 | 418.75 | 461.91 | 382.11 | 398.18 | 399.16 | 437.92 | 375.01 | 416.10 | 440.16 | 452.45 | 396.40 | 211.71 | 347.23 | 305.93 | 333.44 | 320.42 | 365.22 | 266.84 | 296.56 | 289.61 | 320.40 | 242.63 | 259.15 | 249.49 | 287.30 | 206.16 | 224.62 | NA | NA | |

| Operating, Corporate And Other | 59.28 | 64.96 | 63.31 | 64.86 | 57.30 | 61.94 | 61.88 | 61.70 | 55.50 | 58.06 | 61.52 | 61.22 | 57.91 | 50.47 | 66.57 | 55.82 | 63.17 | 62.35 | 63.88 | 55.63 | 54.20 | 50.76 | 51.83 | 46.24 | 49.53 | 48.38 | 47.73 | 41.49 | 42.38 | NA | NA | |

| Product Sales | 410.89 | 435.56 | 432.93 | 464.76 | 382.76 | 410.70 | 421.60 | 433.25 | 391.48 | 425.59 | 458.21 | 443.07 | 403.34 | 209.71 | 392.84 | 329.65 | 355.79 | 357.53 | 383.16 | 292.12 | 319.31 | 319.41 | 338.78 | 262.12 | 283.65 | 276.96 | 306.58 | NA | NA | NA | NA | |

| Services And Plans | 95.51 | 96.80 | 92.42 | 97.61 | 86.17 | 88.51 | 87.95 | 94.46 | 86.37 | 92.41 | 91.28 | 91.11 | 82.02 | 50.30 | 76.86 | 72.11 | 76.11 | 71.92 | 78.06 | 63.81 | 68.11 | 66.12 | 69.20 | 59.70 | 62.44 | 60.58 | 63.27 | NA | NA | NA | NA | |

| Transferred At Point In Time | 469.04 | 492.79 | 485.74 | 522.94 | 431.27 | 459.20 | 468.25 | 485.08 | 436.37 | 473.45 | 504.97 | 493.44 | 447.40 | 229.54 | 434.18 | 366.44 | 394.71 | 393.02 | 424.21 | 322.45 | 352.25 | 350.35 | 372.76 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred Over Time | 37.36 | 39.57 | 39.60 | 39.43 | 37.66 | 40.01 | 41.31 | 42.63 | 41.49 | 44.56 | 44.52 | 40.74 | 37.95 | 30.47 | 35.52 | 35.33 | 37.19 | 36.43 | 37.00 | 33.48 | 35.18 | 35.19 | 35.21 | NA | NA | NA | NA | NA | NA | NA | NA |