| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | |

| Earnings Per Share Basic | 0.20 | 1.85 | 2.02 | 2.41 | 2.60 | 2.63 | 1.94 | 1.39 | 1.69 | 1.92 | 2.35 | 2.46 | 1.50 | 1.45 | 0.81 | -0.46 | 1.87 | 1.98 | 1.95 | 2.14 | 1.91 | 1.89 | 1.90 | 1.62 | 1.15 | 1.15 | |

| Earnings Per Share Diluted | 0.20 | 1.84 | 2.01 | 2.39 | 2.59 | 2.60 | 1.92 | 1.37 | 1.66 | 1.90 | 2.32 | 2.43 | 1.49 | 1.44 | 0.80 | -0.46 | 1.85 | 1.96 | 1.94 | 2.11 | 1.88 | 1.86 | 1.87 | 1.59 | 1.13 | 1.11 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

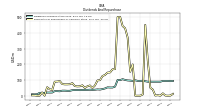

| Revenue From Contract With Customer Excluding Assessed Tax | 192.00 | 201.00 | 211.00 | 194.00 | 192.00 | 198.00 | 204.00 | 194.00 | 196.00 | 194.00 | 212.00 | 194.00 | 192.00 | 193.00 | 188.00 | 185.00 | 186.00 | 190.00 | 189.00 | 184.00 | 192.00 | 190.00 | 187.00 | 188.00 | 212.00 | 209.00 | |

| Interest Expense | 465.00 | 502.00 | 453.00 | 241.00 | 134.00 | 43.00 | 16.00 | 13.00 | 13.00 | 14.00 | 14.00 | 16.00 | 20.00 | 26.00 | 40.00 | 96.00 | 115.00 | 125.00 | 124.00 | 104.00 | 90.00 | 76.00 | 60.00 | 41.00 | 29.00 | 26.00 | |

| Interest Expense Long Term Debt | 105.00 | 106.00 | 110.00 | 57.00 | 40.00 | 26.00 | 12.00 | 9.00 | 8.00 | 9.00 | 9.00 | 9.00 | 10.00 | 11.00 | 19.00 | 40.00 | 45.00 | 50.00 | 51.00 | 51.00 | 47.00 | 40.00 | 32.00 | 25.00 | 20.00 | 17.00 | |

| Interest Income Expense Net | 584.00 | 601.00 | 621.00 | 708.00 | 742.00 | 707.00 | 561.00 | 456.00 | 461.00 | 475.00 | 465.00 | 443.00 | 469.00 | 458.00 | 471.00 | 513.00 | 544.00 | 586.00 | 603.00 | 606.00 | 614.00 | 599.00 | 590.00 | 549.00 | 500.00 | 470.00 | |

| Income Tax Expense Benefit | 19.00 | 76.00 | 83.00 | 85.00 | 96.00 | 104.00 | 76.00 | 49.00 | 61.00 | 70.00 | 93.00 | 98.00 | 63.00 | 48.00 | 27.00 | -21.00 | 82.00 | 80.00 | 87.00 | 85.00 | 90.00 | 63.00 | 93.00 | 54.00 | 99.00 | 66.00 | |

| Income Taxes Paid Net | 62.00 | 83.00 | 161.00 | 11.00 | 95.00 | 80.00 | 97.00 | 5.00 | 42.00 | 19.00 | 95.00 | 1.00 | 8.00 | 56.00 | 74.00 | 3.00 | 45.00 | 60.00 | 149.00 | 12.00 | 75.00 | 31.00 | 92.00 | 2.00 | 131.00 | -1.00 | |

| Profit Loss | 33.00 | 251.00 | 273.00 | 324.00 | 350.00 | 351.00 | 261.00 | 189.00 | 228.00 | 262.00 | 328.00 | 350.00 | 215.00 | 211.00 | 113.00 | -65.00 | 269.00 | 292.00 | 298.00 | 339.00 | 310.00 | 318.00 | 326.00 | 281.00 | 203.00 | 202.00 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 673.00 | -244.00 | -425.00 | 333.00 | 105.00 | -754.00 | -124.00 | -224.00 | -34.00 | -17.00 | -17.00 | -32.00 | -21.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 1492.00 | -784.00 | -585.00 | 571.00 | -155.00 | -1633.00 | -781.00 | -961.00 | -5.00 | -87.00 | -15.00 | -169.00 | 52.00 | -42.00 | -16.00 | 409.00 | 101.00 | 46.00 | 131.00 | 96.00 | 2.00 | -22.00 | -36.00 | -103.00 | 18.00 | 4.00 | |

| Net Income Loss Available To Common Stockholders Basic | 27.00 | 244.00 | 266.00 | 317.00 | 342.00 | 343.00 | 255.00 | 182.00 | 221.00 | 255.00 | 321.00 | 343.00 | 209.00 | 203.00 | 112.00 | -65.00 | 267.00 | 290.00 | 297.00 | 337.00 | 308.00 | 316.00 | 324.00 | 279.00 | 202.00 | 200.00 | |

| Interest Income Expense After Provision For Loan Loss | 572.00 | 587.00 | 588.00 | 678.00 | 709.00 | 679.00 | 551.00 | 467.00 | 486.00 | 517.00 | 600.00 | 625.00 | 486.00 | 453.00 | 333.00 | 102.00 | 536.00 | 551.00 | 559.00 | 619.00 | 598.00 | 599.00 | 619.00 | 537.00 | 483.00 | 454.00 | |

| Noninterest Expense | 718.00 | 555.00 | 535.00 | 551.00 | 541.00 | 502.00 | 482.00 | 473.00 | 486.00 | 465.00 | 463.00 | 447.00 | 473.00 | 446.00 | 440.00 | 425.00 | 451.00 | 435.00 | 424.00 | 433.00 | 448.00 | 452.00 | 448.00 | 446.00 | 457.00 | 457.00 | |

| Noninterest Income | 198.00 | 295.00 | 303.00 | 282.00 | 278.00 | 278.00 | 268.00 | 244.00 | 289.00 | 280.00 | 284.00 | 270.00 | 265.00 | 252.00 | 247.00 | 237.00 | 266.00 | 256.00 | 250.00 | 238.00 | 250.00 | 234.00 | 248.00 | 244.00 | 276.00 | 271.00 |

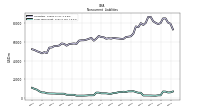

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

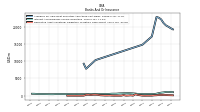

| Assets | 85834.00 | 85706.00 | 90761.00 | 91127.00 | 85406.00 | 84143.00 | 86889.00 | 89165.00 | 94616.00 | 94529.00 | 88355.00 | 86291.00 | 88129.00 | 83631.00 | 84397.00 | 76337.00 | 73402.00 | 72848.00 | 72537.00 | 70690.00 | 70818.00 | 71448.00 | 71987.00 | 72335.00 | 71447.00 | 72976.00 | |

| Liabilities | 79428.00 | 80734.00 | 85166.00 | 85133.00 | 80225.00 | 79074.00 | 80454.00 | 82129.00 | 86719.00 | 86726.00 | 80424.00 | 78139.00 | 80079.00 | 75757.00 | 76595.00 | 68935.00 | 66075.00 | 65648.00 | 65214.00 | 63281.00 | 63311.00 | 63662.00 | 63908.00 | 64335.00 | 63462.00 | 65046.00 | |

| Liabilities And Stockholders Equity | 85834.00 | 85706.00 | 90761.00 | 91127.00 | 85406.00 | 84143.00 | 86889.00 | 89165.00 | 94616.00 | 94529.00 | 88355.00 | 86291.00 | 88129.00 | 83631.00 | 84397.00 | 76337.00 | 73402.00 | 72848.00 | 72537.00 | 70690.00 | 70818.00 | 71448.00 | 71987.00 | 72335.00 | 71447.00 | 72976.00 | |

| Tier One Risk Based Capital | 4600.00 | NA | NA | NA | 4700.00 | NA | NA | NA | 4200.00 | NA | NA | NA | 4000.00 | NA | NA | NA | 4100.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 9502.00 | 8112.00 | 10223.00 | 10734.00 | 6282.00 | 5970.00 | 7533.00 | 13550.00 | 22679.00 | 23589.00 | 16501.00 | 14871.00 | 15767.00 | NA | NA | NA | 5818.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 81.00 | NA | NA | NA | 81.00 | NA | NA | NA | 85.00 | NA | NA | NA | 86.00 | NA | NA | NA | 86.00 | NA | NA | NA | 85.00 | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 16869.00 | 16323.00 | 17415.00 | 18295.00 | 19012.00 | 19452.00 | 20829.00 | 18810.00 | 16986.00 | NA | NA | NA | 15028.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 1385.00 | NA | NA | NA | 1336.00 | NA | NA | NA | 1453.00 | NA | NA | NA | 1418.00 | NA | NA | NA | 1417.00 | NA | NA | NA | 1419.00 | NA | NA | NA | NA | NA | |

| Furniture And Fixtures Gross | 536.00 | NA | NA | NA | 518.00 | NA | NA | NA | 516.00 | NA | NA | NA | 485.00 | NA | NA | NA | 513.00 | NA | NA | NA | 492.00 | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 940.00 | NA | NA | NA | 936.00 | NA | NA | NA | 999.00 | NA | NA | NA | 959.00 | NA | NA | NA | 960.00 | NA | NA | NA | 944.00 | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 445.00 | 410.00 | 397.00 | 399.00 | 400.00 | 412.00 | 422.00 | 444.00 | 454.00 | 447.00 | 454.00 | 456.00 | 459.00 | 456.00 | 450.00 | 454.00 | 457.00 | 467.00 | 470.00 | 474.00 | 475.00 | 472.00 | 467.00 | 468.00 | 484.00 | 488.00 | |

| Goodwill | 635.00 | NA | NA | NA | 635.00 | NA | NA | NA | 635.00 | NA | NA | NA | 635.00 | NA | NA | NA | 635.00 | NA | NA | NA | 635.00 | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 19541.00 | 19969.00 | 20351.00 | 21019.00 | 22045.00 | 22559.00 | 22785.00 | 19905.00 | 17116.00 | NA | NA | NA | 14752.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 66762.00 | 67158.00 | 66015.00 | 64706.00 | 71397.00 | 73016.00 | 75765.00 | 77608.00 | 82339.00 | 82284.00 | 76066.00 | 73807.00 | 72869.00 | 68459.00 | 67720.00 | 57366.00 | 57295.00 | 56809.00 | 55537.00 | 54091.00 | 55561.00 | 56006.00 | 57210.00 | 57635.00 | 56781.00 | 58863.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 6206.00 | 6049.00 | 6961.00 | 7084.00 | 3024.00 | 3016.00 | 2630.00 | 2682.00 | 2796.00 | 2837.00 | 2854.00 | 2852.00 | 5728.00 | 5754.00 | 6521.00 | 7434.00 | 7269.00 | 7311.00 | 6558.00 | 6848.00 | 6463.00 | 6418.00 | 5583.00 | 5594.00 | 5143.00 | 5153.00 |

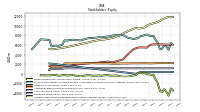

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 6406.00 | 4972.00 | 5595.00 | 5994.00 | 5181.00 | 5069.00 | 6435.00 | 7036.00 | 7897.00 | 7803.00 | 7931.00 | 8152.00 | 8050.00 | 7874.00 | 7802.00 | 7402.00 | 7327.00 | 7200.00 | 7323.00 | 7409.00 | 7507.00 | 7786.00 | 8079.00 | 8000.00 | 7985.00 | 7930.00 | |

| Common Stock Value | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | 1141.00 | |

| Additional Paid In Capital Common Stock | 2224.00 | 2220.00 | 2212.00 | 2209.00 | 2220.00 | 2209.00 | 2204.00 | 2194.00 | 2175.00 | 2170.00 | 2163.00 | 2183.00 | 2185.00 | 2179.00 | 2173.00 | 2168.00 | 2174.00 | 2172.00 | 2168.00 | 2159.00 | 2148.00 | 2144.00 | 2144.00 | 2134.00 | 2110.00 | 2106.00 | |

| Retained Earnings Accumulated Deficit | 11727.00 | 11796.00 | 11648.00 | 11476.00 | 11258.00 | 11005.00 | 10752.00 | 10585.00 | 10494.00 | 10366.00 | 10202.00 | 9975.00 | 9623.00 | 9511.00 | 9404.00 | 9389.00 | 9538.00 | 9369.00 | 9176.00 | 8979.00 | 8781.00 | 8587.00 | 8374.00 | 8110.00 | 7580.00 | 7431.00 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -3048.00 | -4540.00 | -3756.00 | -3171.00 | -3742.00 | -3587.00 | -1954.00 | -1173.00 | -212.00 | -207.00 | -120.00 | -105.00 | 168.00 | 116.00 | 158.00 | 174.00 | -235.00 | -336.00 | -382.00 | -513.00 | -609.00 | -611.00 | -589.00 | -553.00 | -361.00 | -379.00 | |

| Treasury Stock Value | 6032.00 | NA | NA | NA | 6090.00 | 6093.00 | 6102.00 | 6105.00 | 6095.00 | 6061.00 | 5849.00 | 5436.00 | 5461.00 | 5467.00 | 5469.00 | 5470.00 | 5291.00 | 5146.00 | 4780.00 | 4357.00 | 3954.00 | 3475.00 | 2991.00 | 2832.00 | 2485.00 | 2369.00 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 8.00 | 9.00 | 7.00 | 28.00 | 12.00 | 9.00 | 11.00 | 28.00 | 5.00 | 7.00 | 7.00 | 22.00 | 6.00 | 6.00 | 4.00 | 8.00 | 2.00 | 5.00 | 8.00 | 24.00 | 7.00 | 7.00 | 10.00 | 24.00 | 6.00 | 18.00 |

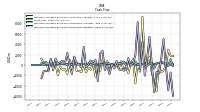

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

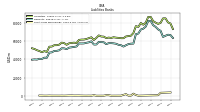

| Net Cash Provided By Used In Operating Activities | 1122.00 | -178.00 | -155.00 | 462.00 | 597.00 | 393.00 | 358.00 | -710.00 | 429.00 | 202.00 | -156.00 | 159.00 | 208.00 | -24.00 | 45.00 | 699.00 | 221.00 | 444.00 | 385.00 | 40.00 | 649.00 | 353.00 | 256.00 | 358.00 | 249.00 | 407.00 | |

| Net Cash Provided By Used In Investing Activities | 1715.00 | 2924.00 | -139.00 | -1006.00 | -1424.00 | -289.00 | -5042.00 | -3197.00 | -1447.00 | 1481.00 | 681.00 | 1008.00 | 9232.00 | -1286.00 | 190.00 | -3534.00 | 1096.00 | 231.00 | -1582.00 | -239.00 | -1183.00 | 743.00 | -569.00 | -147.00 | -1172.00 | 773.00 | |

| Net Cash Provided By Used In Financing Activities | -1447.00 | -4857.00 | -217.00 | 4996.00 | 1139.00 | -1667.00 | -1333.00 | -5222.00 | 108.00 | 5405.00 | 1105.00 | -2063.00 | 4390.00 | -860.00 | 8221.00 | 1872.00 | 384.00 | -139.00 | 1297.00 | -881.00 | -744.00 | -917.00 | -863.00 | 780.00 | -1765.00 | -79.00 |

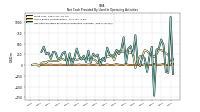

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 1122.00 | -178.00 | -155.00 | 462.00 | 597.00 | 393.00 | 358.00 | -710.00 | 429.00 | 202.00 | -156.00 | 159.00 | 208.00 | -24.00 | 45.00 | 699.00 | 221.00 | 444.00 | 385.00 | 40.00 | 649.00 | 353.00 | 256.00 | 358.00 | 249.00 | 407.00 | |

| Profit Loss | 33.00 | 251.00 | 273.00 | 324.00 | 350.00 | 351.00 | 261.00 | 189.00 | 228.00 | 262.00 | 328.00 | 350.00 | 215.00 | 211.00 | 113.00 | -65.00 | 269.00 | 292.00 | 298.00 | 339.00 | 310.00 | 318.00 | 326.00 | 281.00 | 203.00 | 202.00 | |

| Increase Decrease In Other Operating Capital Net | -911.00 | 531.00 | 592.00 | -207.00 | -138.00 | 4.00 | -83.00 | 831.00 | -204.00 | 159.00 | 410.00 | 104.00 | 53.00 | 266.00 | 191.00 | -399.00 | 118.00 | -25.00 | -64.00 | 289.00 | -282.00 | 113.00 | 40.00 | -55.00 | -43.00 | -137.00 | |

| Deferred Income Tax Expense Benefit | -67.00 | -10.00 | -6.00 | -9.00 | 4.00 | -8.00 | -21.00 | -2.00 | -40.00 | 50.00 | 30.00 | 39.00 | 15.00 | -9.00 | -22.00 | -73.00 | 8.00 | 8.00 | 0.00 | -4.00 | -13.00 | 23.00 | 7.00 | 7.00 | -18.00 | -1.00 | |

| Share Based Compensation | 8.00 | 9.00 | 7.00 | 28.00 | 12.00 | 9.00 | 11.00 | 28.00 | 5.00 | 7.00 | 7.00 | 22.00 | 6.00 | 6.00 | 4.00 | 8.00 | 2.00 | 5.00 | 8.00 | 24.00 | 7.00 | 7.00 | 10.00 | 24.00 | 6.00 | 18.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 1715.00 | 2924.00 | -139.00 | -1006.00 | -1424.00 | -289.00 | -5042.00 | -3197.00 | -1447.00 | 1481.00 | 681.00 | 1008.00 | 9232.00 | -1286.00 | 190.00 | -3534.00 | 1096.00 | 231.00 | -1582.00 | -239.00 | -1183.00 | 743.00 | -569.00 | -147.00 | -1172.00 | 773.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

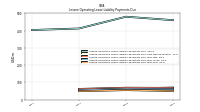

| Net Cash Provided By Used In Financing Activities | -1447.00 | -4857.00 | -217.00 | 4996.00 | 1139.00 | -1667.00 | -1333.00 | -5222.00 | 108.00 | 5405.00 | 1105.00 | -2063.00 | 4390.00 | -860.00 | 8221.00 | 1872.00 | 384.00 | -139.00 | 1297.00 | -881.00 | -744.00 | -917.00 | -863.00 | 780.00 | -1765.00 | -79.00 | |

| Payments Of Dividends Common Stock | 97.00 | 92.00 | 94.00 | 88.00 | 87.00 | 88.00 | 89.00 | 89.00 | 88.00 | 91.00 | 95.00 | 95.00 | 93.00 | 91.00 | 96.00 | 95.00 | 99.00 | 100.00 | 104.00 | 99.00 | 102.00 | 57.00 | 51.00 | 53.00 | 41.00 | 40.00 | |

| Payments For Repurchase Of Common Stock | 1.00 | 0.00 | 1.00 | 15.00 | 0.00 | 3.00 | 1.00 | 39.00 | 50.00 | 220.00 | 451.00 | 8.00 | 0.00 | 0.00 | 0.00 | 199.00 | 152.00 | 370.00 | 429.00 | 443.00 | 501.00 | 500.00 | 169.00 | 168.00 | 132.00 | 125.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 192.00 | 201.00 | 211.00 | 194.00 | 192.00 | 198.00 | 204.00 | 194.00 | 196.00 | 194.00 | 212.00 | 194.00 | 192.00 | 193.00 | 188.00 | 185.00 | 186.00 | 190.00 | 189.00 | 184.00 | 192.00 | 190.00 | 187.00 | 188.00 | 212.00 | 209.00 | |

| Brokerage Commissions Revenue | 8.00 | 6.00 | 8.00 | 8.00 | 7.00 | 6.00 | 4.00 | 4.00 | 3.00 | 3.00 | 4.00 | 4.00 | 4.00 | 5.00 | 5.00 | 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | 6.00 | 7.00 | NA | NA | |

| Capital Markets | 5.00 | 4.00 | 4.00 | 4.00 | 3.00 | 3.00 | 3.00 | 2.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Commercial Loan | 2.00 | 3.00 | 3.00 | 3.00 | 4.00 | 5.00 | 5.00 | 4.00 | 4.00 | 5.00 | 6.00 | 4.00 | 5.00 | 5.00 | 4.00 | 4.00 | 5.00 | 5.00 | 4.00 | 4.00 | 4.00 | 5.00 | 5.00 | 4.00 | NA | NA | |

| Credit And Debit Card | 68.00 | 71.00 | 72.00 | 69.00 | 68.00 | 67.00 | 69.00 | 69.00 | 71.00 | 72.00 | 84.00 | 71.00 | 72.00 | 71.00 | 68.00 | 59.00 | 62.00 | 67.00 | 65.00 | 63.00 | 64.00 | 61.00 | 60.00 | 59.00 | NA | NA | |

| Deposit Account | 45.00 | 47.00 | 47.00 | 46.00 | 47.00 | 50.00 | 50.00 | 48.00 | 50.00 | 50.00 | 47.00 | 48.00 | 47.00 | 47.00 | 42.00 | 49.00 | 50.00 | 51.00 | 51.00 | 51.00 | 51.00 | 53.00 | 53.00 | 54.00 | NA | NA | |

| Fiduciary And Trust | 56.00 | 59.00 | 62.00 | 58.00 | 55.00 | 58.00 | 62.00 | 58.00 | 60.00 | 58.00 | 60.00 | 53.00 | 52.00 | 51.00 | 52.00 | 54.00 | 52.00 | 53.00 | 52.00 | 49.00 | 51.00 | 51.00 | 52.00 | 52.00 | NA | NA | |

| Brokerage Commissions Revenue, Wealth Management | 6.00 | 8.00 | 8.00 | 8.00 | 7.00 | 6.00 | 4.00 | 4.00 | 3.00 | 3.00 | 4.00 | 4.00 | 4.00 | 5.00 | 5.00 | 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | 6.00 | 7.00 | NA | NA | |

| Capital Markets, Business Bank | 5.00 | 4.00 | 4.00 | 4.00 | 3.00 | 3.00 | 3.00 | 2.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Commercial Loan, Business Bank | 2.00 | 3.00 | 3.00 | 3.00 | 4.00 | 5.00 | 5.00 | 4.00 | 4.00 | 5.00 | 6.00 | 4.00 | 5.00 | 5.00 | 4.00 | 4.00 | 5.00 | 5.00 | 4.00 | 4.00 | 4.00 | 5.00 | 5.00 | 4.00 | NA | NA | |

| Credit And Debit Card, Business Bank | 56.00 | 58.00 | 59.00 | 58.00 | 56.00 | 56.00 | 57.00 | 58.00 | 58.00 | 60.00 | 72.00 | 60.00 | 61.00 | 60.00 | 59.00 | 49.00 | 51.00 | 55.00 | 54.00 | 53.00 | 52.00 | 50.00 | 50.00 | 49.00 | NA | NA | |

| Credit And Debit Card, Retail Bank | 11.00 | 12.00 | 12.00 | 10.00 | 11.00 | 10.00 | 11.00 | 10.00 | 12.00 | 11.00 | 11.00 | 10.00 | 10.00 | 11.00 | 8.00 | 9.00 | 10.00 | 11.00 | 10.00 | 9.00 | 11.00 | 10.00 | 9.00 | 9.00 | NA | NA | |

| Credit And Debit Card, Wealth Management | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | NA | NA | |

| Deposit Account, Business Bank | 30.00 | 32.00 | 32.00 | 31.00 | 31.00 | 34.00 | 34.00 | 33.00 | 35.00 | 34.00 | 33.00 | 34.00 | 33.00 | 33.00 | 30.00 | 32.00 | 32.00 | 32.00 | 33.00 | 33.00 | 32.00 | 34.00 | 33.00 | 35.00 | NA | NA | |

| Deposit Account, Retail Bank | 14.00 | 14.00 | 13.00 | 14.00 | 14.00 | 15.00 | 14.00 | 14.00 | 14.00 | 14.00 | 13.00 | 13.00 | 13.00 | 12.00 | 11.00 | 16.00 | 16.00 | 18.00 | 17.00 | 17.00 | 18.00 | 18.00 | 18.00 | 18.00 | NA | NA | |

| Deposit Account, Wealth Management | 1.00 | 1.00 | 2.00 | 1.00 | 2.00 | 1.00 | 2.00 | 1.00 | 1.00 | 2.00 | 1.00 | 1.00 | 1.00 | 2.00 | 1.00 | 1.00 | 2.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 | 1.00 | NA | NA | |

| Fiduciary And Trust, Business Bank | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | |

| Fiduciary And Trust, Wealth Management | 56.00 | 58.00 | 62.00 | 58.00 | 55.00 | 58.00 | 62.00 | 58.00 | 60.00 | 58.00 | 60.00 | 53.00 | 52.00 | 51.00 | 52.00 | 54.00 | 52.00 | 53.00 | 52.00 | 49.00 | 51.00 | 51.00 | 52.00 | 52.00 | NA | NA | |

| Business Bank | 94.00 | 98.00 | 99.00 | 96.00 | 92.00 | 97.00 | 99.00 | 96.00 | 96.00 | 96.00 | 115.00 | 103.00 | 104.00 | 106.00 | 104.00 | 89.00 | 91.00 | 93.00 | 93.00 | 92.00 | 91.00 | 92.00 | 83.00 | 84.00 | 103.00 | 103.00 | |

| Retail Bank | 29.00 | 30.00 | 28.00 | 27.00 | 28.00 | 28.00 | 30.00 | 29.00 | 31.00 | 30.00 | 27.00 | 27.00 | 26.00 | 25.00 | 21.00 | 28.00 | 29.00 | 30.00 | 31.00 | 29.00 | 35.00 | 34.00 | 38.00 | 39.00 | 46.00 | 45.00 | |

| Wealth Management | 67.00 | 75.00 | 83.00 | 71.00 | 71.00 | 73.00 | 75.00 | 69.00 | 69.00 | 68.00 | 70.00 | 64.00 | 62.00 | 62.00 | 63.00 | 68.00 | 66.00 | 67.00 | 65.00 | 63.00 | 65.00 | 64.00 | 66.00 | 65.00 | 63.00 | 61.00 |