| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | NA | NA | NA | NA | 15.77 | 15.67 | 15.60 | NA | 15.43 | 13.66 | 13.65 | NA | 13.65 | 13.65 | 13.65 | NA | 13.19 | 12.81 | 12.60 | NA | 11.94 | 11.93 | 11.92 | NA | 11.90 | 11.90 | 11.89 | NA | 15.33 | 15.38 | 11.94 | NA | 59.62 | 49.32 | 9.32 | NA | 31.64 | 31.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | NA | NA | NA | NA | 15.77 | 15.67 | 15.60 | NA | 15.43 | 13.66 | 13.65 | NA | 13.65 | 13.65 | 13.65 | NA | 13.19 | 12.81 | 12.60 | NA | 11.94 | 11.93 | 11.92 | NA | 11.90 | 11.90 | 11.89 | NA | 11.87 | 11.91 | 11.94 | NA | 59.62 | 47.62 | 9.32 | NA | 31.64 | 31.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

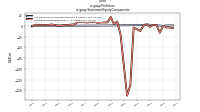

| Earnings Per Share Basic | NA | NA | NA | NA | -1.17 | -0.08 | -0.01 | -0.31 | 0.02 | -0.14 | -1.07 | -0.36 | -0.46 | -10.24 | -12.04 | 0.55 | -1.65 | 0.59 | 0.12 | 1.52 | 0.44 | 0.45 | 0.45 | 0.37 | 0.57 | 0.58 | 0.56 | 0.59 | 0.69 | 0.66 | 0.20 | 0.22 | -0.01 | 0.07 | 0.36 | 0.00 | 0.06 | 0.10 | 0.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | NA | NA | NA | NA | -1.17 | -0.08 | -0.01 | -0.31 | 0.02 | -0.14 | -1.07 | -0.36 | -0.46 | -10.24 | -12.04 | 0.55 | -1.65 | 0.59 | 0.12 | 1.32 | 0.44 | 0.45 | 0.45 | 0.37 | 0.57 | 0.58 | 0.56 | 0.59 | 0.68 | 0.66 | 0.20 | 0.22 | -0.01 | 0.06 | 0.36 | 0.00 | 0.06 | 0.10 | 0.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

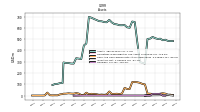

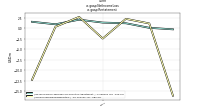

| Revenue From Contract With Customer Including Assessed Tax | 33.04 | 35.65 | 29.34 | 36.29 | 32.96 | 31.52 | 32.87 | 35.77 | 37.03 | 32.30 | 23.04 | 5.88 | 4.63 | 9.97 | -9.13 | 21.71 | 21.08 | 21.53 | 21.62 | 22.90 | 4.24 | 3.87 | 21.54 | 22.40 | 5.27 | 4.78 | 22.08 | 22.82 | 22.12 | 22.06 | 22.26 | 22.48 | 22.14 | 12.68 | 13.99 | 11.90 | 9.35 | 9.02 | 10.05 | 7.99 | 7.57 | 7.57 | 8.15 | 1.73 | 2.85 | 2.57 | 2.08 | 3.08 | 3.08 | 1.08 | 2.80 | 0.43 | |

| Revenues | 33.04 | 35.65 | 29.34 | 36.29 | 32.96 | 31.52 | 32.87 | 35.77 | 37.03 | 32.30 | 23.04 | 5.88 | 4.63 | 9.97 | -9.13 | 21.71 | 21.08 | 21.53 | 21.62 | 22.90 | 22.64 | 22.15 | 21.54 | 22.40 | 22.44 | 21.83 | 22.08 | 22.82 | 22.12 | 22.06 | 22.26 | 22.48 | 22.14 | 12.68 | 13.99 | 11.90 | 9.35 | 9.02 | 10.05 | 7.99 | 7.57 | 7.57 | 8.15 | 1.73 | 2.85 | 2.57 | 2.08 | 3.08 | 3.08 | 1.08 | 2.80 | 0.43 | |

| Costs And Expenses | 32.68 | 35.52 | 28.28 | 31.61 | 45.01 | 25.97 | 25.26 | 29.38 | 27.65 | 26.72 | 30.00 | 6.23 | 6.40 | 156.21 | 150.37 | 9.51 | 9.26 | 9.63 | 10.02 | 11.56 | 11.58 | 10.93 | 11.09 | 10.20 | 11.03 | 9.93 | 10.40 | 11.17 | 10.25 | 10.26 | 14.59 | 15.29 | 18.13 | 7.24 | 9.06 | 9.41 | 6.59 | 6.15 | 7.51 | 6.42 | 6.29 | 5.97 | 6.35 | 1.83 | 3.02 | 2.78 | 2.20 | 2.88 | 2.85 | 0.99 | 2.68 | 1.21 | |

| General And Administrative Expense | 6.60 | 7.45 | 6.77 | 6.21 | 5.74 | 5.28 | 5.14 | 6.27 | 5.16 | 5.38 | 9.84 | 2.04 | 2.79 | 4.33 | 3.08 | 2.49 | 2.49 | 2.74 | 2.87 | 4.16 | 3.05 | 3.11 | 2.73 | 2.53 | 2.63 | 2.56 | 3.06 | 3.19 | 3.02 | 2.77 | 3.29 | 2.43 | 2.84 | 1.91 | 2.57 | 3.26 | 1.84 | 1.33 | 1.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Income Loss | 0.36 | 0.13 | 1.06 | 4.69 | -12.05 | 5.55 | 7.61 | 6.38 | 9.37 | 5.58 | -6.96 | -0.36 | -1.78 | -146.24 | -159.50 | 12.19 | 11.83 | 11.90 | 11.60 | 11.34 | 11.06 | 11.22 | 10.46 | 12.20 | 11.41 | 11.90 | 11.67 | 11.65 | 11.87 | 11.80 | 7.66 | 7.19 | 4.01 | 5.44 | 4.92 | 2.49 | 2.76 | 2.87 | 2.54 | 1.57 | 1.29 | 1.60 | 1.80 | -0.10 | -0.17 | -0.21 | -0.13 | 0.20 | 0.22 | 0.09 | 0.12 | -0.78 | |

| Interest Expense | 4.50 | 4.43 | 4.40 | 3.96 | 3.48 | 3.34 | 3.15 | 3.16 | 3.35 | 3.30 | 2.93 | 2.25 | 2.25 | 2.92 | 2.89 | 3.00 | 2.78 | 2.30 | 2.51 | 3.17 | 3.18 | 3.20 | 3.21 | 2.79 | 2.93 | 3.20 | 3.45 | 3.43 | 3.52 | 3.54 | 3.93 | 3.65 | 3.85 | 1.13 | 1.15 | 1.05 | 0.98 | 0.82 | 0.82 | 0.83 | 0.82 | 0.91 | 0.74 | 0.42 | 0.01 | 0.02 | 0.03 | 0.03 | 0.03 | NA | 0.02 | 0.01 | |

| Interest Paid Net | 4.27 | 3.54 | 5.47 | 2.54 | 3.80 | 0.50 | 4.50 | 1.02 | 4.46 | 1.50 | 4.25 | 0.21 | 3.67 | 1.06 | 4.33 | 0.94 | 1.53 | 3.25 | 1.12 | 4.80 | 0.86 | 4.84 | 0.71 | 4.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.16 | -0.93 | -0.00 | 1.23 | 0.04 | 0.17 | 0.22 | 3.81 | 0.11 | 0.16 | 0.00 | 0.09 | -0.08 | -0.07 | -0.02 | -0.18 | -0.09 | 0.06 | 0.45 | -0.61 | -0.75 | -0.61 | -0.44 | 2.39 | 0.19 | 0.10 | -0.33 | -0.10 | 0.48 | 0.41 | -1.26 | -0.37 | -1.85 | -0.05 | 0.32 | -1.81 | 0.32 | 0.74 | 0.51 | 0.58 | 1.11 | 0.24 | 1.02 | -0.92 | 0.22 | 2.79 | 1.19 | 3.47 | -3.47 | -0.63 | 0.89 | 0.48 | |

| Income Taxes Paid Net | 0.00 | NA | NA | 0.02 | 0.00 | -0.01 | -0.00 | 0.00 | -0.63 | -0.01 | 0.01 | 0.00 | 0.00 | 0.00 | -0.47 | -0.19 | 0.00 | 0.50 | -0.22 | 0.02 | -0.00 | 2.12 | 0.00 | 0.00 | 0.07 | 0.13 | 0.00 | -0.00 | 0.04 | -0.01 | 0.01 | 0.14 | 0.61 | -0.30 | 0.30 | 2.83 | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | -4.31 | -3.17 | -3.20 | -0.55 | -15.50 | 2.17 | 4.36 | -0.19 | 5.92 | 2.43 | -10.69 | -2.67 | -3.92 | -137.43 | -162.04 | 9.81 | -19.42 | 9.82 | 3.87 | 20.50 | 7.70 | 7.81 | 7.71 | 7.24 | 9.61 | 9.44 | 8.05 | 8.41 | 9.57 | 9.27 | 3.74 | 4.01 | 0.84 | 4.60 | 4.50 | 0.40 | 2.28 | 3.39 | 2.50 | 1.94 | 0.81 | 0.42 | 2.80 | -1.52 | -0.36 | 4.99 | 1.98 | 5.75 | NA | 1.06 | NA | NA | |

| Net Income Loss | -5.12 | -3.98 | -4.01 | -1.36 | -16.10 | 1.20 | 2.30 | -2.41 | 2.76 | 0.41 | -12.30 | -2.67 | -3.92 | -137.43 | -162.04 | 9.81 | -19.42 | 9.82 | 3.87 | 20.50 | 7.70 | 7.81 | 7.71 | 6.76 | 9.18 | 9.00 | 7.67 | 8.09 | 9.23 | 8.95 | 3.39 | 3.62 | 0.43 | 4.19 | 4.09 | 0.01 | 1.89 | 3.01 | 2.11 | 1.58 | 0.44 | 0.07 | 2.41 | -1.50 | -0.36 | 4.99 | 1.98 | 5.75 | 5.75 | 1.06 | -1.56 | 0.59 | |

| Net Income Loss Available To Common Stockholders Basic | -7.51 | -6.36 | -6.40 | -3.75 | -18.49 | -1.18 | -0.08 | -4.80 | 0.38 | -1.90 | -14.61 | -4.98 | -6.23 | -139.74 | -164.30 | 7.49 | -21.73 | 7.51 | 1.55 | 18.14 | 5.30 | 5.41 | 5.31 | 4.36 | 6.78 | 6.88 | 6.63 | 7.05 | 8.19 | 7.92 | 2.35 | 2.58 | -0.61 | 3.15 | 3.35 | 0.01 | 1.89 | 3.01 | 2.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | NA | NA | NA | NA | -18.49 | NA | -0.08 | NA | 0.38 | -1.90 | -14.61 | -4.98 | -6.23 | -139.74 | -164.30 | 7.49 | -21.73 | 7.51 | 1.55 | 26.90 | 5.30 | 5.41 | 5.31 | 4.36 | 6.78 | 6.88 | 6.63 | 7.05 | 10.41 | 10.10 | 2.35 | 2.58 | -0.61 | 3.19 | 3.35 | 0.01 | 1.89 | 3.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill Impairment Loss | NA | NA | NA | 0.00 | 16.21 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 146.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

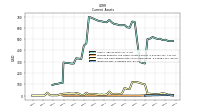

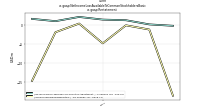

| Assets | 482.92 | 482.83 | 484.65 | 494.96 | 490.28 | 504.16 | 501.79 | 508.59 | 519.71 | 504.50 | 502.14 | 284.95 | 289.34 | 298.62 | 473.20 | 651.46 | 655.81 | 600.74 | 604.83 | 624.88 | 622.93 | 623.36 | 630.42 | 633.42 | 647.94 | 670.73 | 649.35 | 650.73 | 657.94 | 659.11 | 669.37 | 678.49 | 689.58 | 696.48 | 461.88 | 443.82 | 324.33 | 327.83 | 331.60 | 283.88 | 284.39 | 288.66 | 289.64 | 293.66 | 111.43 | 111.55 | 104.73 | 104.22 | NA | 95.93 | 94.29 | NA | |

| Liabilities | 253.82 | 249.53 | 248.31 | 255.30 | 246.50 | 241.33 | 237.53 | 244.96 | 252.06 | 253.62 | 251.11 | 135.55 | 134.27 | 136.65 | 170.80 | 174.72 | 179.84 | 126.07 | 128.65 | 169.87 | 173.18 | 170.54 | 174.40 | 171.63 | 148.68 | 169.36 | 217.09 | 216.82 | 222.83 | 223.82 | 231.53 | 234.30 | 239.57 | 237.15 | 72.61 | 106.27 | 78.34 | 79.65 | 81.01 | 78.33 | 80.17 | 81.14 | 78.97 | 82.82 | 12.58 | 11.37 | 8.57 | 9.05 | NA | 4.45 | 3.86 | NA | |

| Liabilities And Stockholders Equity | 482.92 | 482.83 | 484.65 | 494.96 | 490.28 | 504.16 | 501.79 | 508.59 | 519.71 | 504.50 | 502.14 | 284.95 | 289.34 | 298.62 | 473.20 | 651.46 | 655.81 | 600.74 | 604.83 | 624.88 | 622.93 | 623.36 | 630.42 | 633.42 | 647.94 | 670.73 | 649.35 | 650.73 | 657.94 | 659.11 | 669.37 | 678.49 | 689.58 | 696.48 | 461.88 | 443.82 | 324.33 | 327.83 | 331.60 | 283.88 | 284.39 | 288.66 | 289.64 | 293.66 | 111.43 | 111.55 | 104.73 | 104.22 | NA | 95.93 | 94.29 | NA | |

| Stockholders Equity | 109.78 | 114.80 | 118.65 | 122.77 | 119.59 | 138.48 | 140.07 | 140.69 | 146.12 | 131.66 | 134.11 | 149.40 | 155.06 | 161.98 | 302.40 | 476.74 | 475.97 | 474.67 | 476.18 | 455.01 | 449.75 | 452.83 | 456.02 | 461.79 | 471.69 | 473.59 | 404.44 | 406.47 | 408.00 | 408.52 | 411.38 | 418.03 | 423.83 | 432.61 | 362.51 | 310.45 | 218.58 | 220.55 | 221.86 | 177.19 | 175.46 | 178.28 | 180.30 | 180.86 | 98.86 | 100.18 | 96.17 | 95.16 | NA | NA | 90.43 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 3.05 | 9.24 | 8.50 | 17.83 | 21.78 | 17.75 | 13.29 | 12.50 | 15.09 | 17.70 | 18.84 | 99.60 | 104.22 | 113.71 | 119.05 | 120.86 | 120.43 | 58.81 | 59.36 | 69.29 | 19.61 | 14.18 | 17.33 | 15.79 | 15.53 | 37.28 | 11.38 | 7.90 | 10.11 | 8.12 | 12.85 | 14.62 | 16.86 | 12.44 | 26.63 | 7.58 | 5.48 | 18.99 | 23.10 | 17.96 | 18.92 | 21.11 | 18.20 | 17.68 | 14.33 | 11.78 | 3.08 | 3.47 | NA | NA | 2.79 | 3.86 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 9.24 | 12.34 | 11.34 | 17.83 | 21.78 | 17.75 | 13.29 | 12.50 | 15.09 | 17.70 | 18.84 | 99.60 | 104.22 | 113.71 | 119.05 | 120.86 | 120.43 | 58.81 | 59.36 | 69.29 | 19.61 | 14.18 | 17.33 | 15.79 | NA | NA | NA | 7.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Inventory Net | 1.94 | 3.58 | 8.73 | 5.95 | 6.00 | 4.54 | 3.97 | 3.95 | 3.34 | 1.63 | 1.80 | 0.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 6.37 | 5.18 | 6.30 | 9.48 | 5.70 | 7.24 | 7.80 | 9.08 | 10.55 | 10.94 | 8.42 | 2.23 | 1.86 | 0.72 | 0.91 | 0.80 | 0.69 | 0.86 | 0.96 | 0.67 | 0.76 | 1.07 | 0.79 | 0.74 | 0.82 | 0.60 | 0.84 | 0.35 | 0.61 | 0.81 | 0.83 | 0.49 | 0.46 | 0.66 | 0.72 | 0.38 | 0.50 | 0.48 | 0.43 | 0.33 | 0.27 | 0.57 | 0.46 | 0.60 | 2.48 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | NA | NA | NA | 0.00 | 0.00 | 16.21 | 16.21 | 16.21 | 16.21 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | 1.72 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt Current | 104.00 | 103.00 | 11.00 | 10.00 | 8.00 | 8.00 | 8.00 | 8.00 | 8.00 | 8.00 | 8.00 | NA | NA | 0.00 | 5.20 | 5.61 | 9.03 | 72.64 | 3.53 | 3.53 | 3.53 | 3.53 | 3.53 | 3.53 | 0.67 | 7.13 | 7.13 | 7.13 | 7.13 | 7.89 | 3.60 | 66.13 | 7.13 | 3.53 | 3.53 | 3.53 | 3.53 | 3.53 | 3.53 | 2.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 220.53 | 219.25 | 217.97 | 216.66 | 215.34 | 212.02 | 212.71 | 215.39 | 218.07 | 219.76 | 218.44 | 115.01 | 114.84 | 114.68 | 151.00 | 152.11 | 156.24 | 104.64 | 105.97 | 150.04 | 150.71 | 151.42 | 152.10 | 152.78 | 129.37 | 152.67 | 198.43 | 200.63 | 202.75 | 206.33 | NA | 216.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 70.00 | 70.00 | 0.00 | 0.91 | 0.93 | 2.24 | NA | NA | 2.28 | NA | |

| Deferred Income Tax Liabilities Net | NA | NA | NA | 1.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 119.32 | 118.51 | 117.70 | 116.89 | 124.19 | 124.35 | 124.20 | 122.95 | 121.53 | 119.22 | 116.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 27.57 | 27.78 | 27.82 | 27.44 | 27.11 | 26.77 | 26.46 | 26.16 | 26.18 | 26.72 | 26.76 | 27.09 | 27.41 | 27.62 | 28.72 | 28.35 | 28.76 | 29.24 | 30.37 | 29.98 | 0.00 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 109.78 | 114.80 | 118.65 | 122.77 | 119.59 | 138.48 | 140.07 | 140.69 | 146.12 | 131.66 | 134.11 | 149.40 | 155.06 | 161.98 | 302.40 | 476.74 | 475.97 | 474.67 | 476.18 | 455.01 | 449.75 | 452.83 | 456.02 | 461.79 | 471.69 | 473.59 | 404.44 | 406.47 | 408.00 | 408.52 | 411.38 | 418.03 | 423.83 | 432.61 | 362.51 | 310.45 | 218.58 | 220.55 | 221.86 | 177.19 | 175.46 | 178.28 | 180.30 | 180.86 | 98.86 | 100.18 | 96.17 | 95.16 | NA | NA | 90.43 | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 229.11 | 233.31 | 236.35 | 239.67 | 243.78 | 262.83 | 264.26 | 263.63 | 267.66 | 250.88 | 251.04 | 149.40 | NA | 161.98 | 302.40 | 476.74 | NA | NA | NA | 455.01 | NA | NA | NA | 461.79 | 499.25 | 501.37 | 432.26 | 433.91 | 435.11 | 435.29 | 437.84 | 444.19 | 450.01 | 459.33 | 389.27 | 337.54 | 245.98 | 248.17 | 250.58 | 205.54 | 204.22 | 207.52 | 210.67 | 210.84 | 98.86 | NA | NA | NA | NA | 91.48 | 90.43 | NA | |

| Additional Paid In Capital | 327.18 | 327.07 | 326.95 | 327.02 | 329.80 | 332.59 | 335.38 | 338.30 | 341.33 | 333.89 | 336.75 | 339.74 | 342.73 | 345.73 | 348.72 | 360.84 | 369.88 | 349.17 | 349.57 | 320.30 | 319.74 | 322.82 | 326.01 | 331.77 | 341.68 | 343.59 | 348.18 | 350.22 | 351.75 | 352.27 | 355.14 | 361.58 | 367.55 | 376.10 | 306.04 | 309.95 | 217.89 | 220.08 | 220.46 | 173.44 | 173.41 | 169.27 | 172.29 | 175.26 | 91.76 | 92.72 | 93.70 | 94.67 | NA | NA | 95.68 | NA | |

| Retained Earnings Accumulated Deficit | -346.94 | -341.82 | -337.84 | -333.79 | -339.75 | -323.65 | -324.85 | -327.16 | -324.75 | -327.51 | -327.93 | -315.63 | -312.95 | -309.04 | -171.60 | -9.61 | -19.42 | 0.00 | 1.10 | 9.15 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.67 | 1.58 | 0.00 | 6.69 | 6.62 | 4.21 | 5.71 | 6.08 | 1.09 | -0.89 | NA | NA | -6.64 | NA | |

| Minority Interest | 119.32 | 118.51 | 117.70 | 116.89 | 124.19 | 124.35 | 124.20 | 122.95 | 121.53 | 119.22 | 116.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 27.57 | 27.78 | 27.82 | 27.44 | 27.11 | 26.77 | 26.46 | 26.16 | 26.18 | 26.72 | 26.76 | 27.09 | 27.41 | 27.62 | 28.72 | 28.35 | 28.76 | 29.24 | 30.37 | 29.98 | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.11 | 0.10 | -0.01 | 0.23 | 0.23 | 0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.84 | 0.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.71 | 0.65 | NA | NA | NA | NA | NA | NA | 0.46 | 0.90 | 0.45 | 0.68 | 0.66 | 0.66 | NA | NA | 5.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

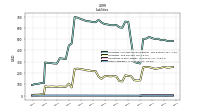

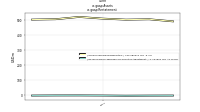

| Net Cash Provided By Used In Operating Activities | 3.20 | 5.74 | -3.11 | 3.18 | 8.05 | 10.07 | 8.58 | 5.06 | 7.88 | 6.84 | -2.48 | -0.34 | -5.70 | 4.65 | 11.77 | 14.01 | 18.45 | 12.26 | 17.06 | 8.90 | 17.20 | 8.77 | 13.75 | 13.95 | 15.05 | 12.22 | 15.57 | 9.45 | 15.64 | 9.30 | 16.71 | 11.69 | 16.30 | 8.45 | 6.16 | -0.84 | 5.44 | 4.22 | 8.12 | 4.59 | -1.89 | 6.46 | -1.45 | 3.85 | 6.82 | 1.06 | 2.09 | -0.32 | NA | NA | 2.29 | -0.11 | |

| Net Cash Provided By Used In Investing Activities | -5.47 | -4.41 | -3.49 | -5.95 | -3.27 | -0.86 | -1.06 | -0.82 | -4.71 | -5.52 | -72.55 | -1.29 | -0.80 | -0.05 | 0.02 | -0.02 | -0.25 | -0.01 | 4.98 | 56.89 | -0.04 | 0.00 | -0.04 | 7.56 | -0.01 | 0.02 | 0.03 | 0.28 | -0.10 | 0.38 | -0.08 | -0.78 | -1.58 | -240.19 | -2.06 | -116.90 | -13.17 | -1.50 | -45.50 | -1.21 | 0.47 | 1.32 | 4.82 | -182.34 | -0.31 | 9.35 | -0.00 | -0.03 | NA | NA | 0.04 | -22.66 | |

| Net Cash Provided By Used In Financing Activities | -0.83 | -0.33 | 0.11 | -0.22 | -0.75 | -4.75 | -6.73 | -6.84 | -5.77 | -2.46 | -5.73 | -2.99 | -2.99 | -9.94 | -13.60 | -13.56 | 43.43 | -12.80 | -31.97 | -16.12 | -11.73 | -11.93 | -12.17 | -21.26 | -36.79 | 13.66 | -12.12 | -11.95 | -13.55 | -14.41 | -18.40 | -13.15 | -10.30 | 217.55 | 14.95 | 119.85 | -5.78 | -6.84 | 42.52 | -4.33 | -0.78 | -4.87 | -2.86 | 181.84 | -3.95 | -1.71 | -2.48 | 1.03 | NA | NA | -3.49 | -0.85 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 3.20 | 5.74 | -3.11 | 3.18 | 8.05 | 10.07 | 8.58 | 5.06 | 7.88 | 6.84 | -2.48 | -0.34 | -5.70 | 4.65 | 11.77 | 14.01 | 18.45 | 12.26 | 17.06 | 8.90 | 17.20 | 8.77 | 13.75 | 13.95 | 15.05 | 12.22 | 15.57 | 9.45 | 15.64 | 9.30 | 16.71 | 11.69 | 16.30 | 8.45 | 6.16 | -0.84 | 5.44 | 4.22 | 8.12 | 4.59 | -1.89 | 6.46 | -1.45 | 3.85 | 6.82 | 1.06 | 2.09 | -0.32 | NA | NA | 2.29 | -0.11 | |

| Net Income Loss | -5.12 | -3.98 | -4.01 | -1.36 | -16.10 | 1.20 | 2.30 | -2.41 | 2.76 | 0.41 | -12.30 | -2.67 | -3.92 | -137.43 | -162.04 | 9.81 | -19.42 | 9.82 | 3.87 | 20.50 | 7.70 | 7.81 | 7.71 | 6.76 | 9.18 | 9.00 | 7.67 | 8.09 | 9.23 | 8.95 | 3.39 | 3.62 | 0.43 | 4.19 | 4.09 | 0.01 | 1.89 | 3.01 | 2.11 | 1.58 | 0.44 | 0.07 | 2.41 | -1.50 | -0.36 | 4.99 | 1.98 | 5.75 | 5.75 | 1.06 | -1.56 | 0.59 | |

| Profit Loss | -4.31 | -3.17 | -3.20 | -0.55 | -15.50 | 2.17 | 4.36 | -0.19 | 5.92 | 2.43 | -10.69 | -2.67 | -3.92 | -137.43 | -162.04 | 9.81 | -19.42 | 9.82 | 3.87 | 20.50 | 7.70 | 7.81 | 7.71 | 7.24 | 9.61 | 9.44 | 8.05 | 8.41 | 9.57 | 9.27 | 3.74 | 4.01 | 0.84 | 4.60 | 4.50 | 0.40 | 2.28 | 3.39 | 2.50 | 1.94 | 0.81 | 0.42 | 2.80 | -1.52 | -0.36 | 4.99 | 1.98 | 5.75 | NA | 1.06 | NA | NA | |

| Depreciation Depletion And Amortization | 3.35 | 3.24 | 4.03 | 4.08 | 3.20 | 4.40 | 4.39 | 4.88 | 4.10 | 4.16 | 3.27 | 2.48 | 2.48 | 3.99 | 5.98 | 5.98 | 5.96 | 5.93 | 5.94 | 6.43 | 6.64 | 6.64 | 6.64 | 6.36 | 6.40 | 6.47 | 6.47 | 6.21 | 6.18 | 6.20 | 5.95 | 5.90 | 6.54 | 3.79 | 4.43 | 3.85 | 3.63 | 3.44 | 3.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Inventories | -1.64 | -5.15 | 2.93 | -0.05 | 1.46 | 0.57 | 0.01 | 0.61 | 1.72 | -0.17 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | 0.16 | -0.93 | -0.01 | 1.40 | 0.01 | 0.02 | 0.07 | 3.85 | 0.11 | 0.14 | -0.03 | 0.09 | -0.07 | -0.07 | 0.37 | 0.29 | -0.09 | 0.06 | 0.09 | -0.08 | -0.74 | -0.60 | -0.41 | -0.35 | 0.13 | 0.04 | -0.30 | -0.17 | 0.39 | 0.21 | -0.58 | -0.65 | -1.95 | -0.15 | -0.12 | -4.31 | -0.16 | 0.74 | -0.34 | 0.76 | 1.79 | -0.34 | 0.74 | -4.78 | -0.22 | 2.77 | 1.19 | 3.46 | NA | NA | -1.29 | 0.48 | |

| Share Based Compensation | 0.11 | 0.10 | -0.01 | 0.23 | 0.23 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | 0.00 | 0.03 | NA | NA | 0.00 | 0.04 | NA | NA | 0.00 | 0.03 | 0.03 | 0.00 | 0.00 | 0.03 | 0.03 | 0.03 | 0.03 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Amortization Of Financing Costs | 0.34 | 0.36 | 0.42 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -5.47 | -4.41 | -3.49 | -5.95 | -3.27 | -0.86 | -1.06 | -0.82 | -4.71 | -5.52 | -72.55 | -1.29 | -0.80 | -0.05 | 0.02 | -0.02 | -0.25 | -0.01 | 4.98 | 56.89 | -0.04 | 0.00 | -0.04 | 7.56 | -0.01 | 0.02 | 0.03 | 0.28 | -0.10 | 0.38 | -0.08 | -0.78 | -1.58 | -240.19 | -2.06 | -116.90 | -13.17 | -1.50 | -45.50 | -1.21 | 0.47 | 1.32 | 4.82 | -182.34 | -0.31 | 9.35 | -0.00 | -0.03 | NA | NA | 0.04 | -22.66 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -0.83 | -0.33 | 0.11 | -0.22 | -0.75 | -4.75 | -6.73 | -6.84 | -5.77 | -2.46 | -5.73 | -2.99 | -2.99 | -9.94 | -13.60 | -13.56 | 43.43 | -12.80 | -31.97 | -16.12 | -11.73 | -11.93 | -12.17 | -21.26 | -36.79 | 13.66 | -12.12 | -11.95 | -13.55 | -14.41 | -18.40 | -13.15 | -10.30 | 217.55 | 14.95 | 119.85 | -5.78 | -6.84 | 42.52 | -4.33 | -0.78 | -4.87 | -2.86 | 181.84 | -3.95 | -1.71 | -2.48 | 1.03 | NA | NA | -3.49 | -0.85 | |

| Payments Of Dividends Common Stock | NA | NA | NA | 0.56 | 0.15 | 0.75 | 0.74 | 0.64 | 0.57 | 0.55 | 0.68 | 0.68 | 0.68 | 0.68 | 10.24 | 10.15 | 10.15 | 9.61 | 9.19 | 8.57 | 8.45 | 8.64 | 8.63 | 8.70 | 8.72 | 8.65 | 8.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.97 | 0.98 | NA | NA | NA | NA | 1.83 | 0.85 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-11-30 | 2012-08-31 | 2012-05-31 | 2012-02-29 | 2012-02-28 | 2011-12-31 | 2011-11-30 | 2011-08-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

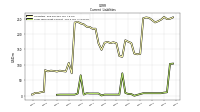

| Revenues | 33.04 | 35.65 | 29.34 | 36.29 | 32.96 | 31.52 | 32.87 | 35.77 | 37.03 | 32.30 | 23.04 | 5.88 | 4.63 | 9.97 | -9.13 | 21.71 | 21.08 | 21.53 | 21.62 | 22.90 | 22.64 | 22.15 | 21.54 | 22.40 | 22.44 | 21.83 | 22.08 | 22.82 | 22.12 | 22.06 | 22.26 | 22.48 | 22.14 | 12.68 | 13.99 | 11.90 | 9.35 | 9.02 | 10.05 | 7.99 | 7.57 | 7.57 | 8.15 | 1.73 | 2.85 | 2.57 | 2.08 | 3.08 | 3.08 | 1.08 | 2.80 | 0.43 | |

| Crude Oil Transportation Contract | NA | NA | NA | NA | NA | NA | 24.13 | NA | NA | NA | 15.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Distribution Contract | NA | NA | NA | NA | NA | NA | 1.20 | NA | NA | NA | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Transportation Contract | NA | NA | NA | NA | NA | NA | 4.06 | NA | NA | NA | 3.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other | NA | NA | NA | NA | NA | NA | 0.37 | NA | NA | NA | 0.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| NA | NA | NA | NA | 32.96 | 31.52 | 32.87 | 35.77 | 37.03 | 32.30 | 23.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| Revenue From Contract With Customer Including Assessed Tax | 33.04 | 35.65 | 29.34 | 36.29 | 32.96 | 31.52 | 32.87 | 35.77 | 37.03 | 32.30 | 23.04 | 5.88 | 4.63 | 9.97 | -9.13 | 21.71 | 21.08 | 21.53 | 21.62 | 22.90 | 4.24 | 3.87 | 21.54 | 22.40 | 5.27 | 4.78 | 22.08 | 22.82 | 22.12 | 22.06 | 22.26 | 22.48 | 22.14 | 12.68 | 13.99 | 11.90 | 9.35 | 9.02 | 10.05 | 7.99 | 7.57 | 7.57 | 8.15 | 1.73 | 2.85 | 2.57 | 2.08 | 3.08 | 3.08 | 1.08 | 2.80 | 0.43 | |

| Crude Oil Transportation Contract | 23.26 | 23.21 | 23.97 | 27.51 | 26.13 | 22.58 | 24.13 | 27.37 | 29.00 | 22.96 | 15.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Lease And Other Income | 0.11 | 0.10 | -0.00 | NA | 0.21 | 0.16 | 0.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Distribution Contract | 1.27 | 1.27 | 1.24 | 1.24 | 1.23 | 1.24 | 1.20 | 1.20 | 1.20 | 1.19 | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Transportation Contract | 3.59 | 3.60 | 3.75 | 3.70 | 3.57 | 4.08 | 4.06 | 3.89 | 3.90 | 3.62 | 3.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other | 0.74 | 0.47 | 0.38 | 0.38 | 0.37 | 0.22 | 0.37 | 0.39 | 0.18 | 0.34 | 0.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Pipeline Loss Allowance Subsequent Sales | 4.08 | 7.01 | NA | 3.47 | 1.48 | 3.07 | 2.73 | 2.49 | 2.12 | 2.92 | 1.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transportation And Distribution | 28.86 | 28.54 | 29.34 | 32.83 | 31.31 | 28.11 | 29.76 | 32.85 | 34.29 | 28.10 | 21.30 | 5.82 | 4.57 | 4.38 | 5.20 | 4.97 | 4.07 | 4.87 | 4.87 | 4.41 | 4.24 | 3.87 | 3.95 | 4.89 | 5.27 | 4.78 | 5.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product And Service Other | NA | NA | NA | -0.04 | 0.07 | 0.30 | 0.35 | 0.38 | 0.58 | 0.58 | 0.20 | 0.03 | 0.03 | 0.03 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Pipeline Loss Allowance Subsequent Sales, | NA | NA | NA | NA | 1.48 | 3.07 | 2.73 | 2.49 | 2.12 | 2.92 | 1.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transportation And Distribution, | NA | NA | NA | NA | 31.31 | 28.11 | 29.76 | 32.85 | 34.29 | 28.10 | 21.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product And Service Other, | NA | NA | NA | NA | 0.07 | 0.30 | 0.35 | 0.38 | 0.58 | 0.58 | 0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |