| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 32.93 | 32.92 | 32.94 | 32.90 | 32.88 | 32.86 | 32.78 | 32.73 | 32.60 | 32.57 | 32.78 | 32.77 | 32.72 | 32.68 | 32.66 | 32.65 | 32.69 | 32.64 | 32.64 | 32.62 | 32.60 | 32.75 | 32.73 | 32.71 | |

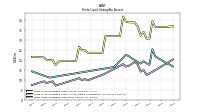

| Earnings Per Share Basic | 1.48 | 1.55 | 1.67 | 1.75 | 1.74 | 1.69 | 1.36 | 1.10 | 1.17 | 1.18 | 1.47 | 1.30 | 1.08 | 0.64 | 0.64 | 0.69 | 1.09 | 1.02 | 1.04 | 0.98 | 1.00 | 1.01 | 0.93 | 0.91 | |

| Earnings Per Share Diluted | 1.46 | 1.52 | 1.64 | 1.72 | 1.70 | 1.65 | 1.34 | 1.08 | 1.15 | 1.16 | 1.45 | 1.27 | 1.06 | 0.63 | 0.63 | 0.68 | 1.07 | 1.00 | 1.02 | 0.96 | 0.98 | 0.98 | 0.91 | 0.89 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

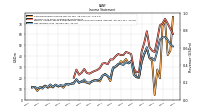

| Interest And Fee Income Loans And Leases | 126.64 | 121.89 | 114.61 | 104.40 | 97.58 | 87.08 | 78.73 | 72.95 | 75.77 | 80.25 | 82.45 | 77.66 | 80.00 | 76.61 | 78.86 | 76.52 | 76.54 | 75.26 | 70.99 | 68.73 | 67.78 | 66.79 | 65.60 | 62.92 | |

| Insurance Commissions And Fees | 7.22 | 8.43 | 6.22 | 8.74 | 6.66 | 7.50 | 5.30 | 7.43 | 6.08 | 6.67 | 5.01 | 5.99 | 5.68 | 5.20 | 4.44 | 5.68 | 5.08 | 5.54 | 4.42 | 5.26 | 4.59 | 5.21 | 3.93 | 5.20 | |

| Marketing And Advertising Expense | 2.65 | 2.03 | 1.90 | 2.53 | 2.46 | 1.95 | 1.59 | 2.07 | 2.08 | 1.80 | 1.65 | 1.88 | 1.67 | 1.49 | 1.49 | 2.35 | 2.33 | 2.05 | 1.92 | 2.26 | 2.03 | 2.00 | 1.65 | 2.35 | |

| Interest Expense | 62.38 | 55.92 | 44.89 | 36.29 | 25.44 | 13.06 | 4.63 | 3.01 | 2.95 | 3.02 | 2.58 | 2.81 | 2.96 | 3.35 | 4.24 | 9.90 | 12.25 | 14.14 | 14.31 | 14.04 | 12.87 | 11.76 | 10.26 | 7.84 | |

| Interest Income Expense Net | 105.07 | 104.31 | 105.93 | 109.16 | 110.35 | 100.95 | 86.87 | 75.51 | 75.90 | 80.19 | 82.36 | 77.21 | 79.53 | 75.85 | 77.21 | 74.07 | 73.94 | 72.29 | 68.79 | 66.90 | 66.89 | 65.67 | 64.88 | 63.03 | |

| Interest Paid Net | 59.90 | 53.69 | 44.15 | 34.03 | 22.78 | 12.70 | 4.95 | 2.50 | 3.64 | 2.62 | 2.58 | 3.15 | 3.31 | 3.69 | 4.64 | 10.41 | 12.50 | 14.22 | 14.23 | 13.65 | 12.45 | 11.57 | 10.04 | 7.49 | |

| Income Tax Expense Benefit | 11.47 | 14.24 | 14.96 | 16.81 | 13.01 | 12.98 | 10.54 | 7.79 | 6.87 | 9.53 | 14.71 | 9.66 | 8.99 | 4.71 | 4.58 | 5.64 | 6.25 | 9.60 | 9.66 | 9.18 | 8.33 | 9.04 | 9.25 | 7.32 | |

| Income Taxes Paid Net | 9.72 | 11.50 | 29.30 | 1.88 | 7.86 | 12.70 | NA | NA | 2.80 | 12.40 | 14.10 | 1.30 | 4.50 | 16.95 | 3.90 | 1.18 | 4.20 | 9.60 | NA | NA | 3.70 | 8.11 | 14.90 | 1.25 | |

| Net Income Loss | 48.93 | 50.99 | 55.01 | 57.53 | 57.13 | 55.35 | 44.71 | 35.91 | 38.17 | 38.75 | 48.19 | 42.52 | 35.36 | 20.89 | 20.73 | 22.61 | 35.51 | 33.37 | 34.17 | 31.84 | 32.73 | 32.88 | 30.59 | 29.62 | |

| Comprehensive Income Net Of Tax | 76.07 | 44.82 | 40.92 | 72.18 | 67.80 | 19.60 | 27.73 | 4.25 | 35.45 | 38.20 | 47.19 | 41.51 | 34.08 | 19.91 | 20.54 | 29.03 | 35.33 | 33.34 | 37.42 | 34.38 | 35.26 | 31.85 | 30.05 | 28.23 | |

| Net Income Loss Available To Common Stockholders Basic | 48.93 | 50.99 | 55.01 | 57.53 | 57.13 | 55.35 | 44.71 | 35.91 | 38.17 | 38.75 | 48.19 | 42.52 | 35.36 | 20.89 | 20.73 | 22.61 | 35.51 | 33.37 | 34.17 | 31.84 | 32.73 | 32.88 | 30.59 | 29.62 | |

| Interest Income Expense After Provision For Loan Loss | 105.07 | 102.00 | 103.10 | 106.83 | 106.58 | 98.08 | 86.37 | 72.57 | 76.12 | 78.71 | 92.31 | 77.21 | 74.54 | 57.11 | 57.88 | 54.49 | 72.53 | 69.53 | 66.36 | 65.22 | 65.37 | 64.93 | 63.66 | 62.72 | |

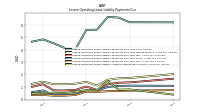

| Noninterest Expense | 89.82 | 81.22 | 81.11 | 80.32 | 84.61 | 79.08 | 73.72 | 72.51 | 76.78 | 70.21 | 74.02 | 64.96 | 65.61 | 66.08 | 64.65 | 61.38 | 66.30 | 62.19 | 56.61 | 56.21 | 56.17 | 55.81 | 54.26 | 55.89 | |

| Noninterest Income | 45.16 | 44.45 | 47.97 | 47.83 | 48.17 | 49.33 | 42.60 | 43.65 | 45.69 | 39.79 | 44.62 | 39.94 | 35.42 | 34.58 | 32.08 | 35.15 | 35.52 | 35.63 | 34.08 | 32.00 | 31.85 | 32.80 | 30.44 | 30.11 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

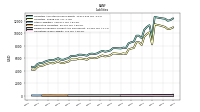

| Assets | 12372.04 | 12114.60 | 12020.26 | 12332.10 | 12387.86 | 12452.38 | 12530.07 | 12624.43 | 9405.61 | 11302.77 | 11015.29 | 10549.31 | 9212.36 | 9618.87 | 9612.45 | 8669.10 | 8565.76 | 8388.82 | 7642.02 | 7709.00 | 7574.26 | 7602.44 | 7622.96 | 7615.64 | |

| Liabilities | 10938.15 | 10744.02 | 10679.47 | 11021.22 | 11137.03 | 11257.23 | 11344.38 | 11456.63 | 8233.88 | 10155.90 | 9883.70 | 9454.63 | 8144.47 | 8575.12 | 8578.25 | 7645.72 | 7560.77 | 7409.06 | 6685.64 | 6781.07 | 6671.47 | 6717.64 | 6760.95 | 6777.55 | |

| Liabilities And Stockholders Equity | 12372.04 | 12114.60 | 12020.26 | 12332.10 | 12387.86 | 12452.38 | 12530.07 | 12624.43 | 9405.61 | 11302.77 | 11015.29 | 10549.31 | 9212.36 | 9618.87 | 9612.45 | 8669.10 | 8565.76 | 8388.82 | 7642.02 | 7709.00 | 7574.26 | 7602.44 | 7622.96 | 7615.64 | |

| Stockholders Equity | 1433.89 | 1370.58 | 1340.79 | 1310.88 | 1250.84 | 1195.15 | 1185.69 | 1167.80 | 1171.73 | 1146.87 | 1131.59 | 1094.67 | 1067.88 | 1043.75 | 1034.20 | 1023.38 | 1004.99 | 979.75 | 956.38 | 927.93 | 902.79 | 884.80 | 862.01 | 838.10 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

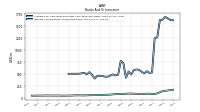

| Available For Sale Securities Debt Securities | 1553.90 | 1524.26 | 1569.43 | 1615.91 | 1538.22 | 1519.26 | 1203.50 | 1208.75 | 531.52 | 526.50 | 560.78 | 517.59 | 552.23 | 593.97 | 604.98 | 589.80 | 489.72 | 553.66 | 423.16 | 723.65 | 770.70 | 475.64 | 460.86 | 484.76 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

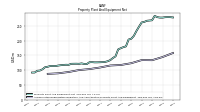

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 158.03 | NA | NA | NA | 144.38 | NA | NA | NA | 133.67 | NA | NA | NA | 134.02 | NA | NA | NA | 123.46 | NA | NA | NA | 117.39 | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.89 | 0.89 | 0.88 | 0.88 | 0.88 | 0.88 | 0.86 | 0.83 | 0.76 | 0.76 | 0.81 | 0.79 | 0.92 | 0.97 | 0.97 | 0.96 | 1.01 | 0.84 | 0.76 | 0.76 | 0.78 | 0.74 | 0.76 | 0.73 | |

| Property Plant And Equipment Net | 278.59 | 279.61 | 279.76 | 279.46 | 278.09 | 278.16 | 279.61 | 283.84 | 269.05 | 268.16 | 267.28 | 263.45 | 261.68 | 247.49 | 232.52 | 215.93 | 206.28 | 203.77 | 180.51 | 177.95 | 174.36 | 170.17 | 146.71 | 141.16 | |

| Goodwill | 182.26 | 182.26 | 182.06 | 182.06 | 182.06 | 182.06 | 183.64 | 176.56 | 149.92 | 149.92 | 149.92 | 149.92 | 149.92 | 149.92 | 149.92 | 149.92 | 148.60 | 147.01 | 79.75 | 79.75 | 79.75 | 79.73 | 79.73 | 79.80 | |

| Finite Lived Intangible Assets Net | 16.70 | 17.59 | 18.22 | 19.10 | 19.98 | 20.86 | 21.74 | 25.46 | 17.57 | 18.32 | 19.28 | 18.21 | 19.00 | 19.91 | 20.88 | 21.85 | 22.61 | NA | NA | NA | 16.47 | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1.19 | 1.19 | 1.19 | 2.32 | 2.38 | 2.39 | 2.39 | 2.92 | 2.98 | 2.98 | 2.99 | 2.95 | 2.98 | 3.01 | 3.05 | 2.22 | 1.90 | 1.91 | 2.00 | 1.22 | 1.43 | 1.45 | 2.02 | 2.09 | |

| Held To Maturity Securities | 1.19 | 1.19 | 1.19 | 2.32 | 2.38 | 2.39 | 2.39 | 2.92 | 2.98 | 2.98 | 2.99 | 2.96 | 2.96 | 2.97 | 3.06 | 2.19 | 1.90 | 1.91 | 2.00 | 1.22 | 1.43 | 1.44 | 2.01 | 2.08 | |

| Available For Sale Debt Securities Amortized Cost Basis | 1619.42 | 1625.31 | 1662.38 | 1690.43 | 1631.89 | 1626.94 | 1264.40 | 1247.43 | 528.69 | 520.10 | 553.66 | 508.99 | 542.29 | 582.32 | 592.01 | 576.56 | 485.08 | 548.79 | 418.25 | 723.12 | 773.57 | 481.91 | 465.74 | 488.92 | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 0.84 | 0.84 | 0.84 | 1267.38 | 1.20 | 1.20 | 1.20 | 2.33 | 2.40 | 2.40 | 2.41 | 2.08 | 2.11 | 1.63 | 1.57 | 1.32 | 1.05 | 1.06 | 1.15 | 0.37 | 0.37 | 0.37 | 0.43 | 0.42 | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 0.35 | 0.35 | 0.35 | 1.19 | 1.19 | 1.19 | 1.19 | 0.58 | 0.58 | 0.58 | 0.58 | 0.86 | 0.81 | 0.81 | 0.88 | 0.30 | 0.30 | 0.30 | 0.30 | 0.29 | 0.49 | 0.50 | 0.98 | 1.04 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 774.01 | NA | NA | NA | 553.05 | NA | NA | NA | 465.80 | NA | NA | NA | 489.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 10700.12 | 10534.17 | 10475.18 | 10610.10 | 10974.23 | 11058.94 | 11142.69 | 11250.97 | 8091.91 | 9992.04 | 9728.39 | 9371.94 | 8064.70 | 8495.89 | 8486.67 | 7573.20 | 7483.64 | 7330.68 | 6613.61 | 6706.39 | 6605.49 | 6643.13 | 6692.17 | 6713.05 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

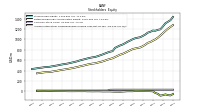

| Stockholders Equity | 1433.89 | 1370.58 | 1340.79 | 1310.88 | 1250.84 | 1195.15 | 1185.69 | 1167.80 | 1171.73 | 1146.87 | 1131.59 | 1094.67 | 1067.88 | 1043.75 | 1034.20 | 1023.38 | 1004.99 | 979.75 | 956.38 | 927.93 | 902.79 | 884.80 | 862.01 | 838.10 | |

| Common Stock Value | 32.93 | 32.92 | 32.94 | 32.90 | 32.88 | 32.86 | 32.78 | 32.73 | 32.60 | 32.57 | 32.78 | 32.77 | 32.72 | 32.68 | 32.66 | 32.65 | 32.69 | 32.64 | 32.64 | 32.62 | 32.60 | 32.75 | 32.73 | 32.71 | |

| Additional Paid In Capital Common Stock | 174.69 | 173.31 | 172.36 | 170.23 | 169.23 | 168.22 | 165.29 | 163.39 | 159.91 | 158.88 | 158.32 | 157.45 | 156.57 | 155.43 | 154.69 | 154.00 | 153.35 | 151.47 | 151.00 | 150.19 | 149.71 | 149.24 | 148.49 | 147.76 | |

| Retained Earnings Accumulated Deficit | 1276.31 | 1241.53 | 1206.50 | 1164.66 | 1120.29 | 1076.32 | 1034.11 | 1001.20 | 977.07 | 950.56 | 935.07 | 898.03 | 871.16 | 846.93 | 837.15 | 826.86 | 815.49 | 792.01 | 769.09 | 744.71 | 722.62 | 707.48 | 684.42 | 661.34 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -50.04 | -77.18 | -71.00 | -56.91 | -71.56 | -82.24 | -46.49 | -29.52 | 2.15 | 4.87 | 5.42 | 6.42 | 7.43 | 8.71 | 9.69 | 9.88 | 3.45 | 3.63 | 3.65 | 0.40 | -2.14 | -4.67 | -3.64 | -3.71 |

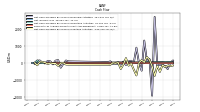

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 42.76 | 61.10 | 59.68 | 69.50 | 46.98 | 59.45 | 56.23 | 63.61 | 28.16 | 27.46 | 65.80 | 68.37 | 43.09 | 28.61 | 47.38 | 35.26 | 46.49 | 40.36 | 35.45 | 36.66 | 31.72 | 43.70 | 29.38 | 26.36 | |

| Net Cash Provided By Used In Investing Activities | -133.71 | -166.84 | -140.58 | -228.58 | -109.86 | -510.81 | -152.53 | -745.97 | -174.19 | 200.77 | 365.29 | 45.16 | 178.87 | 30.28 | -720.93 | -386.21 | -23.06 | -146.01 | 297.58 | -78.16 | -338.68 | 36.21 | -8.51 | 26.03 | |

| Net Cash Provided By Used In Financing Activities | 151.65 | 33.35 | -346.35 | -173.44 | -101.52 | -94.68 | -115.77 | 2723.74 | -1914.82 | 241.24 | 147.91 | 1331.96 | -440.56 | -11.71 | 913.03 | 31.53 | 142.98 | 103.08 | -106.00 | 94.65 | -60.95 | -55.80 | -24.91 | -38.16 |

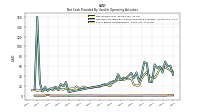

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 42.76 | 61.10 | 59.68 | 69.50 | 46.98 | 59.45 | 56.23 | 63.61 | 28.16 | 27.46 | 65.80 | 68.37 | 43.09 | 28.61 | 47.38 | 35.26 | 46.49 | 40.36 | 35.45 | 36.66 | 31.72 | 43.70 | 29.38 | 26.36 | |

| Net Income Loss | 48.93 | 50.99 | 55.01 | 57.53 | 57.13 | 55.35 | 44.71 | 35.91 | 38.17 | 38.75 | 48.19 | 42.52 | 35.36 | 20.89 | 20.73 | 22.61 | 35.51 | 33.37 | 34.17 | 31.84 | 32.73 | 32.88 | 30.59 | 29.62 | |

| Depreciation Depletion And Amortization | 5.45 | 5.57 | 5.65 | 5.52 | 5.45 | 5.49 | 5.50 | 5.61 | 5.47 | 4.96 | 4.94 | 4.67 | 4.69 | 4.76 | 4.51 | 4.46 | 4.36 | 4.11 | 3.77 | 3.74 | 3.74 | 3.47 | 3.19 | 3.14 | |

| Deferred Income Tax Expense Benefit | -0.75 | -0.55 | -0.71 | -0.78 | 3.26 | -1.13 | -0.84 | -0.97 | 2.38 | 6.16 | -0.76 | -0.74 | -0.83 | -4.68 | -2.78 | -1.21 | 1.90 | 0.14 | -0.43 | -0.46 | 3.07 | 0.69 | -0.49 | -0.12 | |

| Share Based Compensation | 0.92 | 0.86 | 0.83 | 0.38 | 0.40 | 0.63 | 0.46 | 0.46 | 0.53 | 0.56 | 0.47 | 0.58 | 0.25 | 0.43 | 0.41 | 0.43 | 0.39 | 0.35 | 0.37 | 0.17 | 0.37 | 0.35 | 0.32 | 0.31 |

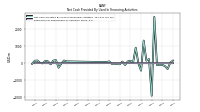

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -133.71 | -166.84 | -140.58 | -228.58 | -109.86 | -510.81 | -152.53 | -745.97 | -174.19 | 200.77 | 365.29 | 45.16 | 178.87 | 30.28 | -720.93 | -386.21 | -23.06 | -146.01 | 297.58 | -78.16 | -338.68 | 36.21 | -8.51 | 26.03 | |

| Payments To Acquire Property Plant And Equipment | 4.81 | 4.68 | 5.05 | 7.96 | 4.68 | 3.24 | 4.97 | 6.90 | 6.39 | 5.66 | 7.48 | 7.72 | 18.13 | 18.02 | 18.94 | 11.35 | 7.19 | 6.96 | 6.12 | 6.79 | 7.46 | 27.77 | 9.46 | 7.17 |

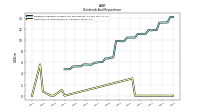

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 151.65 | 33.35 | -346.35 | -173.44 | -101.52 | -94.68 | -115.77 | 2723.74 | -1914.82 | 241.24 | 147.91 | 1331.96 | -440.56 | -11.71 | 913.03 | 31.53 | 142.98 | 103.08 | -106.00 | 94.65 | -60.95 | -55.80 | -24.91 | -38.16 | |

| Payments Of Dividends Common Stock | 14.16 | 13.18 | 13.16 | 13.15 | 13.14 | 11.80 | 11.78 | 11.74 | 11.73 | 11.15 | 11.14 | 11.12 | 11.11 | 10.45 | 10.45 | 10.46 | 10.45 | 9.79 | 9.79 | 9.78 | 9.82 | 6.87 | 6.87 | 6.70 | |

| Payments For Repurchase Of Common Stock | 0.00 | NA | NA | NA | NA | NA | NA | NA | -0.00 | NA | NA | NA | 0.00 | 0.00 | 0.00 | 3.10 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposit Account | 16.84 | 17.03 | 22.27 | 21.23 | 21.60 | 22.16 | 21.62 | 21.38 | 22.09 | 21.71 | 20.52 | 19.10 | 19.80 | 19.08 | 16.76 | 18.80 | 19.94 | 19.87 | 19.11 | 17.66 | 18.55 | 18.10 | 17.54 | 16.65 | |

| Fiduciary And Trust | 5.11 | 4.87 | 4.59 | 4.22 | 4.07 | 4.12 | 3.95 | 3.51 | 3.34 | 3.21 | 3.26 | 3.10 | 2.98 | 3.13 | 3.37 | 3.65 | 3.68 | 3.49 | 3.25 | 3.18 | 3.02 | 3.28 | 3.40 | 3.13 |