| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

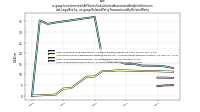

| Common Stock Value | 1.72 | 1.71 | 1.71 | 1.71 | 1.71 | 1.63 | 1.61 | 1.61 | 1.58 | 1.53 | 1.51 | 1.46 | 1.37 | 1.33 | 1.25 | 1.24 | 1.21 | 1.13 | 1.12 | 1.11 | 1.11 | 1.06 | 1.03 | 1.01 | 1.00 | 0.94 | 0.92 | 0.90 | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | 170.89 | 170.86 | 170.78 | NA | 161.55 | 161.41 | 158.20 | NA | 151.56 | 146.06 | 137.69 | NA | 125.83 | 124.45 | 121.78 | NA | 112.12 | 111.50 | 111.05 | NA | 105.39 | 102.24 | 100.12 | NA | 93.30 | 90.75 | 88.20 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 170.89 | 170.86 | 170.78 | NA | 161.55 | 161.41 | 158.20 | NA | 150.85 | 145.82 | 137.32 | NA | 124.90 | 124.33 | 121.43 | NA | 112.12 | 111.43 | 111.05 | NA | 104.18 | 101.88 | 99.86 | NA | 92.60 | 90.22 | 88.15 | |

| Earnings Per Share Basic | -0.54 | 0.13 | 0.51 | 0.44 | 0.30 | 2.11 | 1.67 | -0.96 | 0.44 | 0.67 | 2.61 | 0.04 | 3.26 | 0.64 | 1.82 | 0.14 | 1.75 | -0.44 | 0.68 | 1.11 | -0.30 | 2.01 | 0.51 | 1.33 | 0.39 | 0.55 | 0.35 | 0.29 | |

| Earnings Per Share Diluted | -0.54 | 0.13 | 0.51 | 0.44 | 0.30 | 2.11 | 1.67 | -0.96 | 0.44 | 0.67 | 2.61 | 0.04 | 3.26 | 0.63 | 1.82 | 0.14 | 1.74 | -0.44 | 0.68 | 1.11 | -0.30 | 1.99 | 0.51 | 1.32 | 0.38 | 0.55 | 0.35 | 0.29 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

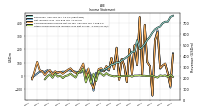

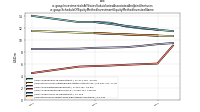

| Revenue From Contract With Customer Including Assessed Tax | 757.22 | 713.79 | 713.90 | 700.79 | 670.28 | 659.85 | 643.76 | 615.07 | 576.92 | 547.76 | 509.62 | 479.85 | 463.72 | 545.04 | 436.96 | 439.92 | 408.11 | 390.48 | 373.86 | 358.84 | 340.46 | 341.82 | 325.03 | 320.14 | 298.79 | 285.37 | 273.06 | 270.88 | |

| Revenues | 757.22 | 713.79 | 713.90 | 700.79 | 670.28 | 659.85 | 643.76 | 615.07 | 576.92 | 547.76 | 509.62 | 479.85 | 463.72 | 545.04 | 436.96 | 439.92 | 408.11 | 390.48 | 373.86 | 358.84 | 340.46 | 341.82 | 325.03 | 320.14 | 298.79 | 285.37 | 273.06 | 270.88 | |

| Gain Loss On Investments | 8.65 | -80.67 | -78.27 | -45.11 | -19.65 | -32.30 | -39.48 | -240.32 | -112.88 | 67.08 | 304.26 | 1.01 | 255.14 | 3.35 | 184.66 | -21.82 | 152.67 | -63.08 | 21.50 | 83.56 | -83.53 | 122.20 | 12.53 | 85.56 | -0.68 | 1.04 | -0.53 | 1.49 | |

| Costs And Expenses | 871.12 | 565.10 | 716.92 | 534.18 | 555.53 | 567.84 | 509.33 | 492.36 | 491.49 | 493.07 | 411.97 | 461.65 | 417.82 | 457.95 | 381.94 | 384.30 | 349.98 | 366.36 | 309.44 | 306.73 | 285.30 | 285.38 | 278.11 | 265.33 | 253.56 | 239.92 | 232.26 | 223.95 | |

| General And Administrative Expense | 59.29 | 45.99 | 45.88 | 48.20 | 42.99 | 49.96 | 43.40 | 40.93 | 41.65 | 37.93 | 37.88 | 34.00 | 32.69 | 36.91 | 31.77 | 31.96 | 29.78 | 27.93 | 26.43 | 24.68 | 22.39 | 22.66 | 22.94 | 22.42 | 18.91 | 17.64 | 19.23 | 19.23 | |

| Interest Expense | 31.97 | 11.41 | 17.07 | 13.75 | 17.52 | 22.98 | 24.26 | 29.44 | 34.86 | 35.68 | 35.16 | 36.47 | 37.54 | 43.32 | 45.01 | 45.74 | 45.49 | 46.20 | 42.88 | 39.10 | 40.24 | 42.24 | 38.10 | 36.91 | 36.08 | 31.03 | 31.75 | 29.78 | |

| Interest Paid Net | 30.02 | 12.53 | -17.49 | 21.52 | -4.66 | 41.94 | 3.37 | 22.55 | 29.08 | 36.69 | 18.64 | 55.05 | 14.98 | 55.65 | 25.22 | 65.50 | 21.00 | 53.83 | 21.74 | 49.60 | 27.45 | 30.75 | 33.39 | 35.49 | 25.88 | 32.42 | 23.73 | 30.08 | |

| Gains Losses On Extinguishment Of Debt | NA | NA | NA | NA | 0.00 | 0.00 | -3.32 | NA | 0.00 | 0.00 | 0.00 | -67.25 | -7.90 | -52.77 | 0.00 | 0.00 | 0.00 | -40.21 | 0.00 | -7.36 | 0.00 | -1.12 | 0.00 | 0.00 | -2.78 | 0.00 | 0.00 | -0.67 | |

| Profit Loss | -42.66 | 68.25 | 133.71 | 121.69 | 95.27 | 383.44 | 309.38 | -117.39 | 99.80 | 124.43 | 404.52 | 25.53 | 457.13 | 95.80 | 243.56 | 30.68 | 216.05 | -36.00 | 87.18 | 136.82 | -18.63 | 219.36 | 60.55 | 141.52 | 45.61 | 59.55 | 41.50 | 47.55 | |

| Other Comprehensive Income Loss Net Of Tax | 9.09 | -8.39 | 3.95 | 0.28 | 3.91 | -12.87 | -6.12 | 1.57 | -1.26 | -1.52 | 1.29 | 0.83 | 4.01 | 2.44 | 2.53 | -5.86 | 1.80 | -0.41 | -0.42 | -0.28 | -6.62 | -1.33 | -3.71 | 0.97 | 6.07 | 21.20 | 1.23 | 16.11 | |

| Net Income Loss | -88.43 | 24.27 | 89.94 | 77.86 | 54.32 | 344.70 | 272.21 | -149.57 | 74.89 | 103.15 | 385.08 | 8.12 | 441.48 | 81.06 | 229.65 | 18.77 | 202.44 | -47.20 | 78.77 | 129.16 | -24.68 | 213.64 | 54.73 | 135.63 | 39.39 | 53.77 | 34.22 | 41.71 | |

| Comprehensive Income Net Of Tax | -79.34 | 15.87 | 93.88 | 78.14 | 58.23 | 331.82 | 266.09 | -148.00 | 73.63 | 101.63 | 386.38 | 8.95 | 445.50 | 83.50 | 232.18 | 12.91 | 204.24 | -47.62 | 78.34 | 128.88 | -31.31 | 212.31 | 51.02 | 136.60 | 45.55 | 74.96 | 35.44 | 57.82 | |

| Net Income Loss Available To Common Stockholders Basic | -91.93 | 21.86 | 87.26 | 75.26 | 51.79 | 341.44 | 269.28 | -151.65 | 72.80 | 101.26 | 380.56 | 6.11 | 435.92 | 79.33 | 226.60 | 16.84 | 199.62 | -49.77 | 76.33 | 123.60 | -30.10 | 208.94 | 52.02 | 132.39 | 36.83 | 51.27 | 31.63 | 25.66 | |

| Net Income Loss Available To Common Stockholders Diluted | -91.93 | 21.86 | 87.26 | 75.26 | 51.79 | 341.44 | 269.28 | -151.65 | 72.80 | 101.26 | 380.56 | 6.11 | 436.62 | 79.33 | 226.60 | 16.84 | 199.62 | -49.77 | 76.33 | 123.60 | -31.74 | 210.24 | 52.02 | 132.39 | 36.83 | 51.27 | 31.63 | 25.66 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

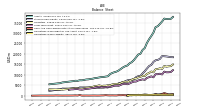

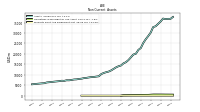

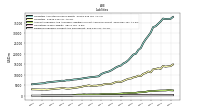

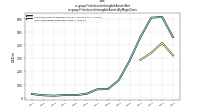

| Assets | 36771.40 | 36783.29 | 36659.26 | 36912.46 | 35523.40 | 34368.61 | 33244.05 | 32844.26 | 30219.37 | 28558.72 | 27018.85 | 25234.35 | 22827.88 | 21910.67 | 20069.11 | 19701.94 | 18390.50 | 17058.15 | 16039.47 | 15480.21 | 14464.96 | 14105.57 | 13562.19 | 12821.20 | 12103.95 | 11545.32 | 11245.67 | 10868.63 | |

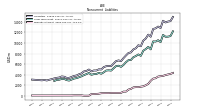

| Liabilities | 14148.41 | 14070.41 | 13892.00 | 14225.70 | 12840.15 | 13113.24 | 12781.92 | 12663.64 | 11186.12 | 11586.60 | 10837.03 | 10452.38 | 9384.10 | 9575.55 | 9000.13 | 8787.67 | 8224.02 | 8094.53 | 7628.00 | 7125.29 | 6570.24 | 6692.18 | 6562.06 | 6087.85 | 5620.78 | 5640.51 | 5591.18 | 5422.30 | |

| Liabilities And Stockholders Equity | 36771.40 | 36783.29 | 36659.26 | 36912.46 | 35523.40 | 34368.61 | 33244.05 | 32844.26 | 30219.37 | 28558.72 | 27018.85 | 25234.35 | 22827.88 | 21910.67 | 20069.11 | 19701.94 | 18390.50 | 17058.15 | 16039.47 | 15480.21 | 14464.96 | 14105.57 | 13562.19 | 12821.20 | 12103.95 | 11545.32 | 11245.67 | 10868.63 | |

| Stockholders Equity | 18471.17 | 18627.91 | 18797.44 | 18883.99 | 18972.39 | 17616.33 | 17139.33 | 16929.98 | 16189.54 | 14723.24 | 14191.02 | 12990.41 | 11725.71 | 10701.81 | 9431.44 | 9322.59 | 8865.83 | 7790.23 | 7629.02 | 7566.58 | 7341.97 | 6872.78 | 6460.46 | 6194.60 | 5949.67 | 5406.97 | 5157.16 | 4952.43 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

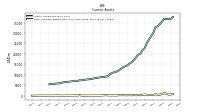

| Cash And Cash Equivalents At Carrying Value | 618.19 | 532.39 | 924.37 | 1263.45 | 825.19 | 533.82 | 420.26 | 775.06 | 361.35 | 325.87 | 323.88 | 492.18 | 568.53 | 446.25 | 206.86 | 445.25 | 189.68 | 410.68 | 198.91 | 261.37 | 234.18 | 204.18 | 287.03 | 221.65 | 254.38 | 118.56 | 124.88 | 151.21 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 660.77 | 567.71 | 960.29 | 1298.38 | 857.98 | 866.17 | 517.66 | 870.17 | 415.23 | 368.05 | 357.57 | 534.40 | 597.71 | 485.04 | 241.54 | 488.37 | 242.69 | 452.97 | 238.22 | 315.81 | 272.13 | 233.88 | 321.84 | 258.98 | 277.19 | 146.28 | 144.88 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Net | 26.56 | 25.67 | 24.10 | 22.79 | 23.19 | 23.49 | 24.98 | 25.93 | 26.43 | 27.33 | 29.87 | 30.83 | 31.13 | 32.33 | 31.03 | 29.83 | 23.03 | 17.51 | 16.73 | 15.89 | 14.79 | 12.96 | 11.54 | 10.90 | 11.07 | 11.44 | 11.79 | 12.30 | |

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 37.78 | 37.70 | 37.80 | 38.35 | 38.44 | 38.28 | 37.59 | 38.46 | 38.48 | 321.74 | 323.62 | 325.93 | 332.35 | 330.79 | 326.86 | 325.67 | 346.89 | 340.19 | 334.16 | 290.40 | 237.51 | 197.97 | 192.97 | 169.87 | 110.62 | 33.69 | 58.08 | 50.46 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 11315.64 | 11202.83 | 11183.36 | 11537.31 | 10159.76 | 10525.85 | 10271.41 | 10303.25 | 8791.87 | 9263.59 | 8841.00 | 8540.92 | 7563.29 | 7823.17 | 7523.27 | 7305.14 | 6777.48 | 6737.68 | 6356.20 | 5843.50 | 5478.26 | 5684.00 | 5614.10 | 5210.80 | 4764.81 | 4817.04 | 4775.39 | 4430.69 | |

| Minority Interest | 4135.34 | 4033.31 | 3917.19 | 3757.91 | 3701.25 | 3629.43 | 3313.19 | 3241.02 | 2834.10 | 2237.20 | 1979.23 | 1780.10 | 1706.72 | 1622.07 | 1625.41 | 1579.67 | 1288.35 | 1161.29 | 771.46 | 777.45 | 541.96 | 529.83 | 528.81 | 528.54 | 521.99 | 486.42 | 485.92 | 482.58 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

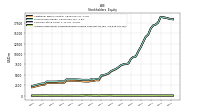

| Stockholders Equity | 18471.17 | 18627.91 | 18797.44 | 18883.99 | 18972.39 | 17616.33 | 17139.33 | 16929.98 | 16189.54 | 14723.24 | 14191.02 | 12990.41 | 11725.71 | 10701.81 | 9431.44 | 9322.59 | 8865.83 | 7790.23 | 7629.02 | 7566.58 | 7341.97 | 6872.78 | 6460.46 | 6194.60 | 5949.67 | 5406.97 | 5157.16 | 4952.43 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 22606.51 | 22661.22 | 22714.62 | 22641.90 | 22673.63 | 21245.77 | 20452.52 | 20171.00 | 19023.64 | 16960.44 | 16170.25 | 14770.51 | 13432.44 | 12323.89 | 11056.85 | 10902.25 | 10154.18 | 8951.52 | 8400.48 | 8344.02 | 7883.93 | 7402.61 | 6989.27 | 6723.14 | 6471.66 | 5893.39 | 5643.08 | 5435.01 | |

| Common Stock Value | 1.72 | 1.71 | 1.71 | 1.71 | 1.71 | 1.63 | 1.61 | 1.61 | 1.58 | 1.53 | 1.51 | 1.46 | 1.37 | 1.33 | 1.25 | 1.24 | 1.21 | 1.13 | 1.12 | 1.11 | 1.11 | 1.06 | 1.03 | 1.01 | 1.00 | 0.94 | 0.92 | 0.90 | |

| Additional Paid In Capital | 18485.35 | 18651.19 | 18812.32 | 18902.82 | 18991.49 | 17639.43 | 17149.57 | 16934.09 | 16195.26 | 14727.74 | 14194.02 | 12994.75 | 11730.97 | 10711.12 | 9443.27 | 9336.95 | 8874.37 | 7743.19 | 7581.57 | 7518.72 | 7286.95 | 6801.15 | 6387.53 | 6117.98 | 5824.26 | 5287.78 | 5059.18 | 4855.69 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -15.90 | -24.98 | -16.59 | -20.54 | -20.81 | -24.73 | -11.85 | -5.73 | -7.29 | -6.03 | -4.51 | -5.80 | -6.62 | -10.64 | -13.08 | -15.61 | -9.75 | -11.55 | -11.13 | -10.71 | -10.44 | -3.81 | -2.48 | 1.23 | 50.02 | 43.86 | 22.68 | 21.46 | |

| Minority Interest | 4135.34 | 4033.31 | 3917.19 | 3757.91 | 3701.25 | 3629.43 | 3313.19 | 3241.02 | 2834.10 | 2237.20 | 1979.23 | 1780.10 | 1706.72 | 1622.07 | 1625.41 | 1579.67 | 1288.35 | 1161.29 | 771.46 | 777.45 | 541.96 | 529.83 | 528.81 | 528.54 | 521.99 | 486.42 | 485.92 | 482.58 | |

| Stock Issued During Period Value New Issues | NA | NA | NA | NA | 1500.70 | 199.43 | 0.00 | 646.32 | 770.55 | 492.08 | 868.82 | 1397.65 | 502.29 | 1309.23 | 0.00 | 504.34 | 980.96 | 150.09 | 85.39 | NA | 608.11 | 296.32 | 300.84 | 99.37 | 570.01 | 245.78 | 241.85 | 217.76 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 59.61 | 31.20 | 29.67 | 35.78 | 22.42 | 29.20 | 26.74 | 30.86 | 25.65 | 21.04 | 24.31 | 26.94 | 19.67 | 21.99 | 19.35 | 22.99 | 17.28 | 16.45 | 17.25 | 16.94 | 16.86 | 4.99 | 12.64 | 11.49 | 11.76 | 12.68 | 9.24 | 8.72 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 51.17 | 57.88 | 71.23 | 62.98 | 52.51 | 47.26 | 61.63 | 30.30 | 31.14 | 27.91 | 27.73 | 25.68 | 22.51 | 26.38 | 21.30 | 16.48 | 9.13 | 14.09 | 14.67 | 9.50 | 6.04 | 5.76 | 12.31 | 5.71 | 4.71 | 6.43 | 5.25 | 5.11 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

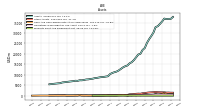

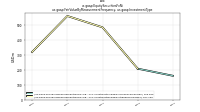

| Net Cash Provided By Used In Operating Activities | 428.62 | 417.89 | 478.47 | 305.57 | 401.16 | 363.04 | 339.03 | 191.09 | 249.56 | 308.82 | 239.76 | 212.05 | 173.57 | 315.28 | 202.39 | 191.27 | 178.29 | 197.23 | 171.61 | 136.73 | 156.25 | 155.85 | 129.32 | 128.92 | 94.00 | 134.72 | 114.14 | 107.46 | |

| Net Cash Provided By Used In Investing Activities | -390.06 | -676.46 | -394.44 | -1039.66 | -1359.84 | -624.42 | -607.40 | -2488.80 | -1673.93 | -1296.94 | -1698.58 | -2437.88 | -413.14 | -1467.96 | -563.47 | -833.59 | -1290.45 | -898.63 | -717.90 | -734.33 | -397.61 | -495.25 | -670.86 | -598.04 | -424.36 | -332.04 | -513.36 | -468.36 | |

| Net Cash Provided By Used In Financing Activities | 55.19 | -133.60 | -422.25 | 1174.81 | 950.75 | 610.12 | -83.67 | 2752.57 | 1473.60 | 998.68 | 1281.83 | 2162.25 | 351.57 | 1395.81 | 113.29 | 889.67 | 901.81 | 916.46 | 468.41 | 640.81 | 280.63 | 251.32 | 605.17 | 451.32 | 466.04 | 190.16 | 372.34 | 386.88 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 428.62 | 417.89 | 478.47 | 305.57 | 401.16 | 363.04 | 339.03 | 191.09 | 249.56 | 308.82 | 239.76 | 212.05 | 173.57 | 315.28 | 202.39 | 191.27 | 178.29 | 197.23 | 171.61 | 136.73 | 156.25 | 155.85 | 129.32 | 128.92 | 94.00 | 134.72 | 114.14 | 107.46 | |

| Net Income Loss | -88.43 | 24.27 | 89.94 | 77.86 | 54.32 | 344.70 | 272.21 | -149.57 | 74.89 | 103.15 | 385.08 | 8.12 | 441.48 | 81.06 | 229.65 | 18.77 | 202.44 | -47.20 | 78.77 | 129.16 | -24.68 | 213.64 | 54.73 | 135.63 | 39.39 | 53.77 | 34.22 | 41.71 | |

| Profit Loss | -42.66 | 68.25 | 133.71 | 121.69 | 95.27 | 383.44 | 309.38 | -117.39 | 99.80 | 124.43 | 404.52 | 25.53 | 457.13 | 95.80 | 243.56 | 30.68 | 216.05 | -36.00 | 87.18 | 136.82 | -18.63 | 219.36 | 60.55 | 141.52 | 45.61 | 59.55 | 41.50 | 47.55 | |

| Share Based Compensation | 34.59 | 16.29 | 15.49 | 16.49 | 11.59 | 17.79 | 14.34 | 14.03 | 14.25 | 9.73 | 12.24 | 12.45 | 11.39 | 12.99 | 9.19 | 9.93 | 10.24 | 10.94 | 11.44 | 11.03 | 9.81 | 9.99 | 7.97 | 7.25 | 6.96 | 7.89 | 5.50 | 5.25 | |

| Amortization Of Financing Costs | 4.06 | 4.06 | 3.73 | 3.64 | 3.98 | 3.23 | 3.24 | 3.10 | 2.91 | 2.85 | 2.86 | 2.82 | 2.90 | 2.60 | 2.74 | 2.25 | 2.24 | 2.25 | 2.38 | 2.23 | 2.40 | 2.73 | 2.59 | 2.54 | 2.57 | 2.84 | 2.84 | 2.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -390.06 | -676.46 | -394.44 | -1039.66 | -1359.84 | -624.42 | -607.40 | -2488.80 | -1673.93 | -1296.94 | -1698.58 | -2437.88 | -413.14 | -1467.96 | -563.47 | -833.59 | -1290.45 | -898.63 | -717.90 | -734.33 | -397.61 | -495.25 | -670.86 | -598.04 | -424.36 | -332.04 | -513.36 | -468.36 | |

| Payments To Acquire Investments | 33.11 | 52.52 | 56.44 | 47.40 | 56.24 | 46.60 | 75.85 | 64.25 | 89.49 | 85.57 | 156.17 | 77.34 | 58.29 | 40.40 | 44.91 | 31.06 | 56.91 | 28.96 | 55.91 | 48.99 | 61.75 | 55.42 | 68.49 | 50.29 | 43.69 | 47.00 | 37.22 | 43.97 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 55.19 | -133.60 | -422.25 | 1174.81 | 950.75 | 610.12 | -83.67 | 2752.57 | 1473.60 | 998.68 | 1281.83 | 2162.25 | 351.57 | 1395.81 | 113.29 | 889.67 | 901.81 | 916.46 | 468.41 | 640.81 | 280.63 | 251.32 | 605.17 | 451.32 | 466.04 | 190.16 | 372.34 | 386.88 | |

| Payments Of Dividends Common Stock | 214.45 | 214.56 | 209.35 | 209.13 | 193.62 | 192.57 | 187.70 | 183.85 | 173.56 | 170.65 | 160.78 | 150.98 | 143.04 | 133.68 | 129.98 | 126.28 | 114.57 | 113.54 | 109.57 | 109.34 | 100.00 | 97.59 | 91.98 | 91.06 | 82.32 | 80.52 | 75.59 | 73.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 757.22 | 713.79 | 713.90 | 700.79 | 670.28 | 659.85 | 643.76 | 615.07 | 576.92 | 547.76 | 509.62 | 479.85 | 463.72 | 545.04 | 436.96 | 439.92 | 408.11 | 390.48 | 373.86 | 358.84 | 340.46 | 341.82 | 325.03 | 320.14 | 298.79 | 285.37 | 273.06 | 270.88 | |

| Incomefromrentals | NA | 707.53 | 704.34 | 687.95 | 665.67 | 656.85 | 640.96 | 612.55 | 574.66 | 546.53 | 508.37 | 478.69 | 461.33 | 543.41 | 435.86 | 437.61 | 404.72 | 385.78 | 371.62 | 354.75 | 337.79 | 336.55 | 322.79 | 317.65 | NA | NA | NA | NA | |

| Revenuessubjecttootheraccountingguidance | NA | 16.50 | 18.20 | 22.70 | 14.30 | 12.50 | 13.60 | 10.50 | 9.90 | 7.90 | 6.10 | 5.40 | 6.70 | 5.40 | 6.00 | 10.60 | 16.20 | 17.30 | 14.80 | 14.90 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product And Service Other | 14.58 | 6.26 | 9.56 | 12.85 | 4.61 | 3.00 | 2.81 | 2.51 | 2.27 | 1.23 | 1.25 | 1.15 | 2.38 | 1.63 | 1.10 | 2.31 | 3.39 | 4.71 | 2.24 | 4.09 | 2.68 | 5.28 | 2.24 | 2.48 | 0.50 | 2.29 | 0.65 | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 757.22 | 713.79 | 713.90 | 700.79 | 670.28 | 659.85 | 643.76 | 615.07 | 576.92 | 547.76 | 509.62 | 479.85 | 463.72 | 545.04 | 436.96 | 439.92 | 408.11 | 390.48 | 373.86 | 358.84 | 340.46 | 341.82 | 325.03 | 320.14 | 298.79 | 285.37 | 273.06 | 270.88 | |

| Incomefromrentals | NA | 707.53 | 704.34 | 687.95 | 665.67 | 656.85 | 640.96 | 612.55 | 574.66 | 546.53 | 508.37 | 478.69 | 461.33 | 543.41 | 435.86 | 437.61 | 404.72 | 385.78 | 371.62 | 354.75 | 337.79 | 336.55 | 322.79 | 317.65 | NA | NA | NA | NA | |

| Revenuessubjecttootheraccountingguidance | NA | 16.50 | 18.20 | 22.70 | 14.30 | 12.50 | 13.60 | 10.50 | 9.90 | 7.90 | 6.10 | 5.40 | 6.70 | 5.40 | 6.00 | 10.60 | 16.20 | 17.30 | 14.80 | 14.90 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product And Service Other | 14.58 | 6.26 | 9.56 | 12.85 | 4.61 | 3.00 | 2.81 | 2.51 | 2.27 | 1.23 | 1.25 | 1.15 | 2.38 | 1.63 | 1.10 | 2.31 | 3.39 | 4.71 | 2.24 | 4.09 | 2.68 | 5.28 | 2.24 | 2.48 | 0.50 | 2.29 | 0.65 | NA |